Charles Hugh Smith on the New Normal http://financialrepressionauthority.com/2020/06/26/the-roundtable-insight-charles-hugh-smith-on-the-new-normal/ Receive trading ideas weekly from Yra: https://cedarportfolio.com/yra-signup-form

Read More »Hands-off regulation of sustainable finance draws mixed response

The goal of sustainable finance is to divert more funds into environmentally and socially responsible projects. Keystone / Laurent Darbellay Extra rules will only be imposed on the sustainable finance sector if banks fail to properly police themselves, says the Swiss government. The hands-off regulatory approach to ethical investing has been welcomed by financial players, but criticised by NGOs. Unveiling a report on sustainable finance on Friday, Finance Minister...

Read More »Swiss gold industry oversight too weak, say auditors

The Swiss gold refining industry has once again come under scrutiny with a report that criticises the lack of control over imports of the precious metal. The Federal Audit Office says it is too easy for illegal imports to enter the country and that sanctions are inadequate. Most of the world’s gold passes through Switzerland to be transformed from raw material and refined. It’s a business that can range in value between CHF60 and CHF90 billion ($70-90 billion)...

Read More »Recent Trade Developments Suggest Some Caution Ahead Warranted

There’s never a good time for a trade war. Yet here we are on the cusp of one between the US and the EU over unfair aircraft subsidies and comes at a time when renewed COVID-19 outbreaks are making the global economic outlook even cloudier. These developments suggest some caution ahead is warranted for risk assets like EM and equities. RECENT DEVELOPMENTS Back in April, the WTO set forth two distinct pandemic scenarios for world trade. The “relatively optimistic”...

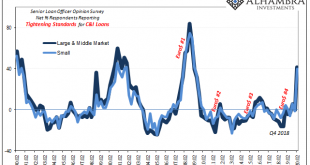

Read More »Not COVID-19, Watch For The Second Wave of GFC2

I guess in some ways it’s a race against the clock. What the optimists are really saying is the equivalent of the old eighties neo-Keynesian notion of filling in the troughs. That’s what government spending and monetary “stimulus” intend to accomplish, to limit the downside in a bid to buy time. Time for what? The economy to heal on its own. Fill up the bathtub, so to speak, with artificial stimulus water (aggregate demand) until such time as the basin stops...

Read More »“The illusions of Keynesianism create a morally corrupt society” – Part II

Part I can be found here Claudio Grass (CG): Overall, apart from the obvious economic consequences of the crisis, do you also see geopolitical and social ones, on a wider scale? Given all these “moving parts”, from the upcoming US election and internal frictions in the EU to the Hong Kong tensions and the rising public discontent in Latin America, where do expect the chips to fall once this is over? Jayant Bhandari (JB): What I have told you about India to a large...

Read More »FX Daily, June 26: Investors Wrestle with Notion that More Covid Cases mean More Stimulus

Swiss Franc The Euro has fallen by 0.01% to 1.0635 EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It may be that a new surge in virus cases will elicit more policy support from officials, but the immediate focus may be on the economic disruption. The number of US cases is reaching records, and at least a couple of states are stopping their re-opening efforts. Several other...

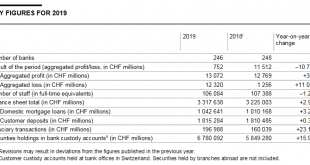

Read More »Banks in Switzerland 2019

The Swiss National Bank has today published its report Banks in Switzerland 2019 and the corresponding data for its annual banking statistics.1 The most important figures are summarised below. 1The figures in Banks in Switzerland are based on data in banks’ (parent companies’) individual financial statements, as required by law. The reporting entity ‘parent company’ includes bank offices in Switzerland and legally dependent branches abroad. Banks’ consolidated...

Read More »Audit office denies ‘mass phenomenon’ of Covid-19 credit abuse

The hospitality sector including restaurants were one of the biggest recipients of financial support during the crisis. Keystone / Pablo Gianinazzi An interim report on government pay-outs to businesses during the Covid-19 crisis has revealed that there is suspected abuse in less than 1% of cases. Тhe Federal Audit Office investigated some 94,000 coronavirus loans amounting to CHF11.4 billion ($12 billion). It found indications of abuse in about 400 cases, which...

Read More »Job postings fall by 27 percent due to pandemic

A hotel in Zurich: there are a lot less jobs going in this sector right now. Keystone / Gaetan Bally New job offers have dropped by over a quarter in Switzerland due to the Covid-19 pandemic, with hotel, restaurant, and personal services sectors worst hit. Between April and June, job postings went down by 27%, the human resources firm Adecco Switzerland reported on Tuesday. Anna von Ow, a University of Zurich researcher who worked on the report, said the collapse in...

Read More » SNB & CHF

SNB & CHF