© Christian Heinz | Dreamstime.com A majority of Switzerland’s parliament voted in favour of introducing a tax on flights departing from Switzerland. 132 voted in favour of the tax, with 65 against. The tax would range from CHF 30 to CHF 120 depending on the distance and class of travel, according to 20 Minutes. Private flights would be taxed too. A tax of between CHF 500 and CHF 5,000 would be charged depending on the type and size of aircraft. Parliament also voted...

Read More »Is the Pandemic Over and a V-Shaped Recovery Baked In?

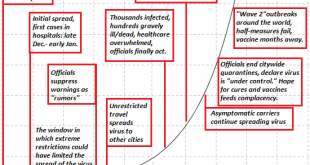

So what do we know with any sort of certainty about the claim that “the pandemic is over”? Very little. Is the pandemic over in China, Europe, Japan and the U.S./Canada? Is the much-anticipated V-Shaped economic recovery already baked in, i.e. already gathering momentum? The consensus, as reflected by the stock market (soaring), the corporate media and governmental easings of restrictions seems to be “yes” to both questions. But science is not a consensus-based...

Read More »Transferwise vs Revolut: Which Is Best in 2020?

(Disclosure: Some of the links below may be affiliate links) TransferWise and Revolut offer services that are quite similar. They are both offering cheap money transfers in many different currencies. How can you decide between both services? I have both cards. But, I am mostly using my Revolut card. So, many of my readers asked me why I was mainly using my Revolut card, where I could have only used my TransferWise card. Today, I am going to answer the question:...

Read More »The Scandinavian Model Won’t Work in Chile

Scandinavian welfare states continue to allure leftist onlookers across the world. The Nordic welfare model is marketed as a humane alternative to the cutthroat nature of Western capitalism. It received a massive boost when Vermont senator Bernie Sanders campaigned on emulating these countries in both of his presidential runs during 2016 and 2020. But it’s not just your typical Bernie Bro that’s obsessing over the Nordic model. Technocrats at the Organisation for...

Read More »EM Preview for the Week Ahead

EM and other risk assets stabilized to end the week after Thursday’s selloff, but remain vulnerable. The risks ahead are the same as before, which include a second wave of infections as well as a longer and shallower than expected recovery in global growth. The Fed’s message of low rates as far as the eye can see was balanced by Powell’s grim outlook for unemployment. The liquidity story should remain positive for EM, with the BOE expected to increase its QE this...

Read More »Coronavirus: new cases stable with small rise in deaths in Switzerland

© Xantana | Dreamstime.com In the seven days to 12 June 2020, the number of new SARS-CoV-2 infections recorded in Switzerland was 127. A similar number of new cases was recorded in the week before (108) and the week before that (121), according to Worldinfometer.com. However, the number of deaths was up slightly when comparing the recent week (17) to the week before (2). Switzerland has come a long way since its first confirmed case in Switzerland was recorded on 24...

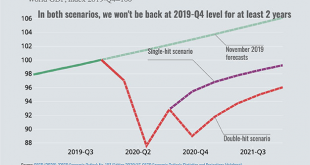

Read More »This Thing Is Only Getting Started; Or, *All* The V’s Are Light On The Right

The Federal Reserve’s models really are the most optimistic of the bunch. With the policy meeting conducted today, no surprises as far as policies go, we now know what ferbus has to say about everything that’s happened this year. Skipping the usual March projections, what with the FOMC totally occupied at the time by a complete global monetary meltdown Jay Powell now says “we saw it coming”, the central bank staff released the calculations performed by its DSGE...

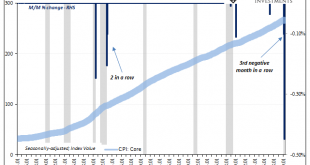

Read More »Why The FOMC Just Embraced The Stock Bubble (and anything else remotely sounding inflationary)

The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t). This provides the financial services industry with the rationalization those working within it desperately want for them to do what they...

Read More »The Great Society: A Lesson in American Central Planning

. [Review of Amity Shlaes, Great Society: A New History (New York, NY: HarperCollins, 2019).] Most people associate the Great Society initiative with Lyndon Baines Johnson. There is very good reason for that, to be sure. As president, Johnson, the “master of the Senate,” was the driving force behind the raft of legislation that passed during his administration, the 1964 and 1965 legislation that framed and filled in his vision for a “great society” in which the...

Read More »A Dollar Crash Is Coming

◆The world is having serious doubts about the once widely accepted presumption of American exceptionalism. The era of the U.S. dollar’s “exorbitant privilege” as the world’s primary reserve currency is coming to an end. In the 1960s French Finance Minister Valery Giscard d’Estaing coined that phrase largely out of frustration, bemoaning a United States that drew freely on the rest of the world to support its overextended standard of living. For almost 60 years, the...

Read More » SNB & CHF

SNB & CHF