Achiko says its Cayman issues only came to light after listing in Switzerland. Keystone / Georgios Kefalas Cayman Islands fintech company Achiko has run into “compliance issues” just months after listing on the Swiss stock exchange. The firm has called a meeting of shareholders this week to approve a plan to create a Swiss company and re-list the shares from this entity. But some shareholders are upset that they will not be able to cast their votes the annual general...

Read More »FX Daily, June 16: Correction Scenario Tested

Swiss Franc The Euro has fallen by 0.39% to 1.0704 EUR/CHF and USD/CHF, June 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Shortly after the US stock market opened sharply lower, the Federal Reserve announced that it’s Main Street facility was up and running. US stocks never looked back. After the S&P 500 recouped its full decline, the Fed announced it would begin buying corporate bonds. Up until now,...

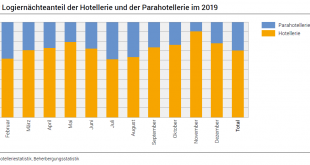

Read More »Supplementary accommodation: 0.7 percent increase in overnight stays in 2019, but decrease in demand for holiday homes

15.06.2020 – In 2019, supplementary accommodation posted a total of 16.7 million overnight stays, i.e. an increase of 0.7% compared with 2018. With 11.4 million units, Swiss visitors represented more than two-thirds of demand (68.6%), i.e. a rise of 2.4%. Foreign visitors registered a 2.8% decrease with 5.2 million units. With 4.4 million overnight stays (-3.8%), European visitors accounted for the majority of stays by foreign guests. These are the final results from...

Read More »Fed Chairman: “We’re Not Even Thinking About Thinking About Raising Rates”

Jerome Powell Market volatility has suddenly spiked in recent days came after the Federal Reserve vowed last Wednesday to keep its benchmark rate near zero through 2022. That’s an unusually long period for the Fed to be projecting rate policy. It reflects the fact that it will take many months and perhaps years for the tens of millions of jobs that were recently lost to return. During his press conference, Chairman Powell stumbled and stammered his way into stating...

Read More »US Money Supply – The Pandemic Moonshot

Printing Until the Cows Come Home… It started out with Jay Powell planting a happy little money tree in 2019 to keep the repo market from suffering a terminal seizure. This essentially led to a restoration of the status quo ante “QT” (the mythical beast known as “quantitative tightening” that was briefly glimpsed in 2018/19). Thus the roach motel theory of QE was confirmed: once a central bank resorts to QE, a return to “standard monetary policy” becomes...

Read More »Making Sense Eurodollar University Episode 13

Jeff Snider, Head of Global Investment Research at Alhambra Investments, and Emil Kalinowski make sense of today's global monetary system. Topics and Times 00:32 US Employment | Establishment / Household Survey 02:52 US Employment | Initial & Continuing Jobless Benefit Claims 04:59 US Employment | Economically Unemployed vs. Exogenous Shock Unemployment 12:51 World Economy | Consensus Two-Year Outlook for GDP 16:38 World Economy | The OECD W-Shaped Recovery Doesn't Factor in a Second...

Read More »FX Daily, June 15: Unwind Continues

Swiss Franc The Euro has fallen by 0.19% to 1.0688 EUR/CHF and USD/CHF, June 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The swing in the pendulum of market sentiment toward fear from greed began last week and has carried over into today’s activity. Global equities are getting mauled. In the Asia Pacific region, no market was spared as the Nikkei’s 3.5% drop, and South Korea’s 4.7% fall led the way. In...

Read More »AR IGTV Episode 5 with Accuvein Director of Sales Accute Markets, Jeff Snider

Swiss Producer and Import Price Index in May 2020: -4.5 percent YoY, -0.5 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

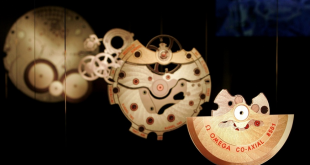

Read More »100 Swiss watch brands risk extinction due to coronavirus, expert says

Luxury brands are weathering the storm better than the rest. Keystone The coronavirus crisis could eliminate up to 100 Swiss watch brands from the market, according to an expert interviewed by the German-language weekly NZZamSonntag. Production came to a standstill during the pandemic and the most important export markets collapsed. Whether tourists with purchasing power will return to Switzerland remains in question. The watch industry, notes the newspaper, has been...

Read More » SNB & CHF

SNB & CHF