It is only through the increase in capital goods, i.e., through the enhancement and the expansion of the infrastructure, that labor can become more productive and earn a higher hourly wage. Original Article: “Understanding Minimum Wage Mandates: Empirical Studies Aren’t Enough” This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Michael Stack. President Joe Biden has promised to raise the minimum wage from $7.25 to $15 per hour. Some...

Read More »Report shows slump in foreign investment in Swiss real estate

View of the Europaalle urban development in Zurich on April 12, 2019. © Keystone / Christian Beutler The share of foreign investment in Swiss commercial real estate fell from 15% before 2011 to 5% between 2017 and 2019, according to new research. The issue of foreigners buying cheap Swiss property during the Covid-19 pandemic is being discussed in Bern. Foreign investment in commercial buildings in Switzerland reached CHF750 million ($841 million) a year, or an...

Read More »Bezirk ist von den Ausreiseverboten besonders betroffen

AUSSERFERN (rei). Wer glaubte, dass mit den Lockerungen in Österreich das Leben in Zeiten der Pandemie einfacher wird, musste in den vergangenen Tagen miterleben, dass das Gegenteil der Fall ist. Jedenfalls in Tirol. Das Land ist abgeschottet, bzw. eingeriegelt. Das Außerfern als Grenzbezirk ist besonders betroffen. Glaube Sie, dass sich die Situation rund um die Coronamaßnahmen rasch ändern wird? Wer innerösterreichisch nach Vorarlberg oder Salzburg ausreisen will,...

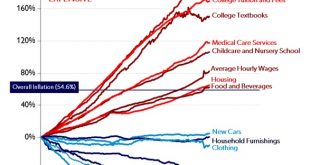

Read More »In One Image, Everything You Need to Know about Government Intervention

by Daniel Mitchell While I freely self-identify as a libertarian, I don’t think of myself as a philosophical ideologue. Instead, I’m someone who likes digging into data to determine the impact of government policy. US Consumer Goods and Services, Wages Price Change, 2000 - 2020 - Click to enlarge And because I’ve repeatedly noticed that more government almost always leads to worse outcomes, I’ve become a practical ideologue. In other words,...

Read More »The Green Market – Episode 1: Charles Hugh Smith, Julian Morris and Martí Jiménez-Mausbach

Local and Decentralised Economies: The Start Of A New Environmentalism This weeks host, Richard Bonugli, CEO of Cedargold, talks with Charles Hugh Smith (OfTwoMinds.com), Julian Morris (Senior Fellow at Reason Foundation), and Martí Jiménez-Mausbach (Head of Research at the Ostrom Institute) on the works of Hayek, Elinor Ostrom and whether local and decentralised economies can promote Market Environmentalism to the masses, who are looking to find a sustainable solution to the...

Read More »The Depression of the 1780s and the Banking Struggle

[Chapter 2 of Rothbard’s newly edited and released Conceived in Liberty, vol. 5, The New Republic: 1784–1791.] It has been alleged—from that day to this—that the depression which hit the United States, especially the commercial cities, was caused by “excessive” imports by Americans beginning in 1783. But this kind of pseudo-explanation merely betrays ignorance of economics: a boom in imports reflects voluntary choices and economic improvement by consumers, and this...

Read More »Swiss spent record amount on food in 2020

Shoppers most often chose traditional retailers such as Migros and Coop over discounters and specialty shops for their groceries. Keystone / Laurent Gillieron Consumers spent 11.3% more on food and beverages in brick-and-mortar shops last year than they did in 2019, helping the food retail trade to pull in a record turnover of nearly CHF30 billion ($33.7 billion). In total, the average household spent CHF7,680 on comestibles, according to figures released on Thursday...

Read More »Gold Price Forecast – LBMA Survey Published

The LBMA (London Bullion Market Association) annual forecast survey published last week shows that forecasters expect the average gold price to rise 11.5% in 2021 to US$1973.8 (forecasters’ average) from the actual average gold price in 2020 of US$1769.6, and for the silver price to rise 38.7% in 2021 to US$28.50 from the actual annual average of US$20.55 in 2020. These expected averages show silver might gain three times more percentage than that of gold in 2021....

Read More »The World Needs a Gold-Backed Deutsche Mark

The seeds of sound-money destruction were sown at the 1944 Bretton Woods Conference, which established that US dollars could be held as central bank reserves and were redeemable for gold by the US Treasury at thirty-five dollars an ounce. This was the so-called gold exchange standard, but only foreign central banks and some multinational organizations, such as the International Monetary Fund (IMF), enjoyed this right of redemption. The system depended upon the solemn...

Read More »European banks need new chiefs

EUROPEAN BANKS’ fourth-quarter earnings, releases of which are clustered around early February, have been surprisingly perky. Those with trading arms, such as UBS or BNP Paribas, rode on buoyant markets. State support helped contain bad loans; few banks needed to top up provisions. Markets should keep them busy and, as the economy recovers, loan volumes should rise. Many banks plan to resume dividends this year. Yet the chronic illness that has dogged the industry...

Read More » SNB & CHF

SNB & CHF