On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012, threatening chaos to the world financial system on top of the collapse of the single currency.” This morning, Bank of France Governor Francois Villeroy de Galhau doubled down on the warning and cautioned French voters about the costs of withdrawing from the euro, noting that local interest rates are already rising on concerns about this year’s presidential election. “The recent increase in French rates – which I believe is temporary – corresponds to a certain worry about the exit from the euro,” Villeroy de Galhau said Monday on France Inter radio. As of Monday, Le Pen has the support of about 26% of the electorate for the first round of voting in April, compared with 20.5% for independent Emmanuel Macron and 17.5 percent for Republican Francois Fillon, according to the latest Ifop daily rolling poll.

Topics:

Tyler Durden considers the following as important: 5s10s, Bank of America, Bank of France, banque de France, Barclays Bank, CDS, CPI, Dutch government, economy, Economy of the European Union, Euro, Europe, European Monetary Union, European Union, Eurozone, Featured, France, French government, Front National, Germany, Global financial system, inflation, International Monetary Fund, Italy, JPMorgan Chase, Marine Le Pen, Monetary Policy, Monetization, National Front, newsletter, Politics of the European Union, Rating Agencies, recovery, Redenomination, risk, Sovereign CDS, Sovereign Default, Swiss Franc, The Economist, Withdrawal from the European Union, Zerohedge on CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

On Friday, after it emerged that as part of Marine Le Pen’s strategic vision for France, should she win, is a return to the French franc as well as redenomination of some €1.7 billion in French (non-international law) bonds, both rating agencies and economists sounded the alarm, warning it would “amount to the largest sovereign default on record, nearly 10 times larger than the €200bn Greek debt restructuring in 2012, threatening chaos to the world financial system on top of the collapse of the single currency.”

This morning, Bank of France Governor Francois Villeroy de Galhau doubled down on the warning and cautioned French voters about the costs of withdrawing from the euro, noting that local interest rates are already rising on concerns about this year’s presidential election. “The recent increase in French rates – which I believe is temporary – corresponds to a certain worry about the exit from the euro,” Villeroy de Galhau said Monday on France Inter radio.

As of Monday, Le Pen has the support of about 26% of the electorate for the first round of voting in April, compared with 20.5% for independent Emmanuel Macron and 17.5 percent for Republican Francois Fillon, according to the latest Ifop daily rolling poll. Yet while according to polls, both Macron and Fillon would defeat Le Pen in the second round vote, nervousness about poll accuracy – especially after Brexit and Trump – persists.

Meanwhile, the National Front candidate has continued to hammer home her message on euro exit. Speaking Sunday she said that the single currency was a political instrument that limits French sovereignty. “I can’t implement my promises of intelligent protectionism and industrial policy with the single currency,” Le Pen said. “It’s a brake on the economy, it’s an obstacle to the recovery. The euro isn’t a currency, it’s a political tool.”

| To counterbalance Le Pen, Villeroy estimates that leaving the euro would increase the cost of debt service for the French government by about 30 billion euros ($32 billion) a year. “That might seem a bit abstract to listeners, but 30 billion euros, to be very concrete, is equivalent to France’s annual defense budget,” he said. He added that France would also have a harder time defending itself on the global economic stage.

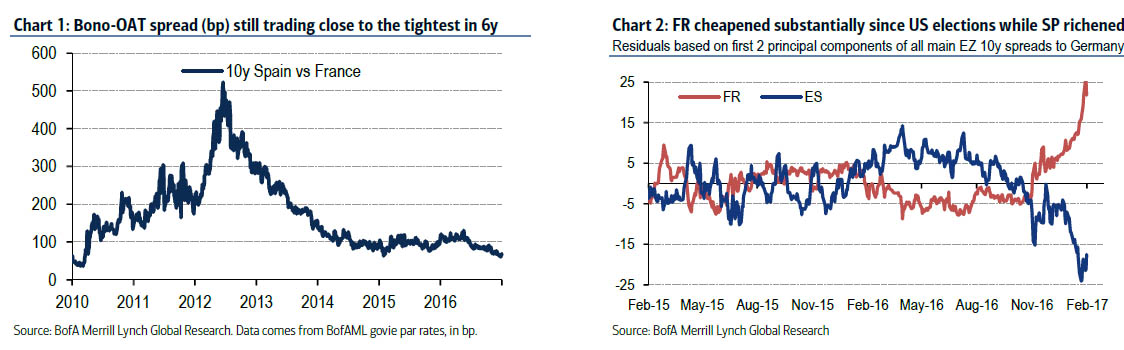

In any case, with concerns about a Le Pen victory clearly troubling European investors, and especially French bondholders as the spread on French bonds to both German and Spanish paper drifts to multi-year wides, closely tracking Le Pen’s victory odds… … analysts at Bank of America Merrill have laid out several scenarios on how to hedge for a Le Pen exit. They expect that, as noted above, the newly reminted franc would depreciate significantly in value against the euro on account of the unprecedented uncertainty unleashed on the continent. It would also raise the prospect of the newly independent French treasury and Banque de France engaging in a blitz of “debt monetisation” – where the central bank would directly finance Ms Le Pen’s ambitious spending plans to help revive the country’s moribund industrial heartlands. |

|

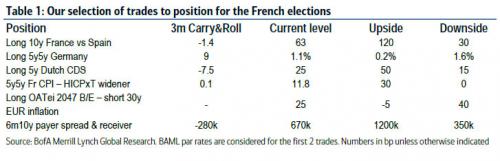

They then look at what are the best ways to hedge increased risks of a potential Eurosceptic win in the upcoming French election. Here is what they find:

|

Some further details, first on a potential blow out in French-Spanish yields:

First, BofA sees “Good risk-reward on long 10y France vs Spain”

On a Eurosceptic win redenomination risk to drive peripheral underperformance: While the conjunctive likelihood of these set of events is an interesting question unlikely to be univocally answered, we think the markets’ reaction on a surprise election result would follow the 2011-2012 blueprint and focus on redenomination risk. This argues for an underperformance of peripherals and a spike in demand for safe haven assets which are currently a scarce good in the Eurozone. Higher uncertainty around Greek EU/IMF reviews could be another factor fuelling Eurozone breakup risks in that scenario.

Once (if) OAT risk abates, attention focuses on ECB QE tapering and periphery: On the alternative election outcome, we see OAT-Bund spread tightening 50bp from here (reaching 30bp) while periphery outperformance, we think, should lag behind as attention shifts to the potential for ECB QE tapering; fuelled by our forecast of a 2% EA HICP inflation print available by the time of the second round of the vote. As we have said previously 1) negative correlation between Bund yields and peripheral spreads, 2) the limited underperformance of periphery vs France in January, and 3) wide periphery CDS basis suggest that, currently, the end of ECB QE is far from being fully priced in. Hence, we think the market will likely substitute political risks with monetary policy risk when considering Eurozone periphery were the French elections to prove a non-event.

Risk-reward looks attractive for Spain-France 10y spread widening: Given that positioning of Japanese life and pension in the French long-end likely remains long and given the directionality of peripheral curves, we like to express a long position in France vs the periphery in the 10y maturity. We choose Spain to express our short peripheral position due to the large outperformance of the 10y SPGB-Bund relative to its traditional relationship versus other country spreads to Germany (see Chart 2). Also, with the market’s attention being almost fully dedicated to Trump and the French elections, we think the idiosyncratic political risk of a Catalonian referendum on independence by September (although currently unconstitutional) seems under-priced at this point. We thus like to position for a widening in peripheral spreads, going long France versus short Spain in the 10y at 63bp with target at 120bp and 30bp stop. The risk to the trade is the redenomination risk remaining contained to France.

10y Spain vs France

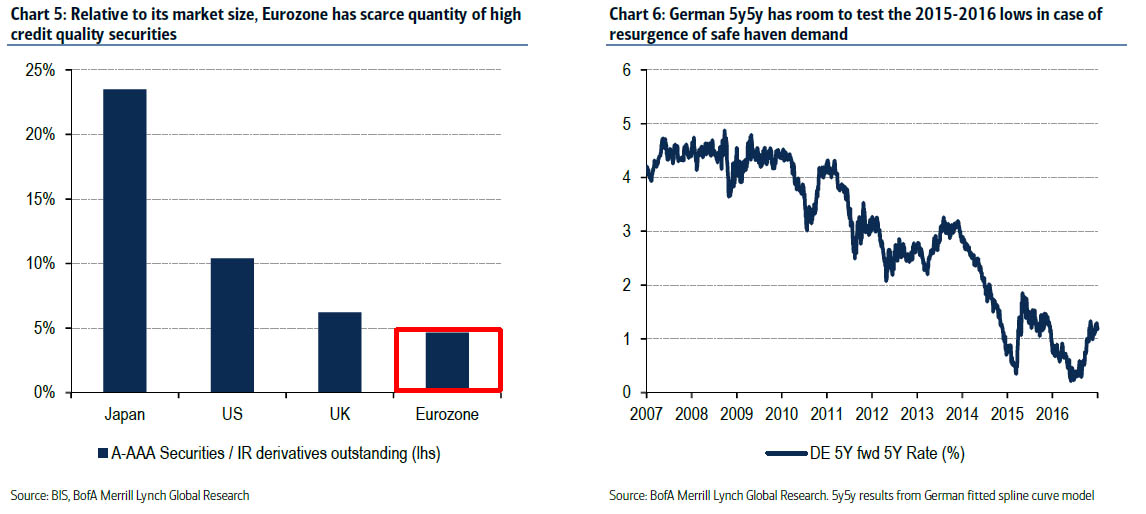

Another trade BofA recommends is to position for safe haven demand through a 5y5y long in Germany

On a Eurosceptic win, we think Bunds would test the negative yields in the 10y maturity. As we have already shown, EUR based investors have very limited supply of high quality collateral relative to the size of their market (Chart 5), therefore we think a resurgence of safe haven demand would likely see German govies as the main beneficiary within EGB space. Given the already rich valuations in the very front-end and the fact that, by April, the average maturity of ECB QE purchases in Germany may remain in the region of 5-10y, we think being long 5y5y is a good hedge for a Eurosceptic win.

Positioning supports further correction in German 5y5y We think that an outright 5y5y long through German bonds, rather than swaps, offers the best risk-reward because 1) although rates positioning looks cleaner after January, EUR rates bear-steepeners and short positions in Bund futures remain crowded trades which have the potential to be heavily unwound on an outlook change 2) on a bear steepening trade resumption, 10s30s may move more than 5s10s 3) on a risk-off scenario, some of the January corporate issuers may decide to hedge unswapped bonds by receiving rates (typically in the 5-10y sector) 4) the reaction in swaps is uncertain given its dependence on moves in bank credit risk and 5) 5y OBL ASW trades close to the widest on record.

For a French election risk hedge, we like a 5y5y Bunds long, at 1.1%: The risk running into the second round of the French election on 7 May for this position is the German curve being dragged higher by renewed steepening in the US. Also, a market friendly election result may shift attention to ECB QE tapering which could fuel further bear steepening.

Eurozone and German 5y5y

BofA also has a trade proposal for derivatives traders: “To hedge French election risks, we suggest positioning for a narrowing in the spread between the OATei 2047 breakeven (now 174bp) and 30y EUR inflation swap (now 196bp) from 25bp with an upside to -5bp and a downside to 40bp.”

On the topic of whether a “Frexit” would lead to a collapse of the Eurozone, BofA’s Mark Capleton writes that “we do not wish to complicate the issue here with a debate about whether the Eurozone would remain intact should France adopt its own currency – although that is clearly important – and we will assume for the purposes of the two trades proposed here that it does. Allowing some flexibility of interpretation on this should not be adverse for the trades. Indeed, in a scenario where concern grew over a “domino effect” with other Eurozone departures perceived as more likely, we would see this as most adverse for the periphery and the market could come to regard the currency risk as biased towards a hardening of the euro, with “core” members becoming dominant.”

What does this mean for the new currency?

Although it is by no means clear from economic competitiveness metrics that France’s implicit real exchange rate within the euro area is overvalued, we believe the market assumes that a “new franc” would devalue by a meaningful amount after currency separation for two reasons: the extreme uncertainty that such an event would create and concern over debt monetization (with Front National committed to using central bank financing of government).

In summary, Capelton notes that “we think the focus on polls is likely to continue from here but, given the precedents, we expect market reaction to be skewed towards pricing higher risk premia than otherwise. The Dutch general election on 15-Mar is the next milestone. While it appears unlikely that a Dutch government could take the country out of the EU post-elections, the market may become increasingly nervous if polls end up underestimating voters’ preference for populist parties.”

Finally, as FT notes, citing Antje Praefcke at Commerzbank, with the potential viability of the single currency project at risk, the German bank expects the European currency haven of choice – the Swiss franc – to come under fresh upward pressure:

It is quite difficult to find the currency that will emerge as the winner from these complex conditions – either short or long term. However, one ultimate safe haven is once again emerging: the Swiss franc. It may be an expensive task to resist the appreciation of the ultimate safe haven in political markets dominated by uncertainty and imponderability.

But the simplest possible trade, considering recent trends, may be to simply buy US equities which hit new all time highs no matter the data or potential risks out of Europe.

Then again, maybe all the worrying is for nothing. As Bloomberg showed on Friday, compiling various Wall Street sellsiders, “whatever the outcome of France’s presidential elections, it probably won’t raise the odds of an exit from the euro, most analysts say.” Some excerpts:

Credit Agricole SA

- The polls suggest that Le Pen will lose at the second round to either Macron or Fillon and this can explain the relative resilience of the euro of late, London-based strategist Valentin Marinov said in e-mailed comments on Feb. 9. “This may be misleading, however, and we advise cautiousness,” he added

- Still, a victory for Le Pen shouldn’t automatically translate into a French exit from the euro zone. “An exit would be a long and complex process” as it would require a constitutional amendment, Marinov added

- The bank assigns a 35 percent chance to Le Pen winning in the second round of elections, in line with polls

Barclays Plc

- The chances of Le Pen winning the second round of the presidential election are “very, very small”, unless Benoit Hamon or Jean-Luc Melenchon qualifies against Le Pen, London-based economist Francois Cabau wrote in e-mailed comments

- “In any case, her party is extremely unlikely to come remotely close to an absolute majority in the lower house in the June general elections. She would have to accept cohabitation and thus would not be able to govern strictly following her manifesto”

- Moreover, “exiting Europe means amending the constitution and barriers to get it done are quite high, in terms of the Parliament approval process,” Cabau added

JPMorgan Chase & Co.

- There is a strong likelihood that Le Pen reaches the second round of the presidential election but she would most likely lose by a decent margin against any opponent, London-based economist Raphael Brun-Aguerre wrote in a note to clients on Feb. 7

- The odds of Le Pen obtaining a majority in parliament is low and a period of cohabitation would be likely if she wins the presidential election

Commerzbank, however, had a notably more downbeat outlook:

- Chances of Le Pen winning the second round of election seen at 20%, Frankfurt-based economist Joerg Kraemer wrote in e-mailed comments

- “A victory of Le Pen in the presidential election would probably lead France to leave the EMU. And without the political and economic heavyweight France, the rest of EMU is unlikely to survive,” the economist added

- “The news of a Le Pen victory would cause massive capital flight not only out of France but also out of the peripheral countries such as Italy. Capital controls and banking holidays would follow, which could be the start of the end of EMU,” he wrote.

Tags: 5s10s,Bank of America,Bank of France,Banque de France,Barclays Bank,CDS,CPI,Dutch government,economy,Economy of the European Union,Euro,Europe,European monetary union,European Union,Eurozone,Featured,France,French government,Front National,Germany,Global financial system,inflation,International Monetary Fund,Italy,JPMorgan Chase,Marine Le Pen,Monetary Policy,monetization,National Front,newsletter,Politics of the European Union,Rating Agencies,recovery,Redenomination,Risk,Sovereign CDS,Sovereign Default,Swiss Franc,The Economist,Withdrawal from the European Union