The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »The War On Cash Is Happening Faster Than We Could Have Imagined

Submitted by Simon Black via SovereignMan.com, It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos. But there have been...

Read More »“Fehldiagnose Secular Stagnation (Secular Stagnation Skepticism),” FuW, 2016

Finanz und Wirtschaft, November 23, 2016. PDF. The diagnosis is far from clear. Nor is the therapy.

Read More »Canadian Bank Starts Charging Negative 0.75% Rate On Most Foreign Cash Balances

BMO Nesbitt Burns - Click to enlarge Despite speculation over the past year that Canada may join Japan and Europe in the NIRP club and launch negative interest rates, so far the BOC has stood its ground. However, starting on December 22, for the broker dealer clients of one of Canada’s most reputable financial institutions, BMO Nesbitt Burns, it will be as if the Canadian bank has cut its deposit rate on most...

Read More »Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered “fake news” within the “serious” financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough “A Recession Is Sometimes Necessary“, the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by...

Read More »Trumpflation Takes A Breather As Global Stocks Rise, Oil Jumps On Renewed OPEC “Deal Optimism”

With the Trumpflation euphoria easing back slightly overnight, leading to a modest paring in the USD index and US Treasury yields, Asian and European stocks rose, while US equity futures rebounded to just shy of new all time highs, as crude jumped on renewed optimism that OPEC will agree to cut output; Italian equities underperformed ahead of the Italian referendum; metals rebounded from last week’s losses as yields dropped and the dollar halted its longest winning streak versus the euro....

Read More »Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? Good times. In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks and their ‘supremacy over the...

Read More »BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the “VIX is now broken.” Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the “central banks’ central bank”...

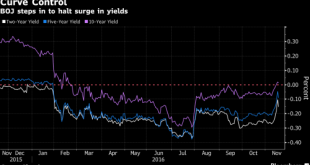

Read More »BOJ “Fires Warning At Bond Market” Sending Global Yields, Dollar Lower; All Eyes On Yellen

Yesterday morning we noted why, in light of the ongoing global bond rout, all eyes would be on the BOJ, and specifically whether Kuroda would engage his "Yield control" operation to stabilize the steepness of the JGB yield curve and implicitly support global bond yields in what DB said would be "full blown helicopter money" where the "BoJ is flying the copter over the US and may be about to become the new US government’s best friend." And sure enough that is precisely what Kuroda did last...

Read More »Time is ripe for change in monetary policy style

Published: 7th November 2016Download issue:In spite of large doses of policy easing, inflation and global growth remain tepid. With the effectiveness of existing monetary policy styles therefore being increasingly questioned, the November 2016 issue of Perspectives looks at three of the most plausible alternatives.One is asset-price targeting. Could central banks assume responsibility for ensuring the stability of asset prices as well as price stability? Christophe Donay, head asset of asset...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org