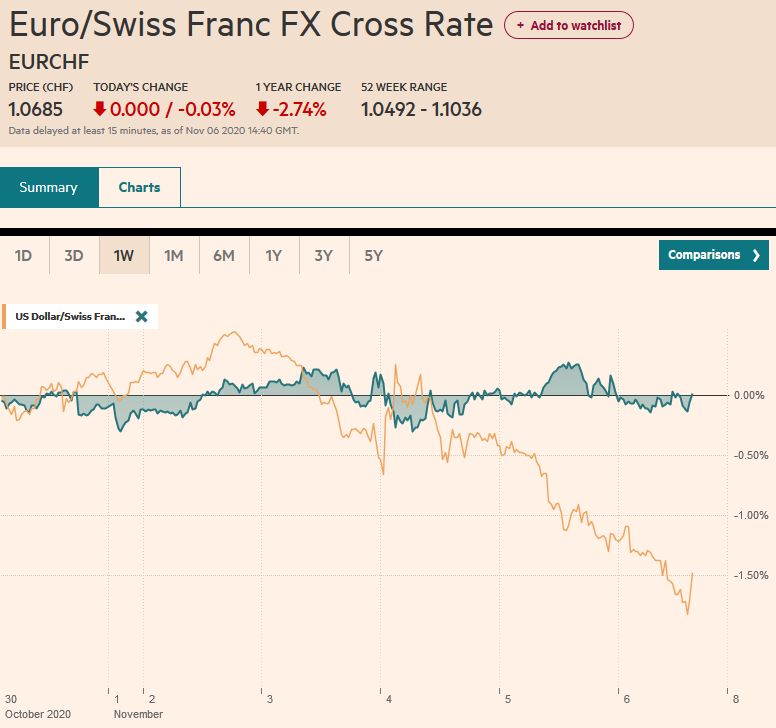

Swiss Franc The Euro has fallen by 0.03% to 1.0685 EUR/CHF and USD/CHF, November 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors have piled into risk assets this week, seemingly undeterred by the US elections’ lack of a clear outcome. The coronavirus is still surging, and a new complication has emerged. A mutation of the virus, originating in minks (Denmark), could pose a challenge in developing a vaccine. MSCI Asia Pacific Index rose for the fifth consecutive session today to end its best week since April. Of note, led by industrials, utilities, and financials, the Nikkei posted its highest close since 1991. However, profit-taking emerged in Europe to snap a five-day advance. The Dow Jones Stoxx

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Currency Movement, Election, EUR/CHF, Featured, Italy, jobs, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.03% to 1.0685 |

EUR/CHF and USD/CHF, November 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

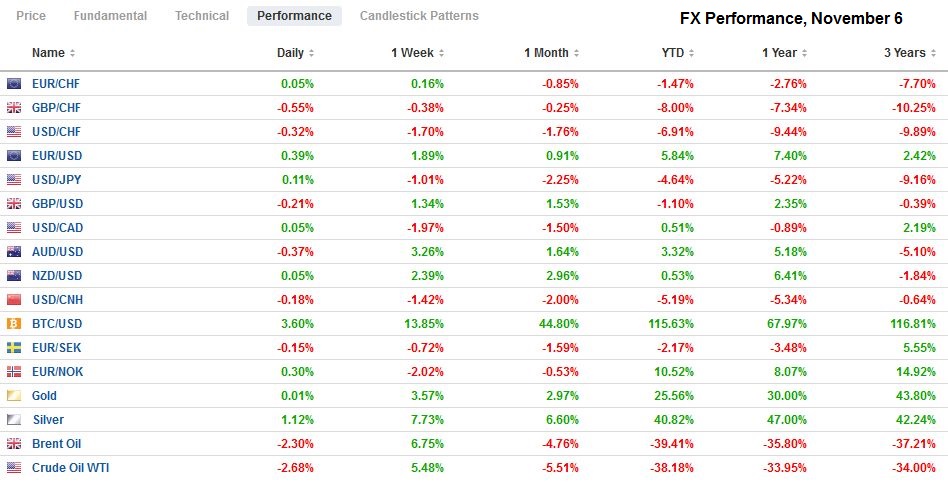

FX RatesOverview: Investors have piled into risk assets this week, seemingly undeterred by the US elections’ lack of a clear outcome. The coronavirus is still surging, and a new complication has emerged. A mutation of the virus, originating in minks (Denmark), could pose a challenge in developing a vaccine. MSCI Asia Pacific Index rose for the fifth consecutive session today to end its best week since April. Of note, led by industrials, utilities, and financials, the Nikkei posted its highest close since 1991. However, profit-taking emerged in Europe to snap a five-day advance. The Dow Jones Stoxx 600 is posting its best weekly gain (6%+) since June. The S&P 500 is up 7.3% this week, coming into today. US stocks are trading a bit heavier today. Benchmark 10-year yields rose in the Asia Pacific region after US rates steadied yesterday but are a little softer in Europe. The US benchmark is near 0.76%, an eight basis point decline this week. China’s 10-year bond, in contrast, rose two basis points this week to 3.19%. The US dollar is mixed today, with the Australian and Canadian dollars the weakest of the majors, off about 0.2%, and the Scandis are up about 0.6%. The greenback has been unable to recapture JPY104, which was lost yesterday for the first time since March. Emerging market currencies are mixed. The JP Morgan Emerging Market Currency Index is slightly lower after advancing about 2.1% over the past three sessions. The Turkish lira’s nearly 2% decline this week to new record lows stands out. Gold reached $1950 yesterday for the first time since late September and consolidated its more than 3.5% gain this week. December WTI recovered off the $33.60 low seen earlier this week and stalled near $39.35 yesterday. It fell back to around $37.60 today but is consolidating in the European morning. |

FX Performance, November 6 |

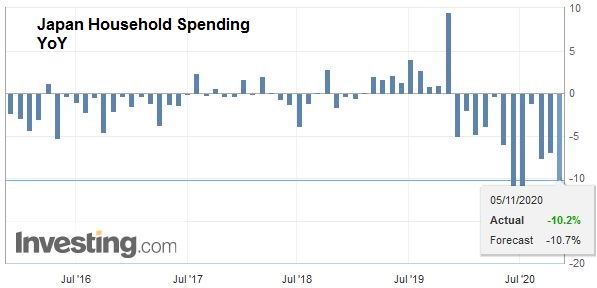

Asia PacificJapan reported that household spending fell 10.2% in the year through September. This is slightly better than economists projected, but still a deterioration from August when it fell by 6.9%. The series may indeed reflect the attempt to beat last year’s sales tax increase. However, the fact of the matter is that household spending in Japan has fallen on a year-over-year basis since last October. In addition to the controversial sales tax increase, the other dampener is wages. Cash wages fell for the sixth consecutive month in September. |

Japan Household Spending YoY, September 2020(see more posts on Japan Household Spending, ) Source: investing.com - Click to enlarge |

Following the Reserve Bank of Australia’s rate cut and QE decision earlier this week, the Monetary Policy Statement today provided updated forecasts. The RBA projects the economy will contract by about 4% this year before expanding 5% next year and 4% in 2022. It expects 1% inflation this year and next and accelerating to 1.5% in Q4 22. Unemployment is expected to fall from 8% this year to 6.5% next and then 6% in 2022.

The USDA estimates that China has bought $13.8 bln of agricultural products from the US through September. This is the most since 2017. It more than tripled the estimated corn purchases to 22 mln tons. Many private sector estimates still have China well behind on its purchase commitments under the Phase 1 trade deal. Meanwhile, today is a deadline for Australian-Chinese trade, and reports suggest that China could act against seven categories of Australian commodities that account for around 7% of Australia’s exports.

The dollar broke below JPY104 yesterday for the first time since March. What was support is now resistance, with a $500 mln option struck at JPY104 that expires today. The dollar’s losses have been extended, and the $450 mln option at JPY103.30 has been approached. If the dollar has entered a new trading range against the yen, it may take some time to fish for the bottom, which could be in the JPY100-JPY101 area. The Australian dollar dipped below $0.7000 at the start of the weekend, and RBA easing aside, rallied to almost $0.7290 yesterday. It is consolidating in a tight range today and has held above $0.7245. Today seemed to be the clearest sign that the PBOC wanted to stabilize the yuan after it rose sharply yesterday. The dollar’s reference rate was set at CNY6.6290, while the bank models in the Bloomberg survey had it at CNY6.6215. The dollar had fallen to about CNY6.6035 yesterday, a new 2.5-year low. The dollar fell a little more than 1% this week and has fallen in all but four weeks since the end of June.

Europe

Germany’s disappointing factory orders report yesterday (0.5% vs. median forecast for 2.0%) has been followed by a softer than expected gain in industrial output. The 1.6% gain was still solid but off the 2.5% forecasts. The sting was partially blunted by the August series’s upward revision from a -0.2% to +0.5%. Spain’s industrial production rose by 0.8% in September, which also missed forecasts (~1.4%). Next week the aggregate figure for the eurozone will be announced, but with Q3 GDP already reported and the new social restrictions, the data is old.

The same is true of Italy’s September retail sales, which fared better than expected. After surging by more than 8% in August, a decline seemed almost inevitable. However, the 0.8% decline was better than the 1.4% fall that had been anticipated. Later today, Italy’s credit rating will be reviewed by Moody’s, which rates it Baa3 (BBB-) with a stable outlook. It is the same rating as Fitch assigns it and one notch below S&P. No change is expected. Separately, note that Moody’s and Fitch also review their German debt ratings.

The euro is firm in the European morning and pushing above yesterday’s high ($1.1860). This area corresponds to the (61.8%) retracement objective of the decline since September 1 when it briefly poked above $1.20. The October high was set near $1.1880, and above there, the $1.1900 may offer some psychological resistance amid fear that the ECB’s jawboning may return. Sterling is also consolidating yesterday’s rally that carried it to around $1.3155. The $1.3175 area was the high last month, and the (612.8%) retracement objective of the decline since the September 1 high. Sterling held support seen around $1.31. The euro settled yesterday just below GBP0.9000 but is back above that support today. There is an expiring option struck there for about 380 mln euros.

AmericaAlthough the vote-counting continues and no major newsgroup has declared a winner in the presidential contest, it is becoming clearer that Biden will win. In many southern states, the mail-in votes were counted first, and as the in-person votes were counted, Biden faded. However, in many of the battleground states, the mail-in votes were counted after the in-person votes. The Democratic Party encouraged mail-in voting while the Republican Party downplayed it. Hence, the mail-in votes in most areas favor Biden. |

U.S. Unemployment Rate, October 2020(see more posts on U.S. Unemployment Rate, ) Source: investing.com - Click to enlarge |

| There have been numerous court cases filed, but several have already been dismissed, and those that remain may not be sufficiently substantive to turn the results. At the same time, there are two Senate races too close to call still, and the two races in Georgia may go to a run-off election in early January. |

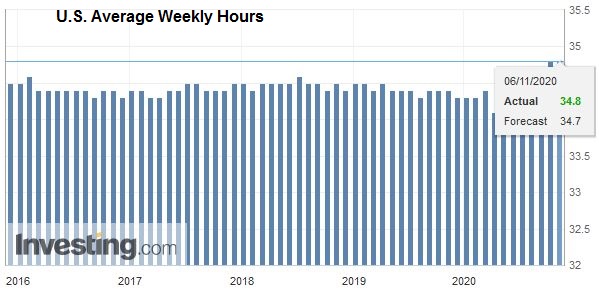

U.S. Average Weekly Hours, October 2020(see more posts on U.S. Average Weekly Hours, ) Source: investing.com - Click to enlarge |

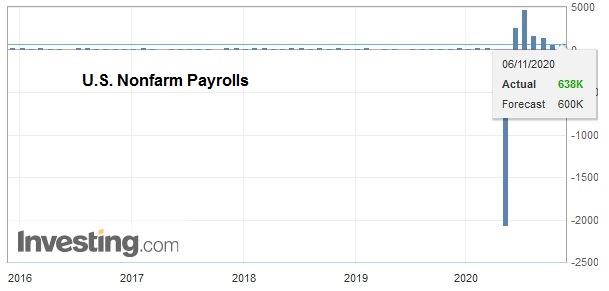

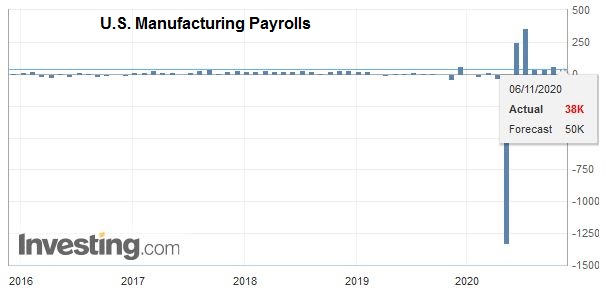

| Aside from the election, the US (and Canadian) jobs data is the immediate economic focus. Both countries are expected to have experienced slower job growth last month than in September. The median guesstimate in the Bloomberg survey called for 685k new private-sector jobs after 877k in September. The government sector appears to have lost jobs, and overall around 600k was expected to have been added to the non-farm payrolls. |

U.S. Nonfarm Payrolls, October 2020(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge |

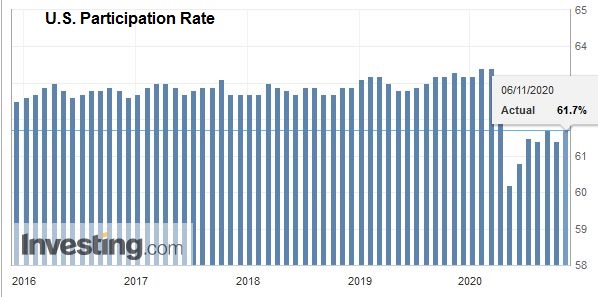

| The participation rate may have ticked-up while the unemployment rate is projected to have fallen to 7.6%. The slowdown in employment growth in Canada is expected to be more pronounced. |

U.S. Participation Rate, October 2020(see more posts on U.S. Participation Rate, ) Source: investing.com - Click to enlarge |

| Recall, its employment surged by 378k in September, which would be the equivalent of a nearly 4 mln increase in US non-farm payrolls. The vast majority in Canada were full-time posts (334k). A modest 75k increase in October employment is expected. |

U.S. Manufacturing Payrolls, October 2020(see more posts on U.S. Manufacturing Payrolls, ) Source: investing.com - Click to enlarge |

The FOMC statement was nearly identical to the previous statement. The main takeaway from the meeting and Chair Powell’s press conference was that the believes its current accommodation of $80 bln a month in Treasury purchases and $40 bln in agency MBS is sufficient. Changing circumstances could change its calculation. Powell was reluctant to commit to any “next step” but noted several dimensions that could be adjusted if needed. He seemed fairly confident that more fiscal stimulus will be provided.

The US dollar began the week near CAD1.34. It fell to about CAD1.3030 yesterday and is consolidating up to almost CAD1.31 today. Although it slipped below CAD1.30 on September 1, it hasn’t spent much time below it since early January. The risk-on mood, reflected in the strong equity rally this week, the recovery in oil prices, and the lower US yields appear to be the main drivers of the Canadian dollar rally. The five-day advance is in jeopardy today, but much demands on the electoral news stream and the employment reports. After testing MXN22.00 in the initial response to the early election news, the US dollar slumped. It fell to about MXN20.63 yesterday, a new eight-month low. It is trading sideways in its trough, having been up to around MXN20.8360, which roughly corresponds to last month’s low. The dollar has lost a little more than 2% against the peso this week. It has risen against the peso in only five weeks since the end of H1. Strong inflows (trade, remittances, and portfolio flows) have been the key drivers.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Currency Movement,Election,EUR/CHF,Featured,Italy,jobs,newsletter,USD/CHF