Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none other than the WSJ writes that “by keeping interest rates low and in some cases negative, central banks have prompted some of the most conservative investors to join the hunt for higher returns: Other central banks.” To be sure, nothing that the WSJ reports is news to our readers, who have known for years how central banks overtly, in the case of the BOJ, PBOC and SNB most prominently, and covertly, as the infamous “leave no trace behind” symbiosis between the NY Fed and Citadel, however we find it particularly enjoyable every time the financial paper of record reports what until only a few years ago was considered “conspiracy theory”, and wonder what other current “fake news” will be gospel in 2020.

Topics:

Tyler Durden considers the following as important: Apple, Asia Pacific, Bank, Bank of Finland, Bank of Japan, Business, Capital Markets, Central Bank, Central Banks, Chinese government, Citadel, Czech, Czech National Bank, Economics, economy, Exxon, Featured, Finance, Financial crisis of 2007–2008, financial markets, Finland, foreign exchange reserves, Global Economy, Great Recession, International Monetary Fund, Low government, Market Crash, Monetary Policy, newslettersent, None, NY Fed, PBOC, SNB, South African Reserve Bank, Stock market crashes, Swiss National Bank, UBS, Zerohedge on SNB

This could be interesting, too:

investrends.ch writes Ermotti verdient 2024 knapp 15 Millionen Franken

Claudio Grass writes The Case Against Fordism

investrends.ch writes UBS schlägt zwei neue Frauen für den Verwaltungsrat vor

investrends.ch writes SNB schreibt 2024 definitiven Gewinn von über 80 Milliarden Franken

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none other than the WSJ writes that “by keeping interest rates low and in some cases negative, central banks have prompted some of the most conservative investors to join the hunt for higher returns: Other central banks.”

To be sure, nothing that the WSJ reports is news to our readers, who have known for years how central banks overtly, in the case of the BOJ, PBOC and SNB most prominently, and covertly, as the infamous “leave no trace behind” symbiosis between the NY Fed and Citadel, however we find it particularly enjoyable every time the financial paper of record reports what until only a few years ago was considered “conspiracy theory”, and wonder what other current “fake news” will be gospel in 2020.

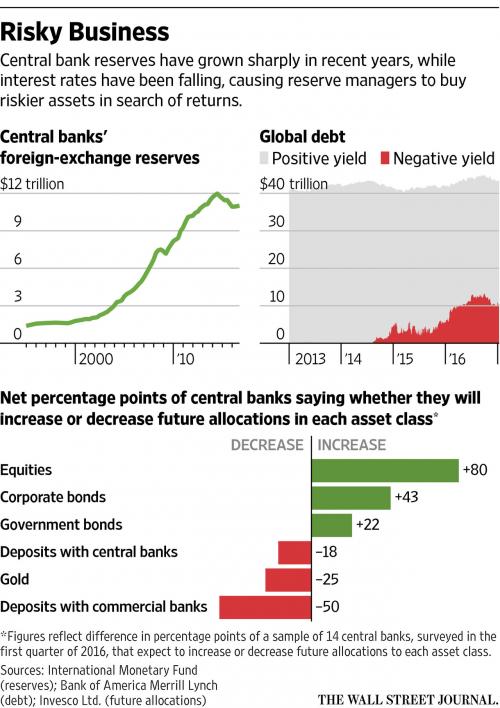

Meanwhile, for those few who are still unfamiliar, this is how central banks who create fiat money out of thin air and for whom “acquisition cost” is a meaningless term, are increasingly nationalizing the equity capital markets. As the WSJ puts it “these central banks care relatively little about whether such investments make profits or losses—though they can matter politically—because they can always print more of their currency. So risk is less important, analysts say.” And since risk was no longer part of the equation, leaving only return, central banks started buying stocks.

“When yields started to get really low and closer to zero in 2014, we decided to start equity investments,” said Jarno Ilves, head of investments at the Bank of Finland, who said he plans to increase his allocation to stocks.

But if you think the farce is bad now, wait until next year. According to a recent study by Invesco on central- bank investment which polled 18 reserve managers, some 80% and 43% of respondents to questions on asset allocation said they planned to invest more in stocks and corporate debt, respectively. Low government-bond returns were behind the moves to diversify, said 12 out of 15 respondents, while three declined to answer.

| So between central banks outbidding each other to buy “risky” assets with “money” that is constantly created at no cost, very soon all other private investors will be crowded out but not before every stock is trading at valuations that even CNBC guests won’t be able to justify.

The good news is that instead of focusing on Ultra High Net Worth clients, a desperate for revenue Wall Street can just advise central banks on which stocks to buy.

The bad news, is that as more people realize that a free “market” now only exists in textbooks, and that Soviet-style central planning is the only game in town, confident in price formation will evaporate, in turn pushing even more market participants out of the quote-unquote market, until only central banks are left bidding on each other’s otherwise worthless stock certificates.

For virtually all central banks, however, the grotesque central planning shift of the past decade means that instead of engaging in monetary policy, the world’s central banks are now activist hedge funds, who are focused first and foremost on “investment management”:

But in the world of central bank hedge funds, no other bank comes even remotely close to the (publically-traded) Swiss National Bank, which has taken risky investing to a whole new level.

Having bought hundreds of billions in equities carries risks even for central banks, if only on paper: in 2015, the SNB booked a loss of 23.3 billion francs, when officials stopped maintaining a ceiling on the value of their currency. As the currency jumped by as much as 22% against the euro, the value of their foreign assets fell. Last year, it offset those losses with a 24 billion-franc profit, as its equity investments paid off. Others did not fare quite as well: “the Czech National Bank started buying stocks in June 2008 just before the financial crisis. The subsequent stock market crash wiped out a third of its equity investment that year, then roughly 2.5% of its total reserves.” |

Risky Business |

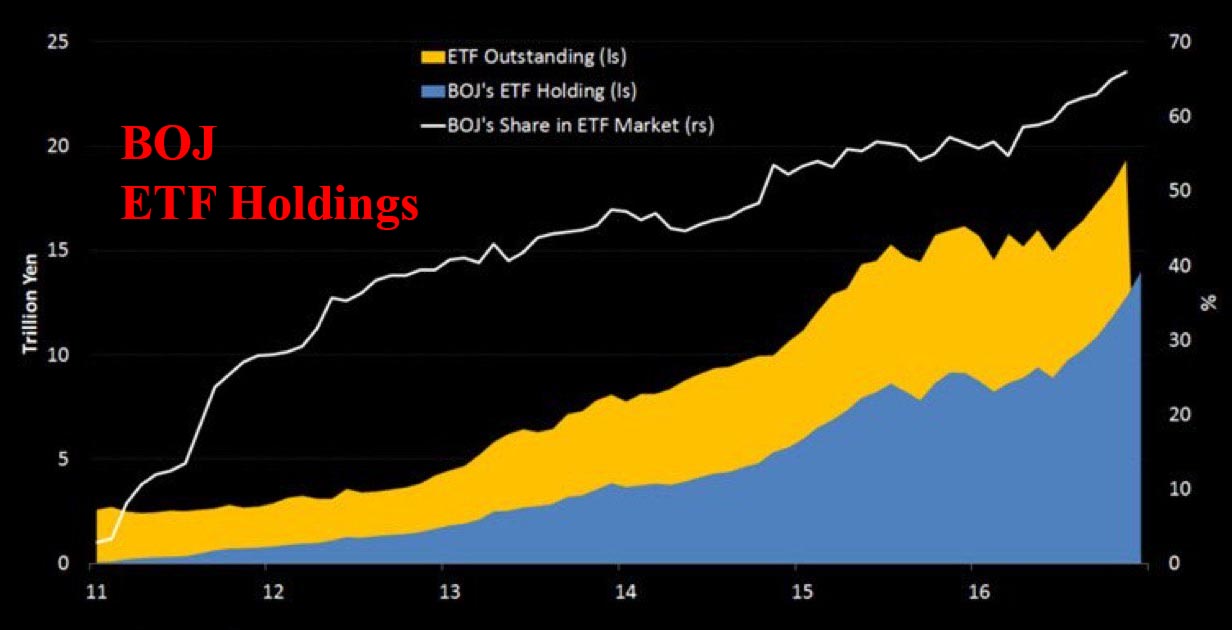

| By now it is common knowledge that central banks openly intervene in markets, the most vivid and recent example of which is the BOJ, which as of this moment owns two-thirds of all Japanes ETFs…

and at the current rate of expansion, within a few years the world’s monetary authorities who are tasked with “financial stability”, will have acquired a majority of the world’s equity tranche, effectively nationalizing it. We bring it up in light of recent ridiculous allegations that “Russia hacked the US elections” – we wonder, will the liberal press blame the USSR after it dawns upon the world’s intrepid press that while it was busy comparing the Obama and Trump crowds, the world’s greatest wealth transfer was taking place right below everyone’s nose. |

Tags: Apple,Asia Pacific,Bank,Bank of Finland,Bank of Japan,Business,Capital Markets,Central Bank,central banks,Chinese government,Citadel,Czech,Czech National Bank,Economics,economy,Exxon,Featured,Finance,Financial crisis of 2007–2008,Financial markets,Finland,Foreign Exchange Reserves,Global Economy,Great Recession,International Monetary Fund,Low government,Market Crash,Monetary Policy,newslettersent,None,NY Fed,PBOC,South African Reserve Bank,Stock market crashes,Swiss National Bank,UBS