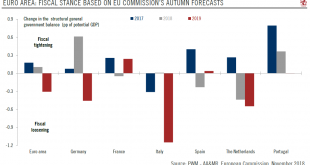

SUMMARY The Euro area’s fiscal stance will turn expansionary in 2019. Among the five biggest economies, this shift mainly reflects significant fiscal loosening in Germany, Italy and the Netherlands. France and Spain plan modest fiscal tightening, but less that what the European Commission (EC) demanded. In Italy, the government budget plan represents a significant deviation from the EU’s fiscal rules. The outcome of arm...

Read More »Euro area’s fiscal policy to turn supportive of growth next year

Modest fiscal easing could help counter mounting external risks and slowing growth indicators.Euro area member states have all submitted their 2019 Draft Budgetary Plans (DBP) to the European Commission (EC) by now. These show that, collectively and based on EU Commission’s autumn forecasts, the euro area’s fiscal stance1 will turn supportive in 2019, although it varies significantly from one country to the next.Germany, Italy and the Netherlands are planning fiscal expansions, but Spain,...

Read More »Revising our euro area 2018 GDP growth forecast down

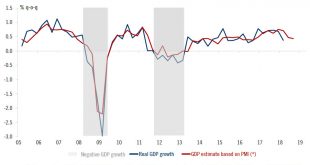

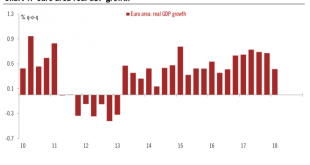

The cut to our growth forecast reflects slippage in euro area data. According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018 (0.346% q-o-q unrounded, 1.4% q-o-q annualised, 2.1% y-o-y), below consensus expectations (0.4%). This was the weakest growth in two years and comes after a GDP growth of 0.4% q-o-q in Q1. The carryover effect for 2018 reached 1.7 %, meaning that...

Read More »Revising our euro area 2018 GDP growth forecast down

The cut to our growth forecast reflects slippage in euro area data.According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018, below consensus expectations. This was the weakest growth in two years and is down slightly from GDP growth of 0.4% q-o-q in Q1.Following today’s GDP growth data and recent economic indicators, we have revised down our GDP growth forecast for 2018. We now expect euro area real GDP to grow by 2.0% on average this year...

Read More »Euro area PMIs on the soft side

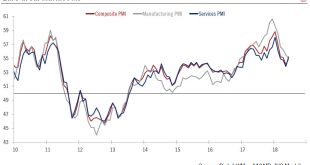

Fundamentals remain solid but the decline in some forward-looking indicators in July signal downside risk in the coming months. Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of...

Read More »Euro area PMIs on the soft side

Fundamentals remain solid but the decline in some forward-looking indicators in July signal downside risk in the coming months.Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline.The services PMI declined to 54.4, but this followed a 1.4 points jump...

Read More »Euro area: a slight rebound

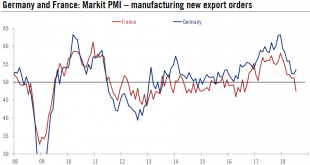

Overall, June saw a halt to recent declines in euro area business sentiment survey. The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit...

Read More »Euro area: a slight rebound

Overall, June saw a halt to recent declines in euro area business sentiment survey.The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany. Growth remains decent in the sector but, as Markit noted, the decline in business optimism “reflects rising trade worries, political...

Read More »Euro area growth: somewhere between hard and soft data

According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.4% q-o-q in Q1 2018 (1.7% q-o-q annualised, 2.5% y-o-y), in line with consensus expectations (0.4%) and down from an upwardly revised figure of 0.7% q-o-q for Q4 2017. The implications of the growth slowdown on ECB staff projections should remain limited, in our view. In March, they had pencilled in 0.7% q-o-q GDP growth for Q1, but...

Read More »Euro area growth: somewhere between hard and soft data

The euro area economy’s loss of momentum in Q1 derived largely from temporary factors. We remain construction on the cyclical outlook.Euro area real GDP expanded by 0.4% q-o-q in Q1, or 1.7% in annualised terms, according to Eurostat’s flash estimate. This comes after an upwardly revised figure of 0.7% q-o-q in Q4 2017. Although this first estimate could be subject to statistical revisions, it confirms that the euro area economy lost some momentum in Q1.This Q1 flash estimate confirms that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org