In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it. Chairman of the Federal Reserve at the time, WPG Harding, wrote, “In April 1919 the Board gave serious consideration to the suggestion made by several of the Federal Reserve Banks that the discount rate be advanced.” Though in today’s terms the matter might seem straightforward, it was far from it at the time for reasons beyond institutional immaturity. For one, unlike the US neutrality period (before entry into WWI) gold flows had reversed, and were moving back to some extent across the Atlantic (and silver to other places). And no one was quite sure what to make of the overall currency situation.

Topics:

Jeffrey P. Snider considers the following as important: bank reserves, Banking, currencies, Deflation, depression, Dollar, easing, economy, EuroDollar, eurodollar system, Featured, Federal Reserve, Federal Reserve/Monetary Policy, global banking, inflation, Markets, Monetary Policy, Money, Money Supply, newslettersent, QE, The United States, wholesale system

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

| In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it.

Chairman of the Federal Reserve at the time, WPG Harding, wrote, “In April 1919 the Board gave serious consideration to the suggestion made by several of the Federal Reserve Banks that the discount rate be advanced.” Though in today’s terms the matter might seem straightforward, it was far from it at the time for reasons beyond institutional immaturity. For one, unlike the US neutrality period (before entry into WWI) gold flows had reversed, and were moving back to some extent across the Atlantic (and silver to other places). And no one was quite sure what to make of the overall currency situation. |

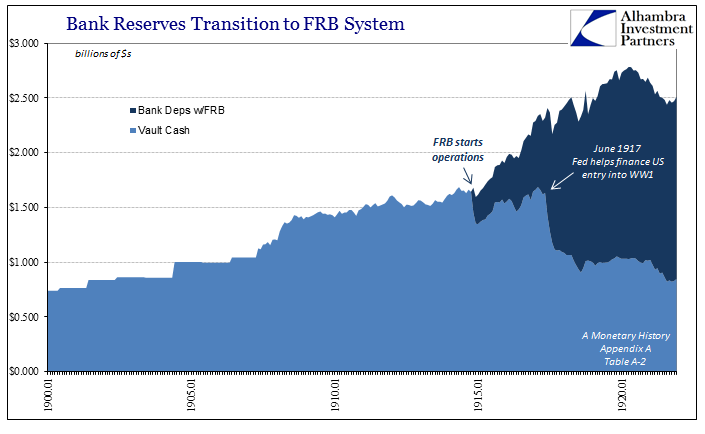

Evolution Fractional Lending Bank Reserves 1900 - 1921 |

The Federal Reserve Bulletin for August 1919 records a statement that to our modern senses might seem ridiculous:

In so far as we might be able to determine a century later, that was a correct assessment. As even Milton Friedman wrote in A Monetary History, “This was a straightforward gold inflation.” The distinctions then have not survived to today, at least in conventional monetary understanding. These were all separate affairs, and the links between them not clearly defined nor their relationships fully understood. The early 20th century was a period of sharp evolution and changes in behavior as well as methods due increasingly to technology. |

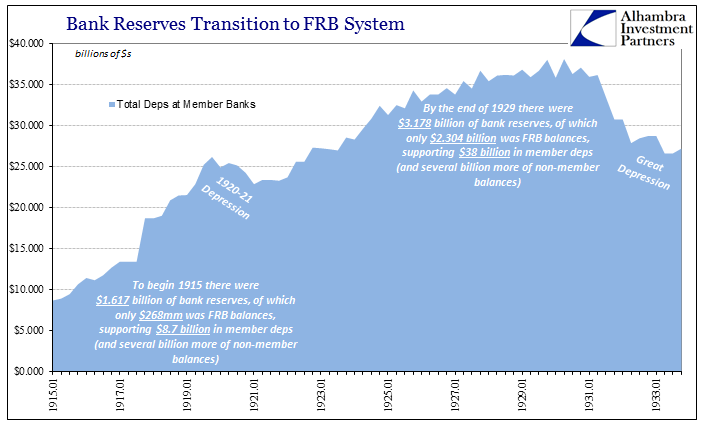

Evolution Fractional Lending Member Deps January 1915 - 1933 |

By “them” I refer to money, currency, and credit. A monetary expansion of gold need not be met specifically by a currency expansion nor one of credit. In fact, each one may offset the other so that the overall contribution of any single factor can be totally obscured. Of this specific period Friedman and co-author Anna Schwartz found inflation to be somewhat less than it might have been, perhaps should have been, in relation to gold and money conditions. The reason was currency left for circulation.

Even interpreting the possibility of these factors is difficult in such arrears because in the early 21st century the distinction between money, currency, and credit have all been blurred and in some cases (like money itself) erased. I write often that monetary policy has no money in it, and while that is true in the literal sense it isn’t taking into account monetary functions carried out by other means. |

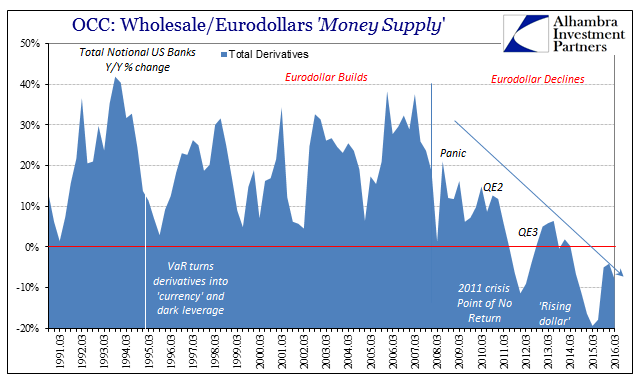

OCC Derivatives Total YoY, March 1991 - 2016 |

| For QE, it has been assumed all along that bank reserves have taken over the role of base money. From that, it has been further assumed that such a large increase in the monetary base would allow and even nudge banks to increase credit. Thus, QE was not so much a monetary policy as one intended for credit. Banks have, obviously, refused all invitations of money or credit, being totally reliant themselves on these other factors. Though currency itself isn’t specifically defined as a specific “thing”, it appears as if the role of currency has been morphed and absorbed by bank balance sheet factors overall.

What I mean by that are these specific instances where the output of the banking system (credit) is influenced in a manner different than what it may have been under strictly bank reserves as money. These are the math-as-money concepts which don’t always have to include math; for example, repo collateral. Like the public holding more currency in the war period, we can easily see that banks have engaged in secured interbank lending in place of unsecured, and therefore the level of accepted and liquid collateral functions very much on the level of a currency function. Where it has been of short supply for banks, it pares back whatever positive influence might have otherwise been attained by the modern money policy of strictly bank reserves. |

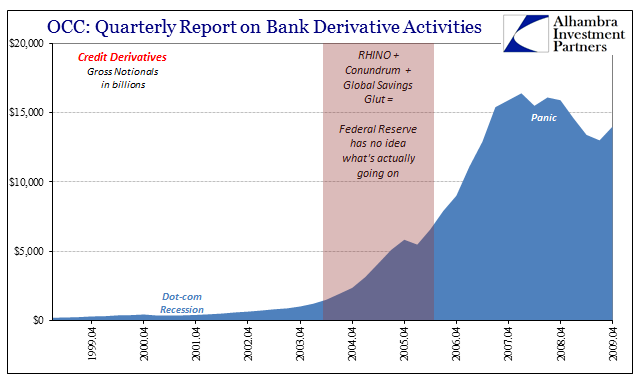

OCC Derivatives CDS RHINO, April 1998 - 2009 |

| We often think of these prior times as much simpler times, where what they had to consider was facile and undemanding. That was just not the case, as any serious review of history reveals often stunning complexity if in more obvious ways. We should not confuse opacity for unconditional differences. The ways of money and banking are almost totally obscured today, but once they become more visible you realize the similarities are striking. We may no longer have strictly money, currency, and credit, but we have every bit those functions if just removed in often derivative fashion.

From that position we can take heart, meaning that we need not rewrite all monetary understanding to match it with the eurodollar system as it is. There are basic human truths that survive monetary formats no matter what they are. We may not be able to define money in this wholesale system like we once could, but that is not the same as the wholesale system being completely stripped of the monetary or currency functions. They are there, we just need to decode and locate them. |

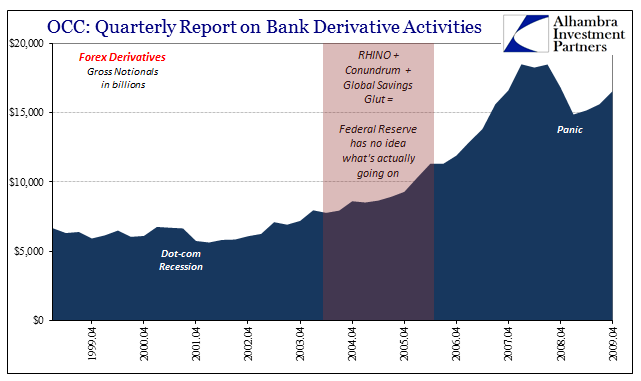

OCC Derivatives Forex RHINO, April 1998 - 2009 |

| This period in history, again, serves as a template of sorts in how to do just that. Prior to it, money was gold and what constituted bank reserves was vault cash. The introduction of the Fed system totally upended that regime, where now balances with Federal Reserve Banks (the 12 district branches of the Fed) counted equally as money (borrowed reserves). The US monetary system was effectively de-monetized, or at least started in one big step in that direction; in early 1917, Federal Reserve Notes and bank balances accounted for about 21% of high powered money, with gold coin and certificates 41%; by the end of WWI, Fed notes and balances were 59% and gold 14%.

In short, one form of money was substituted for another in parallel. Those of us paying attention have found that something similar has been performed over the past half century, but especially after 1995. We can also easily relate to what happened as a result; in 1929 after a decade of uncertainty about these definitions and relationships there was a Great Depression; in the 2000’s, something similar. In the former, officials spent decades trying to piece together what had happened. We really don’t need to repeat the process. All the answers are there for us in history should we only recalibrate our frame of reference. |

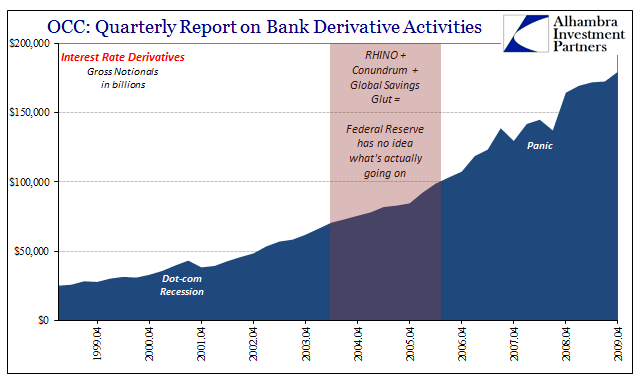

OCC Derivatives IR RHINO, April 1998 - 2009 |

Tags: bank reserves,Banking,currencies,Deflation,depression,dollar,easing,economy,EuroDollar,eurodollar system,Featured,Federal Reserve,Federal Reserve/Monetary Policy,global banking,inflation,Markets,Monetary Policy,money,Money Supply,newslettersent,QE,wholesale system