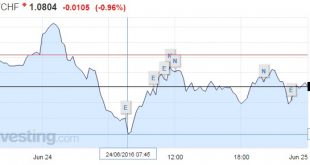

SNB interventions During the Brexit turmoil on Friday, the Swiss National Bank has intervened in markets. Just after they got into the office, at 7.45 am CET, they started the interventions. Apparently the Singapore office did not have a mandate to do interventions. The central bank drove the EUR/CHF price from a low of 1.0646 towards 1.08. FX traders might have moved it higher to 1.0850. We do not think that the...

Read More »Britain’s Dreams of a ‘Swiss Miracle’ Look More Like Fantasy

Electoral workers prepared a polling station for the referendum on the European Union in north London. Credit Neil Hall/Reuters To help explain why the British voted to leave the European Union, look to Switzerland. The famously neutral Swiss rejected membership in the European Economic Area, a potential steppingstone to the European Union, in a 1992 referendum, but Switzerland didn’t formally withdraw its dormant...

Read More »Brexit and what if means for the Bank of England

“Some market and economic volatility can be expected as this process unfolds,” Carney said in a televised statement in London after the referendum result. His comments followed Prime Minister David Cameron’s announcement that he will step down this year, which will inject political uncertainty into an already volatile period. His full announcement is below and his statement can be found here: [embedded content]...

Read More »Transport minister Doris Leuthard gets emotional at Gotthard opening

"It's a day to be proud," said Doris Leuthard, Switzerland's transport minister, visibly moved as she spoke with swissinfo.ch at the opening of the Gotthard rail tunnel on June 1 2016. "It's proof that Switzerland can achieve something." (Daniele Mariani, swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and...

Read More »Rule Britannia

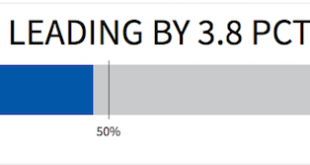

A Glorious Day What a glorious day for Britain and anyone among you who continues to believe in the ideas of liberty, freedom, and sovereign democratic rule. The British people have cast their vote and I have never ever felt so relieved about having been wrong. Against all expectations, the leave camp somehow managed to push the referendum across the center line, with 51.9% of voters counted electing to leave the...

Read More »The EU Begins to Splinter, a new Tsunami for Kuroda

Dark Social Mood Tsunami Washes Ashore Early this morning one might have been forgiven for thinking that Japan had probably just been hit by another tsunami. The Nikkei was down 1,300 points, the yen briefly soared above par. Gold had intermittently gained 100 smackers – if memory serves, the biggest nominal intra-day gain ever recorded (with the possible exception of one or two days in early 1980). Here is a...

Read More »FX Daily, June 24: Brexit Sends Shock Waves, SNB Intervenes

SNB interventions During the Brexit turmoil on Friday, the Swiss National Bank has intervened in markets. Just after they got into the office, at 7.45 am CET, they started the interventions. Apparently the Singapore office did not have a mandate to do interventions. The central bank drove the EUR/CHF price from a low of 1.0646 towards 1.08. FX traders might have moved it higher to 1.0850. We do not think that the...

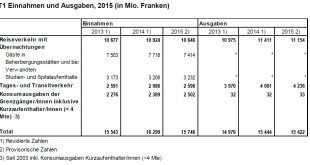

Read More »Tourism balance of payments 2015: Tourism balance of payments affected by strong franc

24.06.2016 09:15 – FSO, National Accounts (0353-1606-40) Tourism balance of payments 2015 Tourism balance of payments affected by strong franc Neuchâtel, 24.06.2016 (FSO) – The strong franc in 2015 made Switzerland less attractive to foreign tourists, whereas holidays abroad maintained their appeal to Swiss residents. Foreign tourists spent CHF 15.7 billion in Switzerland in 2015, 3.4% less than in 2014, while the...

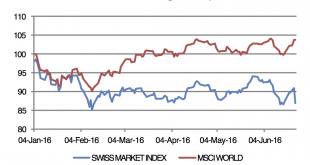

Read More »Brexit shakes global markets and the SMI

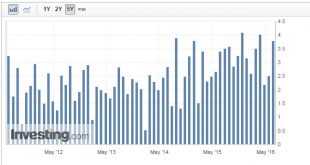

Investec Switzerland. Swiss Market Index The Swiss Market Index (SMI) is set to post a modest gain this week despite confirmation that the UK has decided to leave the European Union. The SMI opened almost 7% lower following the announcement before recovering. The Swiss franc strengthened the most since the Swiss National Bank (SNB) lifted its cap against the euro in 2015. click to enlarge Around...

Read More »Purchasing Power Parity, REER: Swiss Franc Overvalued?

After the strong revaluation of the Swiss franc in recent years, some economists, like the ones at the Swiss National Bank (SNB), claim that the franc were overvalued. Finally this claim is propaganda, because it is based on a not usable models (the REER and purchasing power parity) and wrong assumptions. The mistakes Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or...

Read More » SNB & CHF

SNB & CHF