The Economist reports that implementation gradually changes: [T]he way in which the People’s Bank of China conducts monetary policy is changing. It is beginning to look a little more like central banks in developed economies as it shifts towards liberalised interest rates. Rather than simply ordering banks to set specific lending or deposit rates—the focus for many years in China—it is altering the monetary environment around them. China does not yet have an equivalent of the...

Read More »A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it. Chairman of the Federal...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

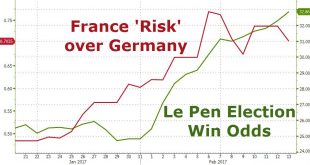

Read More »Here Are The Best Hedges Against A Le Pen Victory

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012,...

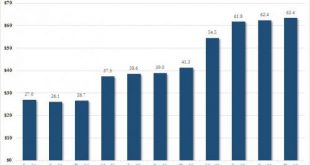

Read More »Swiss National Bank’s U.S. Stock Holdings Hit A Record $63.4 Billion

Being able to print your own money and buy stocks at any price sure can be fun. Just as the SNB which unlike many other (if ever fewer) central banks admits to doing just that. In its latest 13F filing, the Swiss National Bank reported that the value of its portfolio of US stocks rose again in the fourth quarter, increasing by 1.6% from $62.4 billion as of Sept. 30 to a record high $63.4 billion at the end of the year....

Read More »Switzerland: Broadening Recovery

The Swiss economy is expected to grow by 1.5 percent in 2017. While more and more export sectors are regaining their competitiveness, the domestic economy lacks growth momentum. With the inflation rate likely to turn positive, the Swiss National Bank (SNB) is expected to reduce its currency purchases in the course of the year....

Read More »Economic Normalization vs. Political Polarization

The global economy appears to be enjoying a solid start to 2017. Business surveys such as the Purchasing Managers' Indices (PMI) indicate that momentum accelerated toward the end of 2016 in nearly all major economies. Still low interest rates, stable commodity prices, as well as a generally...

Read More »Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos’ elites discussed why the world needs to “get rid of currency,” the European Commission has introduced a proposal enforcing “restrictions on payments in cash.” With Rogoff, Stiglitz, Summers et al. all calling for the end of cash – because only terrorists and...

Read More »Collateral Values in ECB Operations

In the NZZ, Kjell Nyborg questions whether the collateral values of the securities the ECB accepts in monetary policy operations reflect market values. He argues that the valuation is discretionary and politicized. Meine Analyse macht deutlich, dass der Besicherungsrahmen in der Euro-Zone in unterschiedlicher Ausprägung unter all diesen Problemen leidet. Das öffentliche Verzeichnis der zulässigen notenbankfähigen Sicherheiten enthält 30 000 bis 40 000 verschiedene Wertpapiere, von...

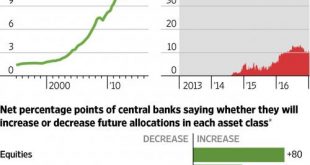

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org