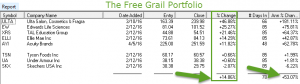

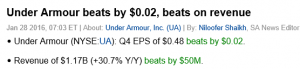

The free portfolio advanced 2.02% this week, but the S&P lost the small amount of 0.12%.

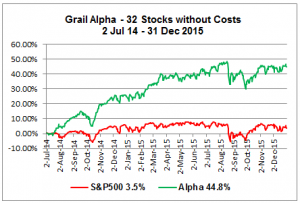

Click to enlarge.

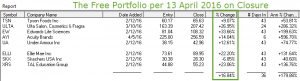

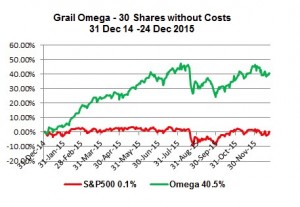

The Ultima Plus portfolio became operational on 31 December 2015.

Click to enlarge.

Market Comment

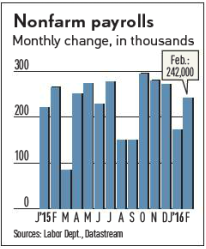

Up to Wednesday, the S&P 500 rose to a 10-month high of 2119.12 points, less than 1% below its all-time high of 2130.82 of 12 May last year. But stocks pulled back on Thursday and more decisively on Friday, as bond yields around the world reached or neared record lows amid looming gloomy political and economic headwinds.

On the political front, the British newspaper ‘The Independent’ published today a survey that showed that in the last 12 days 55% of voters polled favoured BREXIT, a swing of 10% in just 12 days, while only 44% were in favour of remaining in the EU.

In my email Report of 15 May, I had warned of both of the difficulty of overcoming the ceiling of 2130.82 and the dangerous economic consequences of the BREXIT ‘leave vote’ winning.

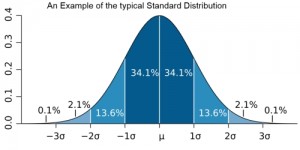

“I would like to add that in my opinion there as lurking Black Swan hiding in all equity markets, which has the name of BREXIT! Describing the uncertainties, Christine Lagarde of the IMF warned that if Britain leaves the European Union the impact would range from “pretty bad to very, very bad.