After September’s negative performance, last week proved one of the strongest in a while for equity markets. This rebound followed news that the Biden administration will start to tackle the supply-chain and logistics issues that have been preventing deliveries. The ports of Los Angeles, the busiest in the US, will begin operating around the clock seven days per week to ease cargo bottlenecks that have led to shortages and higher costs for consumers. Showing some relaxation in long-term inflation fears, 10-year US Treasury yields declined slightly last week. Such ongoing supply issues, in addition to labour shortages across the US economy, have also driven up the cost of US shale oil production, further reinforcing strong crude oil prices. This has helped send

Topics:

Cesar Perez Ruiz considers the following as important: 2.) Pictet Macro Analysis, 2) Swiss and European Macro, Featured, Macroview, newsletter, Pictet

This could be interesting, too:

investrends.ch writes Die Schweiz an der Schwelle zur digitalen Transformation der Fondsindustrie

investrends.ch writes Pictet setzt bei neuem Hedgefonds auf KI

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

After September’s negative performance, last week proved one of the strongest in a while for equity markets. This rebound followed news that the Biden administration will start to tackle the supply-chain and logistics issues that have been preventing deliveries. The ports of Los Angeles, the busiest in the US, will begin operating around the clock seven days per week to ease cargo bottlenecks that have led to shortages and higher costs for consumers. Showing some relaxation in long-term inflation fears, 10-year US Treasury yields declined slightly last week. Such ongoing supply issues, in addition to labour shortages across the US economy, have also driven up the cost of US shale oil production, further reinforcing strong crude oil prices. This has helped send commodities prices to a new all-time highs. The infrastructure needed to increase production is one reason why we are positive on real assets.

After September’s negative performance, last week proved one of the strongest in a while for equity markets. This rebound followed news that the Biden administration will start to tackle the supply-chain and logistics issues that have been preventing deliveries. The ports of Los Angeles, the busiest in the US, will begin operating around the clock seven days per week to ease cargo bottlenecks that have led to shortages and higher costs for consumers. Showing some relaxation in long-term inflation fears, 10-year US Treasury yields declined slightly last week. Such ongoing supply issues, in addition to labour shortages across the US economy, have also driven up the cost of US shale oil production, further reinforcing strong crude oil prices. This has helped send commodities prices to a new all-time highs. The infrastructure needed to increase production is one reason why we are positive on real assets.

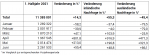

The US consumer price index came in higher than expected at an annual 5.4% in September. However, core inflation showed signs of peaking. The latest inflation numbers confirm our view that the US Federal Reserve will announce a start to tapering of its asset purchases in the coming weeks. In Europe, Bank of England officials have increasingly been arguing for rate hikes while in China, the September producer price index (PPI) came in at its highest level since 1995. The Chinese government also suggested that risks around the troubled developer Evergrande have been contained at the same time as it takes steps to constrain property developers’ mortgage activities.

Many of our 2021 investment themes continue to gain traction. Recently, our Green Marshall Plan theme has been bolstered by China’s immense 100-gigawatt wind and solar project and French president Macron’s France 2030 investment plan, which includes EUR30 bn to decarbonise French industry and make France a world leader in green hydrogen. The third-quarter earnings season kicked off last week with strong bank results. Some luxury retailers also reaffirmed guidance for the rest of the year, which, on top of stronger-than-expected retail sales figures, helped support equity markets last week. Despite a tactically neutral stance, we remain constructive on equities. Finally, M&A and flotation volumes for 2021 are double last year’s, which supports our overweight on private equity and hedge funds and particularly our preference for event-driven hedge fund strategies.

Tags: Featured,Macroview,newsletter,Pictet