Dollar weakness has resumed as risk on sentiment dominates; the US election outcome is starting to take shape Senate Majority Leader McConnell said passing a stimulus bill is a top priority during the lame duck session; the two day FOMC meeting concludes today with a likely dovish hold; weekly jobless claims will be reported BOE increased its asset purchases by GBP150 bln vs. GBP100 bln expected; UK government is due to announce more details of the growing fiscal measures today; eurozone data came in soft; Norges Bank left rates unchanged at 0.0%, as expected Japan reported firmer final services and composite PMI readings; Australia reported September trade; Indonesia is climbing out of recession Dollar weakness has resumed as risk on sentiment dominates. DXY is

Topics:

Win Thin considers the following as important: 4) FX Trends, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Dollar weakness has resumed as risk on sentiment dominates; the US election outcome is starting to take shape

- Senate Majority Leader McConnell said passing a stimulus bill is a top priority during the lame duck session; the two day FOMC meeting concludes today with a likely dovish hold; weekly jobless claims will be reported

- BOE increased its asset purchases by GBP150 bln vs. GBP100 bln expected; UK government is due to announce more details of the growing fiscal measures today; eurozone data came in soft; Norges Bank left rates unchanged at 0.0%, as expected

- Japan reported firmer final services and composite PMI readings; Australia reported September trade; Indonesia is climbing out of recession

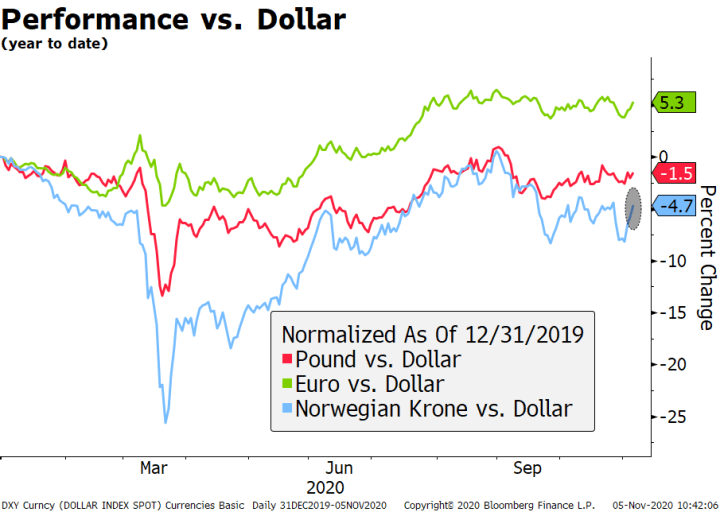

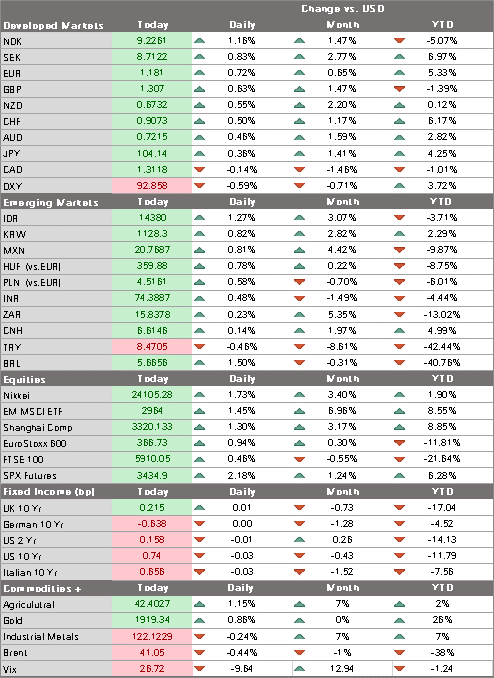

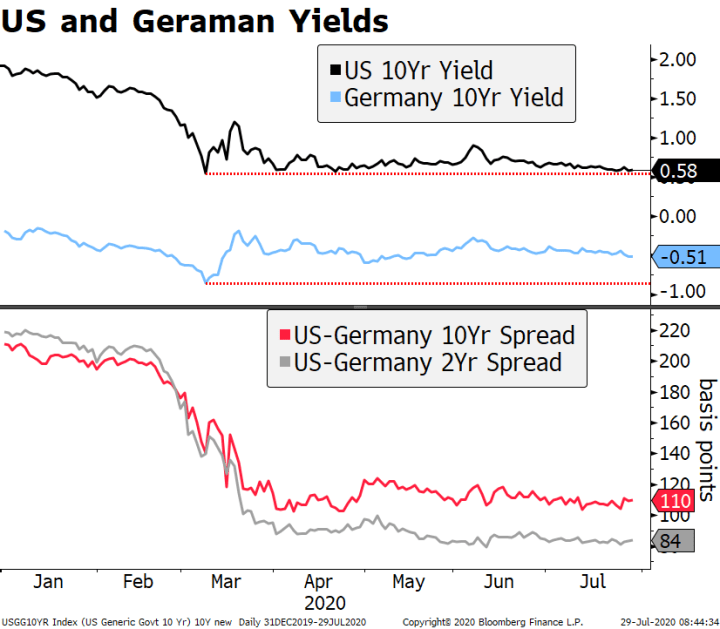

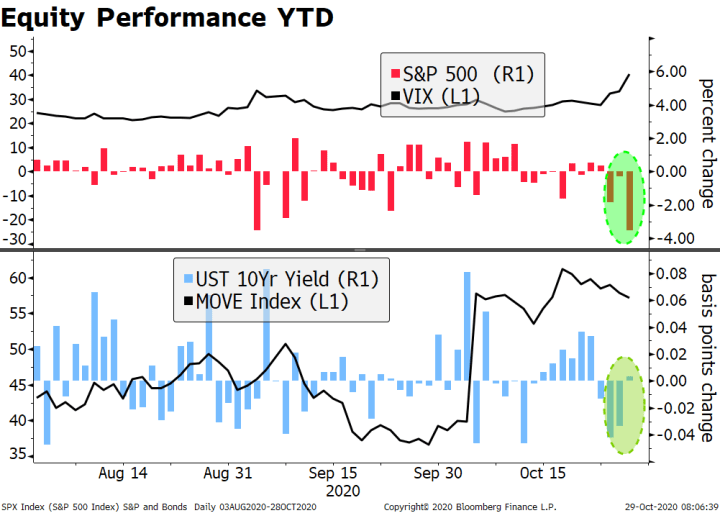

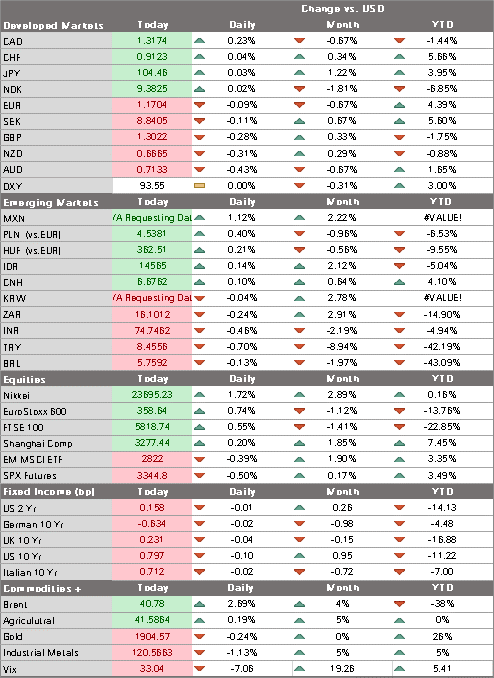

Dollar weakness has resumed as risk on sentiment dominates. DXY is trading back below 93 and is on track to test the October 21 low near 92.475. If weakness persists as we expect, DXY should eventually test the September 1 low near 91.746. The euro is moving back above $1.18 and sterling is likely to move back above $1.31. USD/JPY remains heavy and is testing the 104 area again. With the Fed expected to deliver a dovish hold today even as the fundamental outlook worsens, we believe the weak dollar tend will remain intact in Q4.

AMERICAS

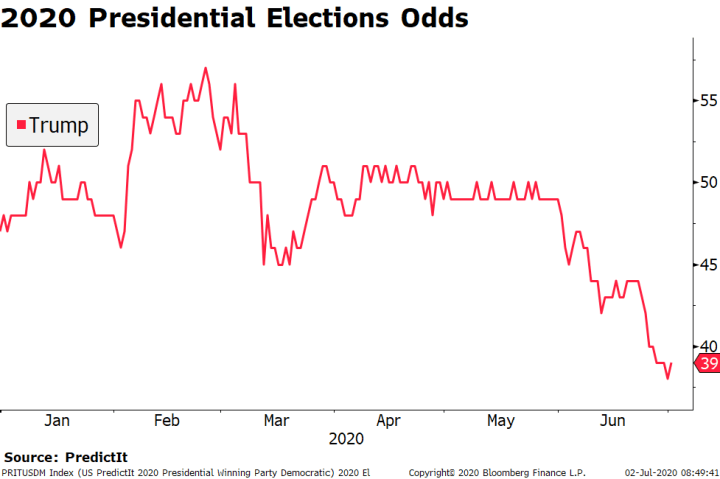

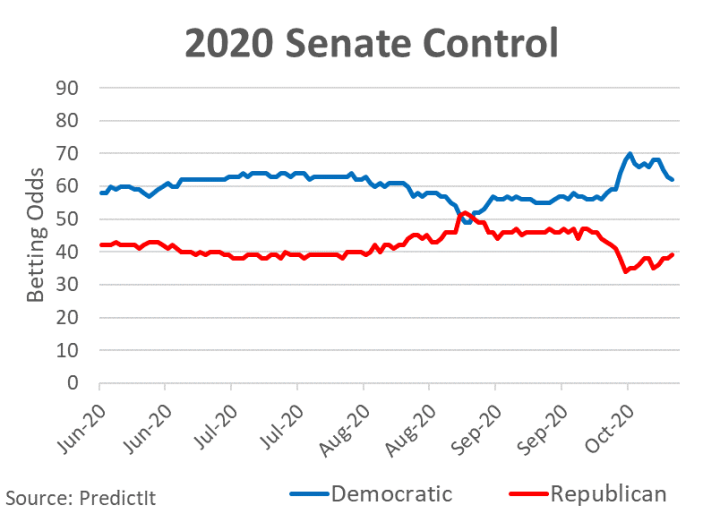

The US election outcome is starting to take shape. AP projects that Biden won Arizona. Its 11 electoral votes would give Biden’s a total of 264 vs. 217 for Trump. Biden only needs to win Nevada (6 electoral votes) to reach the magic 270, and a scheduled update from that state will be given at noon today. Nevada is leaning Biden (49.3% to 48.7%) with only 75% of the votes counted so far. In Georgia (16 votes), Trump is leading but his gap has narrowed to only 18k as the remaining votes have been skewed towards Biden. It’s the same story in Pennsylvania (20 votes), with Trump leading by 165k with more than 1 mln votes to be counted. Lastly, Trump is clinging to a 75k lead in North Carolina (15 votes). These two states would be rendered moot if Biden wins Nevada.

In Wisconsin, Trump looks set to request a recount, thought that’s unlikely to change the results. In the 2016 presidential election, Green Party candidate Stein requested a Wisconsin recount that resulted in a net gain of 131 votes for Trump. Former Wisconsin Governor Scott Walker said the Trump campaign faced a “high hurdle,” noting the 2016 recount as well as one in 2011 for the Wisconsin Supreme Court that produced “a swing of 300 votes.”

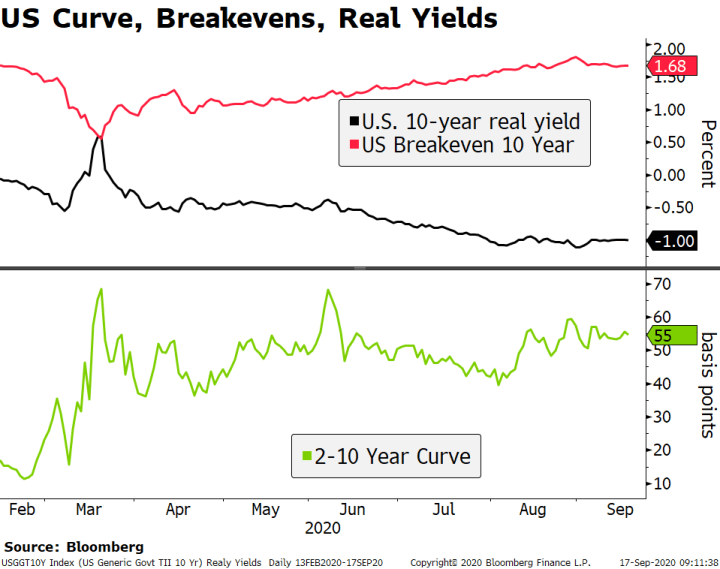

Why are equity markets rallying under the (likely) government split of a Democratic President and House plus a Republican Senate? First, it suggests that most investors are looking through the risk of a serious legal challenge and the possibility of civil unrest. This might be premature but we tend to favor this position. Also, a Republican Senate implies no tax hikes, which is good for equities. Big Tech getting an added boost on the lower likelihood of regulatory constraints or even breakup. The odds of a massive fiscal package are very small now, which is worse for growth but also dampens longer-term concerns about a runaway deficit. At 0.74%, the 10-year yield is well below the .90% pre-election peak. This could mean that the Fed is left as the remaining source of counter-cyclical policy in any new downturn. We cannot help but feel that legislative gridlock is bad for the economy as a whole.

Senate Majority Leader McConnell said passing a stimulus bill is a top priority during the lame duck session. This is noteworthy, as we had believed nothing would happen until the new Congress came in next year. We think House Speaker Pelosi was one of the election night losers and her decision not to agree on a stimulus compromise ahead of the elections will be second-guessed for years. Now, we think she has even less negotiating leverage and will likely have to accept something closer to McConnell’s skinny bill (around $500 bln) than the White House offer of $1.8 trln. While something is better than nothing in terms of stimulus, this lower amount won’t move the needle much in terms boosting the economy and so we think economists will mark down their Q1 GDP forecasts in the coming weeks.

The two day FOMC meeting concludes today with a likely dovish hold. Policy settings will be kept unchanged even as Chair Powell will likely play up the downside risks to the economy due to rising virus numbers and the lack of another fiscal stimulus package. While Powell and company will likely pledge to do more as needed, we think it is really up to fiscal policy now and in this regard, Powell will likely be disappointed. The dollar tends to weaken on FOMC decision days. Of the eight so far this year, DXY has weakened on seven of them. See our FOMC preview here.

Weekly jobless claims will be reported. Regular initial claims are expected at 735k vs. 751k the previous week, while continuing claims are expected at 7.2 mln vs. 7.756 mln the previous week. PUA initial claims rose for the second straight week to 360k last week and so the two together still total around 1.1 mln, which remains elevated. Regular continuing claims have continued to fall but PUA continuing claims remain stuck above 10 mln and so the two together still total around 19 mln. While the labor market overall appears to be improving again after a stall in much of Q3, it’s not particularly robust. Indeed, we got two warning signs yesterday. The ADP reading of 365k private sector jobs suggests downside risks to 600k consensus for the October jobs report Friday. So too does the employment component of ISM Services, which fell to 50.1 and is in danger of moving back into contractionary territory. Q3 nonfarm productivity and unit labor costs will also be reported today.

| EUROPE/MIDDLE EAST/AFRICA

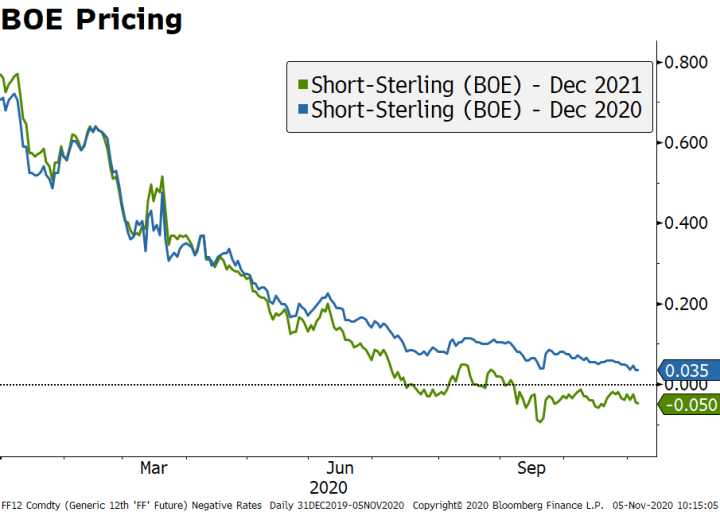

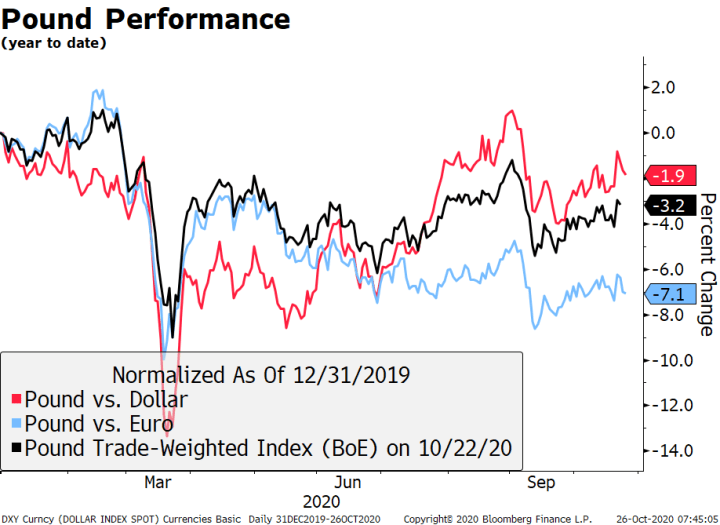

Bank of England kept rates on hold but increased its asset purchases by GBP150 bln vs. GBP100 bln expected. The new purchases will be government bonds, with no additional corporate debt and no change in the rate of purchase (about £4.5 bln per week). While a bit higher than the consensus, we don’t think markets were too surprised by it given the worsening of the pandemic and new lockdown policies. It’s tempting to make the connection between the upside surprise and greater fiscal expending fiscal stimulus (see below), but Governor Bailey made a point of saying that the increase in QE is not related to the government funding needs. Despite ongoing discussions, we don’t expect negative rates in the UK, and there was nothing in today’s meeting to challenge this view. More stimulus, if needed, will come from the fiscal side or QE and we believe the risk of negative rates priced in the futures market will eventually be priced out. Sterling tends to strengthen on BOE decision days. Of the eight so far this year, cable has gained on five of them. It’s up today and so that record looks set to improve. |

BOE Pricing, 2020 |

| The UK government is due to announce more details of the growing fiscal measures today. One of the centerpieces of the new effort is the new furlough scheme to cover 80% of wages during the lockdown. Reports also claim that wage support measures will be extended beyond the December 2 lockdown deadline for the most affected areas.

Eurozone data came in soft today. Headline retail sales fell -2.0% m/m vs. -1.5% expected, and this will only get worse as lockdowns widen. Elsewhere, Germany reported September factory orders up 0.5% m/m vs. 2.0% expected). It will be followed by IP (2.6% m/m expected) Friday and the orders data suggests weakness ahead for Germany’s factories. The Norges Bank left rates unchanged at 0.0%, as expected. However, the krone is rallying on official comments that suggest concern about its weakness. The communique emphasized the downside risks from the pandemic’s second wave. The bank maintained that rates would likely remain at current levels for “the next couple of years” and still expects to start hiking rates in late 2022. Norway’s economy is faring comparatively well during the pandemic. Though the currency has underperformed in part due to the weaker oil prices, today’s statement noted that the krone “is weaker than projected.” Recall that Norges bank threatened to intervene in FX markets to stem the currency decline in March. Nokkie tends to strengthen on Norges Bank decision days. Of the seven so far this year, NOK has gained against EUR on four of them. It’s up today and so that record looks set to improve. Czech National Bank and is expected to keep rates steady at 0.25%. Here too, the weak koruna reflects the negative impact of the rising virus numbers. The bank has left rates steady since the last 75 bp cut in May. Earlier that day, September retail sales will be reported and are expected to fall -0.6% y/y vs. -2.6% in August. Trade and industrial and construction output will be reported Friday. |

Performance vs. Dollar, 2020 |

| ASIA

Japan reported firmer final services and composite PMI readings. Both improved over a point from the preliminary readings to 47.7 and 48.0, respectively. BOJ Governor Kuroda said he is closely monitoring the impact of the US elections on financial markets, adding that “Stability in foreign exchange rates is very important.” With the recovery taking hold, policymakers are clearly concerned about the impact of a stronger yen. USD/JPY traded at a new low today just below 104, where it is seeing continued support. A clean break below the figure would set up a test of the March low near 101.20. No wonder Mr. Kuroda sounds concerned. Australia reported September trade. Exports rose 4% m/m vs. 3% expected and -4% in August, while imports fell -6% m/m vs. -1% expected and a revised +1% (was 2%) in August. Improved market sentiment has seen AUD move back above .7200 this week. A break above the .7250 area would set up a test of the September 1 high near .7415. The RBA will issue its quarterly Statement on Monetary Policy Friday in which it lays out new macro forecasts. Indonesia is climbing out of recession, its first since the Asian financial crisis over two decades ago. Q3 GDP rose 5.05% q/q vs. -4.19% in Q2. GDP had shrunk q/q for three straight quarters and so it entered the pandemic already in a weakened position. The y/y rate came in at -3.49%, a bit worse than the -3.2% expected but better than the -5.32% reading for Q2. It looks like the worst may be over for Indonesia, but it will be a steep climb since the government re-imposed restrictions in October. Bank Indonesia has left rates steady at 4.0% since the last 25 bp cut in July due to concerns about capital outflows and a weak rupiah. Next scheduled policy meeting is November 19 and steady rates are likely. However, a dovish surprise is possible if the rupiah continues to firm. |

Tags: Articles,Daily News,Featured,newsletter