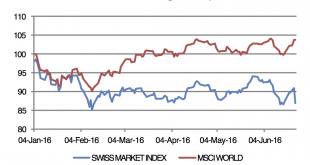

Investec Switzerland. Swiss Market Index The Swiss Market Index (SMI) is set to post a modest gain this week despite confirmation that the UK has decided to leave the European Union. The SMI opened almost 7% lower following the announcement before recovering. The Swiss franc strengthened the most since the Swiss National Bank (SNB) lifted its cap against the euro in 2015. click to enlarge Around...

Read More »Purchasing Power Parity, REER: Swiss Franc Overvalued?

After the strong revaluation of the Swiss franc in recent years, some economists, like the ones at the Swiss National Bank (SNB), claim that the franc were overvalued. Finally this claim is propaganda, because it is based on a not usable models (the REER and purchasing power parity) and wrong assumptions. The mistakes Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or...

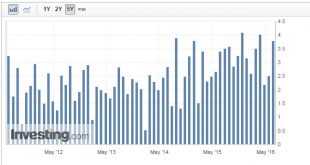

Read More »In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal. Jeff Gundlach confirmed as...

Read More »FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK’s referendum is underway. The capital markets are continuing the move that began last week with the murder of UK MP Cox. The tragedy seemed to mark a shift in investor sentiment. Sterling bottomed on June 17 just ahead of $1.40. Earlier today in Asia, after more polls showed a move toward remain, sterlingrallied to almost $1.4845, its highest level since last December. The market continues to put anticipate...

Read More »The EU and Turkey: Unvarnished Truth and Stuffing

Summary Turkey and the EU will begin negotiations over financial and budget reform. It is one of 35 areas (chapters) of negotiations. Turkey is no where close to joining the EU, for which it initially applied in 1987. In the vitriolic debate over the UK’s membership of the EU, Turkey’s potential membership became one of the talking points. Prime Minister Cameron, who has advocated Turkey’s eventual membership,...

Read More »Behind the scenes at SWI swissinfo.ch

Follow us during a day of work at SWI swissinfo.ch. From editorial meetings to voiceovers in the studio to reporting outdoors. A behind the scenes look into our daily life. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch...

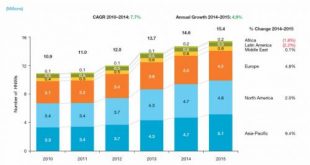

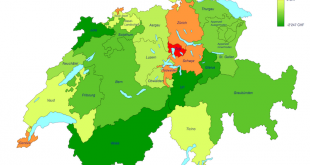

Read More »Swiss tax redistribution in 2017 – winners and losers

Swiss cantons have very different tax bases, tax rates and costs. To even things up, and temper tax rate competition between cantons that jockey to attract the wealthiest residents with the lowest tax rates, Switzerland has a system known as la péréquation financière nationale in French, or Finanzausgleich in German, which requires “rich” cantons to give money to “poor” cantons. Yesterday, the Swiss federal government...

Read More »As Of This Moment, Barclays Is Not Accepting FX Stop Loss Orders

Anyone wondering why gaps and volatility in FX, and especially cable is reaching on the absured today, with 100 pips swings in minutes the norm, the reason is that there is virtually no liquidity, and a main catalyst for this is that as HFTs conduct their usual stop hunts to stop out proximal limit orders, they simply find no such stops. They can blame banks such as Barclays for this development: as of 600 GMT...

Read More »Cool Video: Chandler at CNBC on Brexit

Click to see the video. I had the privilege to be on CNBC’s Trading Block show to discuss how the market is positioned for the UK referendum. The markets are strongly anticipating the UK to vote to stay in the EU, even though polls remain very tight. Given that leveraged participants and speculators have rallied sterling more than nine cents from last week’s lows. This makes us wary of the risk that...

Read More »British Discontent About The EU: Only A Precursor To Unrest On The Continent

Authored by Peter Cleppe, originally posted at Euro Insight, If Brexit marks the beginning of the end for the European project, Brussels will take its share of the blame If Britain leaves the EU and if the reaction to Brexit causes years of uncertainty, the EU will reap what it has sowed. British discontent is only a precursor to unrest on the Continent, where populists from across the political spectrum feel they...

Read More » SNB & CHF

SNB & CHF