Summary Center-right PP won the Spanish election. Anti-EU forces were setback. Rajoy needs a coalition partner. The UK has decided to seek a divorce from the EU after a 43-year rocky marriage. It was not an overwhelming decision. Brexit won by 52%-48% margin, seemingly too small for such a momentous decision. The UK has not decided exactly when it will formally begin the divorce proceedings, and it wants to be...

Read More »Brexit Drives Gold Frenzy

He should have known… (the cartoon shows a list of polls of “Dewey wins by landslide” or “Trump will never win the primaries” quality…) Markets Blindsided by Brexit The big news this week was that the British voted to exit the European Union. This was not the outcome expected by pundits, or the polls. “Risk on” assets were relentlessly bid up prior to the vote. For example, S&P 500 index futures had closed the...

Read More »Quitting the Cucumber Affair

Winners and Quitters Vince Lombardi, the famous American football coach, once said, “Winners never quit and quitters never win.” Maybe he meant that winners overcome obstacles to reach their goals while quitters give up and fall short… or something to that effect. Certainly, this makes for a good bumper sticker. Perhaps it’s a helpful quote for the first time marathon runner to repeat come mile 20. Saying it aloud...

Read More »Another Sexual Assault Gets Refugees Banned From Pools In Austria

Authorities in the Austrian town of Mistelbach issued a temporary pool ban for refugees following a sexual assault by a “dark-skinned’ man on a 13-year-old girl. German and Swiss are issuing leaflets how to behave in pools. Earlier this year we reported that a town in Germany had banned adult male asylum seekers from the public pool after receiving complaints that some women were sexually harassed. As a result,...

Read More »Emerging Market Preview: Week Ahead

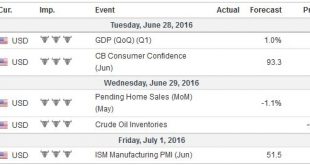

The Brexit vote is a game-changer for EM. While the direct impact on EM is limited, the damage to market sentiment is undeniable. And to make matters worse, there will be a protracted period of uncertainty as the UK and the EU negotiate the divorce proceedings. We do not think individual country stories will matter much in this new investment climate, where risk assets are likely to remain under broad-based...

Read More »FX Weekly Preview: Post-Brexit: Week One

The EU response to Brexit is important. The EU summit and the talks with Turkey are very important. Brexit leaders seem as surprised and unprepared for the results as anyone. And a preview on economic data for the week. The UK choice to leave the EU on a 52%-48% vote is one of those moments that define before and after. It is true that there are examples of the EU not liking the outcome of a referendum and allowed a...

Read More »Cool Video: Early Thoughts on Brexit Implications with FT’s John Authers

Click to see the video. About a dozen hours after it became clear that a slight majority of the British voters favored leaving the UK, the Financial Times’ John Authers visited me at Brown Brothers Harriman to discuss the initial implications. The situation is very fluid and there are many moving pieces. In Chinese, the characters for crisis are “danger” and “opportunity.” The danger component is the first cut...

Read More »El-Erian: Cash is more valuable than ever

Mohamed El-Erian says the global economy is at a crossroads. ‘Investors cannot rely on correlations as a risk mitigator,’ he says Investors shouldn’t underestimate the role of cash in their portfolios said Mohamed El-Erian, chief economic adviser at Allianz Global Investors. At a breakfast meeting with reporters on Monday, the former Pacific Investment Management Company chief executive said central bank asset...

Read More »Fasting as a teenager during Ramadan

What is it like to fast as a 15-year-old during Ramadan? This year the period of observing the Muslim fast falls during June. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »Currency intervention for Central Banks: When and at which level?

The papers from the Reserve Bank of New Zealand describes in easy words where central banks should intervene based on economic history and experience. It avoids the often used econometric considerations. For FX rates those often do not incorporate sufficient long-term data. Details1 Via Forexlive:It is very interesting, but what perhaps makes it more useful for a wider FX trader audience is its reference the triggers...

Read More » SNB & CHF

SNB & CHF