PMI surveys for the euro area eased somewhat in July, suggesting that momentum slowed at the start of Q3. We maintain our GDP growth forecast of 1.9% for 2017.The composite flash PMI fell to 55.8 in July from 56.4 in May, below consensus expectations (56.2). The headline dip was entirely driven by the manufacturing index, which fell to 56.8 in July from 57.4 in June. By contrast, the services index remained stable at 55.4. The PMI’s forward-looking components remained pretty strong, despite edging down in July. The bright spots came from new export orders and employment.Composite PMIs declined in Germany and France, while activity was pretty strong elsewhere, in particular in periphery countries. Markit mentioned that growth perked up, registering the second largest monthly rise in output

Topics:

Nadia Gharbi considers the following as important: euro area composite PMI, Euro area GDP growth, euro area growth, euro area growth forecast, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

PMI surveys for the euro area eased somewhat in July, suggesting that momentum slowed at the start of Q3. We maintain our GDP growth forecast of 1.9% for 2017.

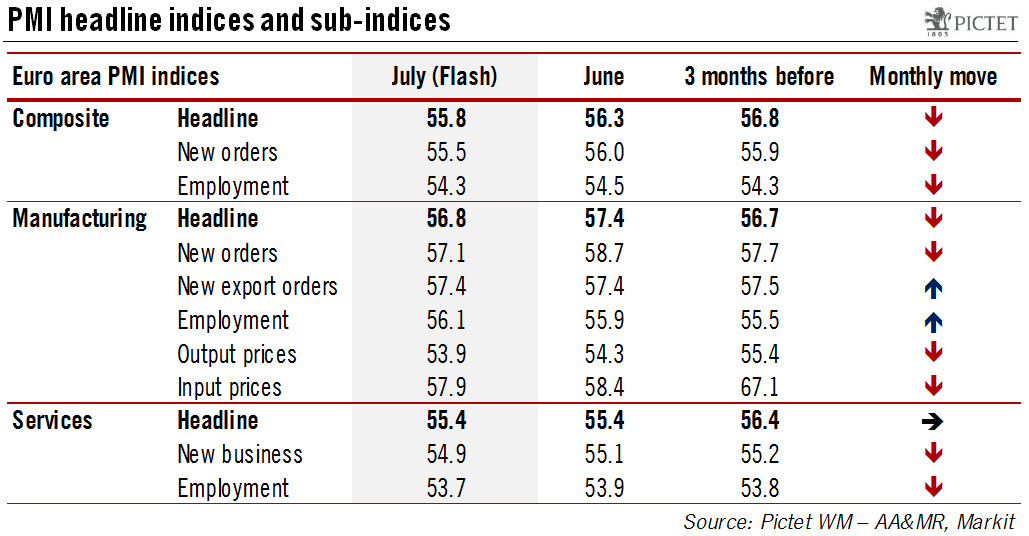

The composite flash PMI fell to 55.8 in July from 56.4 in May, below consensus expectations (56.2). The headline dip was entirely driven by the manufacturing index, which fell to 56.8 in July from 57.4 in June. By contrast, the services index remained stable at 55.4. The PMI’s forward-looking components remained pretty strong, despite edging down in July. The bright spots came from new export orders and employment.

Composite PMIs declined in Germany and France, while activity was pretty strong elsewhere, in particular in periphery countries. Markit mentioned that growth perked up, registering the second largest monthly rise in output in the past decade.

The euro area composite PMI is now consistent with GDP growth of 0.59% q-o-q in Q3, cooling from the pace of over 0.7% signalled by the PMI for the second quarter.

We are keeping unchanged our GDP growth forecast at 1.9% for 2017 as a whole. We continue to see a number of headwinds leading to a modest slowdown in the pace of economic expansion for the rest of this year, but growth should nonetheless remain comfortably above potential, at around 1.75% in annualised terms.