After appointing an auditor last December, FINMA decided to open so-called enforcement proceedings. © Keystone/Lukas Lehmann The Swiss financial supervisor FINMA says it has opened enforcement proceedings against Credit Suisse into the 2019 spying affair that toppled the bank’s leadership and tarnished its reputation. FINMA opened the proceedings after an auditor appointed last December completed its investigation of Credit Suisse, which has acknowledged...

Read More »Eurodollar University’s Making Sense; Episode 24, Part 2: Peering Behind The (Unemployment Rate) Curtain

———WHERE——— AlhambraTube: https://bit.ly/2Xp3roy Apple: https://apple.co/3czMcWN iHeart: https://ihr.fm/31jq7cI Castro: https://bit.ly/30DMYza TuneIn: http://tun.in/pjT2Z Google: https://bit.ly/3e2Z48M Spotify: https://spoti.fi/3arP8mY Castbox: https://bit.ly/3fJR5xQ Breaker: https://bit.ly/2CpHAFO Podbean: https://bit.ly/2QpaDgh Stitcher: https://bit.ly/2C1M1GB Overcast: https://bit.ly/2YyDsLa SoundCloud: https://bit.ly/3l0yFfK PocketCast: https://pca.st/encarkdt...

Read More »Monetary and Fiscal Sorcery Make Home Price Magic

Make the money cheap enough and government intrusive enough, and incongruous headlines appear side by side. For instance, from the Las Vegas Review-Journal comes this head-scratcher: “Las Vegas Housing Market ‘on Fire’ as Economy Limps Along.” Almost Daily Grant’s reminds us the Federal Reserve is on the job 24/7/365, There’s more where that came from. Last week’s release of the minutes to the Federal Reserve’s July meeting indicated that the Open Market Committee...

Read More »MARK O’BYRNE, Goldcore.com: SILVER IS ABOUT TO EXPLODE THROUGH ALL BARRIERS!

VERY IMPORTANT REPORTS: https://www.portfoliowealthglobal.com/no/ https://www.portfoliowealthglobal.com/Ray/ https://www.portfoliowealthglobal.com/Bull/ https://www.portfoliowealthglobal.com/dollar/ Disclosure/Disclaimer: We are not brokers, investment or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or...

Read More »Government exempts high-emission cars from Swiss climate goals

More than half of new vehicles registered in Switzerland are 4x4s. Keystone / Gaetan Bally The Swiss government is easing the pressure on the automotive industry to reduce CO2 emissions, reports Sunday newspaper Le Matin Dimanche. In its revision of the CO2 ordinance to mitigate global warming, the government had agreed to lower the limit on CO2 emissions to 95g/km from 2020. However, this year car importers can exclude 15% of the most polluting vehicles from their...

Read More »Powell Would Ask For His Money Back, If The Fed Did Money

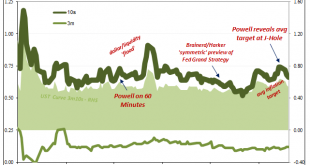

Since the unnecessary destruction brought about by GFC2 in March 2020, there have been two detectable, short run trendline upward moves in nominal Treasury yields. Both were predictably classified across the entire financial media as the guaranteed first steps toward the “inevitable” BOND ROUT!!!! Each has been characterized as the handywork of master monetary tactician Jay Powell. There is some truth underlying, only stripped of all that hyperbole. These backups in...

Read More »The Fed’s Latest Lie: It Can Make Everything Go Back to Normal

The Fed Emperor’s New Clothes Show is a continuous comedy without laughter. The latest act, the virtual Jackson Hole conference (August 27), was dreadful. The show’s audiences are accustomed to the Fed chair and his board delivering solemn pronouncements about their aims—low inflation, high employment, and financial stability. These officials play their parts according to script. They never explain how they will fulfill their promise—it is all boast and no substance....

Read More »High gold prices spur more illegal mining in Peru

A small section of La Pampa region in Peru being replanted after illegal miners deforested large swaths of the rainforest. Paula Dupraz-Dobias The boom in gold prices during the Covid-19 pandemic has kept Swiss refineries in business but has also boosted illegal mining, imperiling lives and the environment. Increased demand for the safe-haven metal has led gold prices to fluctuate in recent weeks around their highest levels since 2011. Mark Haefele, Chief...

Read More »Eurodollars & Global Deflation Risk W/ Jeff Snider | Expert View | Real Vision™

Is the global economy poised to enter another deflationary cycle? Jeff Snider, head of global research and chief investment strategist at Alhambra Partners, believes that we have never enjoyed a true recovery from the global financial crisis - but instead, have merely bounced between cycles of deflation and reflation. In this piece, Snider unpacks the importance of Eurodollars as a key to understanding where the global economy is headed next. Filmed on September 11, 2018 in Tonawanda, New...

Read More »FX Daily, September 4: Markets Look for more Solid Footing, but Need to Get Passed US Jobs Data

Swiss Franc The Euro has risen by 0.14% to 1.0789 EUR/CHF and USD/CHF, September 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic sell-off of US shares yesterday is the main focus, capturing the limelight from other forces, including today’s US employment report. It was the third-worst session for the S&P 500 since the March 23 bottom, and the other two did not see follow-through selling. ...

Read More » SNB & CHF

SNB & CHF