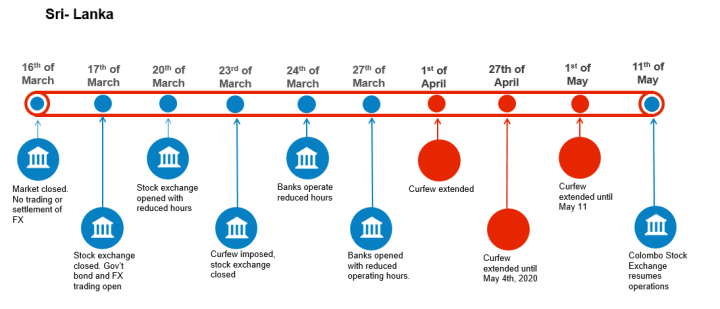

Restricted Market Trading Comments By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations today following an extended period of closure. Foreign exchange trading is still permitted between the hours of 8:30am and 1.15pm. Bangladesh: On May 7, 2020, the Bangladesh Bank (BB), the central bank, amended banking hours to the new time of 10:00am to 2:30 pm. On May 5, the government announced market lockdown will continue until May 16. While there is no trading and

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Restricted Market Trading Comments

By Dara O’Sullivan, Derrick Leonard, and Ilan Solot Covid-19 related measures for restricted markets remain largely unchanged from last week. Sri Lanka and India have extended their lockdown periods, while Kenya and Nigeria continue to face limited liquidity. Please see trading comments below Sri Lanka: The Colombo Stock Exchange (CSE) resumed operations today following an extended period of closure. Foreign exchange trading is still permitted between the hours of 8:30am and 1.15pm. |

|

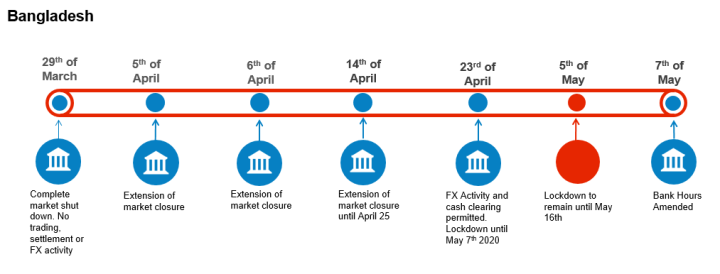

| Bangladesh: On May 7, 2020, the Bangladesh Bank (BB), the central bank, amended banking hours to the new time of 10:00am to 2:30 pm. On May 5, the government announced market lockdown will continue until May 16. While there is no trading and settlement allowed, banks will operate on the reduced hours to facilitate cash clearing and FX activity. |  |

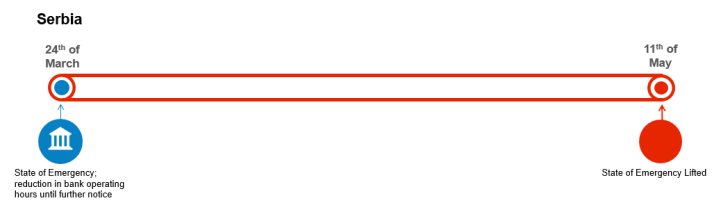

| Serbia: The State of Emergency has been lifted, effective May 11, 2020. While local depositories have today resumed operations, the Belgrade Stock Exchange (BELEX) will resume operations on May 18, 2020. |  |

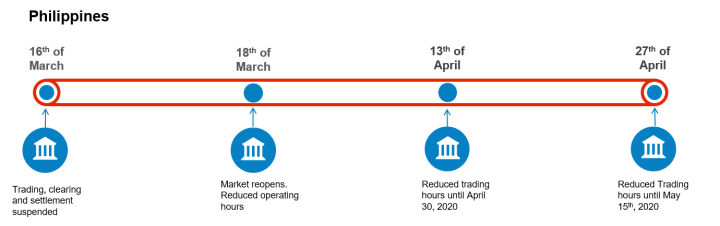

| Philippines: The market continues to operate under reduced hours from 9:00 to 14:00 until May 15. The cut off for FX activity is set at 2:00 pm. |  |

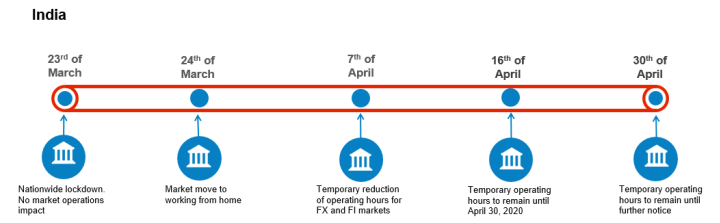

| India: The Reserve Bank of India (RBI) announced on April 30 an extension of the current lockdown scenario until further notice. All markets will be open from 10:00am to 2:00pm. For any clients actively trading this market, please continue to observe the current reduced temporary trading hours. |  |

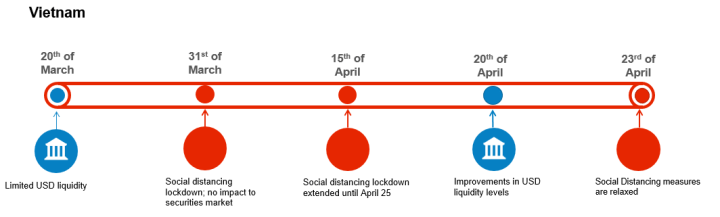

| Vietnam: The government relaxed social distancing measures on April 23, but it kept some restrictions in place for high risk areas including Hanoi and Ho Chi Minh. The FX market had been experiencing limited foreign currency liquidity. However, local banks advised there has been a noticeable improvement in liquidity and they are no longer seeing delays in repatriations. |  |

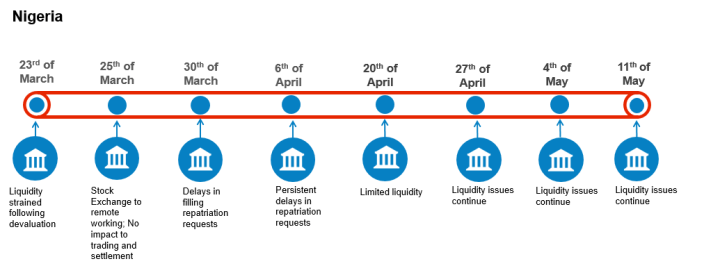

| Nigeria: Liquidity issues continue in the Nigerian market. The CBN remains the single largest provider of USD to Foreign Portfolio Investors and as a result, investors are only seeing rare allocations of liquidity. As a result, only a few repatriation requests are being executed. We continue to monitor the liquidity situation and will provide updates as they are received. |  |

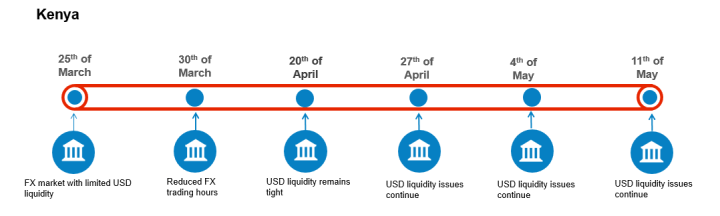

| Kenya: The market has been experiencing limited USD liquidity and delays in repatriations. The FX market reduced its trading hours on March 30 and now operates from 9:00 am until 2:00 pm until further notice. |  |

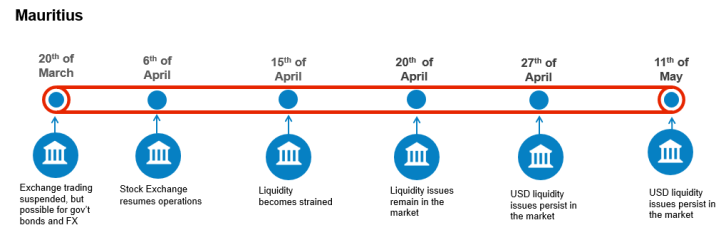

| Mauritius: Local banks continue to experience liquidity issues. The Stock Exchange of Mauritius (SEM) reopened on April 6 following a period of closure and the banks continue to support trading, settlement, cash clearing and FX activities. |  |

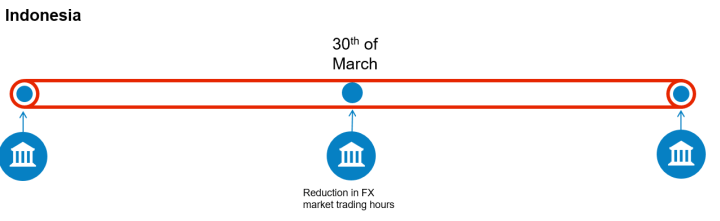

| Indonesia: Bank Indonesia reduced FX and bond market trading hours from until further notice. Where previously the market was open for trading from 8:00am until 4:00pm the revised hours are now 9:00am until 3:00pm. |  |

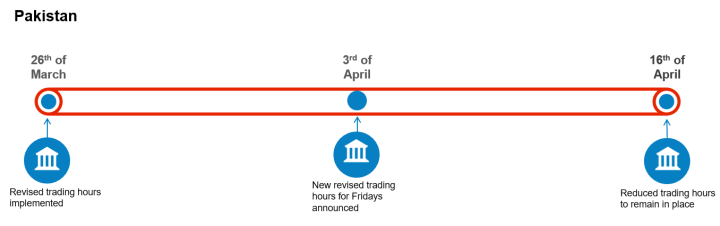

| Pakistan: Effective April 16, the Pakistan Stock Exchange (PSE) announced the amended trading hours currently in operation are to remain in place. From Monday to Thursday trading hours have been reduced to 10:00am to 4:00pm. On Fridays, they continue to operate a single trading session only on Fridays from 10:00am to 1:00pm. During this time banks will facilitate support for trading, settlement and cash clearing for FX and government debt. |  |

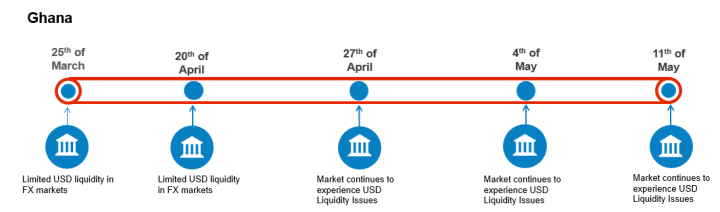

| Ghana: The FX market continues to experience limited foreign currency liquidity. Local banks warned about possible delays in repatriations. |  |

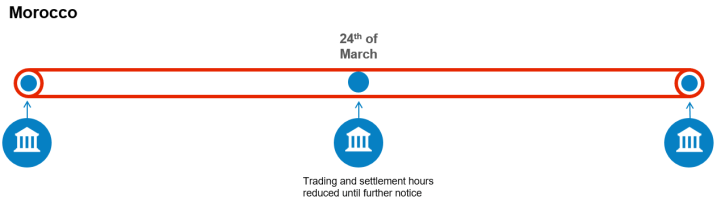

| Morocco: The Casablanca Stock Exchange (CSE) and the Bank al Maghrib (BAM) shortened their FX and securities deadlines to 2:00 pm until further notice. |  |

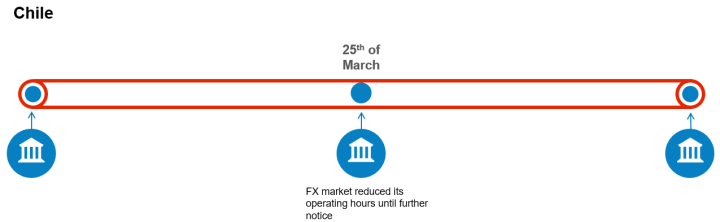

| Chile: The Chilean interbank FX market reduced its operating hours. The FX market will close at 1:00 pm until further notice. |  |

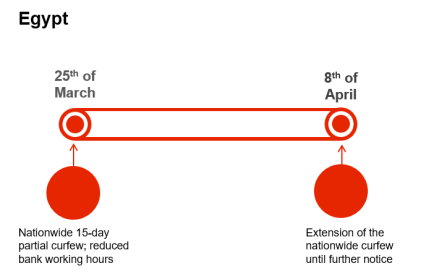

| Egypt: On April 8, 2020, the government extended the nationwide curfew until further notice. While cash and securities deadlines have been reduced so far there has been no impact to our FX executions. |  |

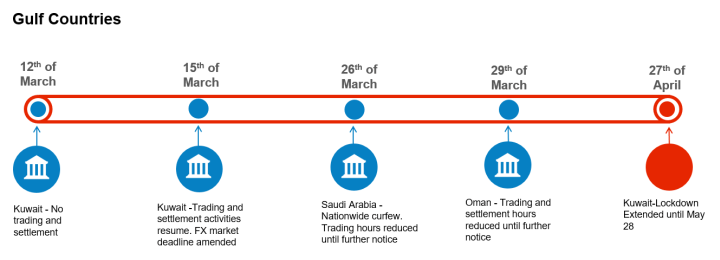

| GULF COUNTRIES

Saudi Arabia: A nationwide curfew remains in place in Saudi Arabia daily from 3:00 pm until 6:00 am. Trading hours had been reduced, and with the holy month of Ramadan the market is now closing at 1:00 pm. Kuwait: Effective April 7, the Council of Ministers extended their previously declared market holiday further to May 28. This has resulted in local FX markets closing at 12.30pm instead of 1.30pm. Oman: Effective March 29, the Muskat Securities Market (MSM) reduced trading hours in response to Covid-19. The market will now close at 1:00pm. |

|

Tags: Emerging Markets,Featured,newsletter