According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate. In those days, transparency was no virtue but rather it was widely...

Read More »US Fed Hikes Rates, Sounds Less Hawkish Than Feared

The US Federal Reserve raised the policy rate by 25 basis points in mid-March, but left its outlook largely unchanged. We continue to expect two more rate hikes in 2017. After hawkish comments from Federal Reserve (Fed) officials in recent weeks, the 25 basis point hike in the target range for the...

Read More »Mugged By Reality; Many Still Yet To Be

In August 2014, Federal Reserve Vice Chairman Stanley Fischer admitted to an audience in Sweden the possibility in some unusually candid terms that maybe they (economists, not Sweden) didn’t know what they were doing. His speech was lost in the times, those being the middle of that year where the Fed having already started to taper QE3 and 4 were becoming supremely confident that they would soon end them. At Janet...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain - For Now Caveat Emptor - Bitcoin surpasses gold price - a psychological and arbitrary headline - Royal Mint blockchain gold asks you to trust in the UK government - Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers - Invest in a gold mine using cryptocurrency - but wait until 2022 for your gold and trust the miners that it is there - Blockchain and gold will...

Read More »Stable Long-Run Money Demand

On VoxEU, Luca Benati, Robert Lucas, Juan Pablo Nicolini, and Warren Weber argue that long-run money demand in many countries is rather stable. … using a specific, narrow monetary aggregate, M1, we study a dataset comprising 32 countries since the mid-19th century (Benati et al. 2016). The main finding of this large-scale investigation is that, contrary to conventional wisdom, in most cases statistical tests do identify with high confidence a long-run equilibrium relationship between...

Read More »Economic Dissonance, Too

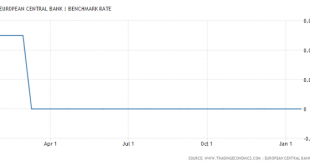

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to....

Read More »The Effects of Negative Interest Rate Policies

A number of central banks have taken their interest rates into negative territory in the past years. Credit Suisse Research Institute explores the markets where negative interest rates have been introduced and reports on whether they have been successful. In the autumn of 2014, Denmark and Sweden...

Read More »Video: The Swiss National Bank Is Acting Like A Hedge Fund

By EconMatters In this Video, we discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy? Central Banks have really...

Read More »Interest Rate Differentials Increasing Financial Market Leverage To Unsustainable Levels

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. This ends badly every...

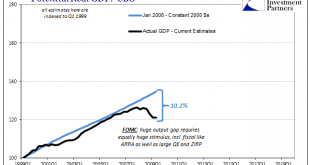

Read More »Their Gap Is Closed, Ours Still Needs To Be

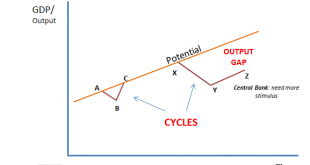

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org