Headlines Second week of February: Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12. Background Sight deposits are currently the by far most important means of financing for SNB currency purchases, for interventions. Sight deposits are assets for commercial banks, the Swiss confederation and other counterparties that deposit money at the SNB, but for the SNB they are liabilities, debt. Sight deposits are always denominated in CHF. The SNB finances itself with Swiss Francs, while its assets are nearly all in foreign currency. When CHF appreciates, then the debt increases more than the assets. The assets lose their value. As consequence the central bank may lose its Owner’s Equity which may result in a central bank bankruptcy or a recapitalization by the Swiss state. The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. With this weekly delivery it gives an far earlier indication of SNB interventions than the relatively late releases of balance sheet or IMF data.

Topics:

George Dorgan considers the following as important: currency reserves, Featured, George Dorgan on SNB, intervention, monetary data, negative interest, newsletter, Reserves, sight deposits, SNB

This could be interesting, too:

investrends.ch writes Der Franken und die Grenzen der Geldpolitik

investrends.ch writes UBS-Prognose: Dollar tendiert seitwärts – Euro steigert sich

investrends.ch writes SNB passt Verzinsung von Sichtguthaben erneut nach unten an

investrends.ch writes Inflation 2025 auf tiefstem Stand seit fünf Jahren

Headlines Second week of February:

Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.

Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.

FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12.

Background

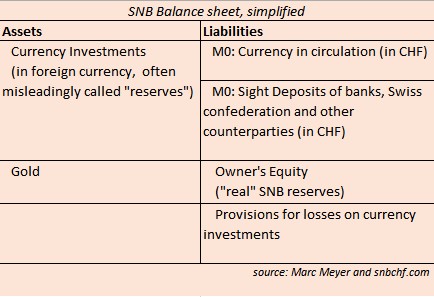

Sight deposits

are currently the by far most important means of financing for SNB currency purchases, for interventions. Sight deposits are assets for commercial banks, the Swiss confederation and other counterparties that deposit money at the SNB, but for the SNB they are liabilities, debt.

Sight deposits are always denominated in CHF. The SNB finances itself with Swiss Francs, while its assets are nearly all in foreign currency. When CHF appreciates, then the debt increases more than the assets. The assets lose their value. As consequence the central bank may lose its Owner’s Equity which may result in a central bank bankruptcy or a recapitalization by the Swiss state.

The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. With this weekly delivery it gives an far earlier indication of SNB interventions than the relatively late releases of balance sheet or IMF data.

The IMF-compliant weekly monetary data release on the SNB website provides the recent developments in sight deposits. With this weekly delivery it gives an far earlier indication of SNB interventions than the relatively late releases of balance sheet or IMF data.

Currency in Circulation

Currency in the form of bank notes and coins is the second financing method, it represents the “money printing” of central bank debt with the printing press. Nowadays this printing of debt in the form of bank notes is far less important than the electronic printing of debt called “sight deposits”. Printing is the popular word for unsterilised central bank interventions that – at least for monetarists – paves the way for price inflation. In the following we concentrate on sight deposits as means of interventions, because currency in circulation does not change as much as sight deposits. From October 2014 to October 2015, the SNB printed new bank notes of a total of 6 billion CHF but electronic money (sight deposits) rose by 100 billion francs (see the SNB balance sheet).

Sight Deposits of Swiss Banks and Other Sight Deposits

Sight Deposits of Swiss banks

They are part of M0, the monetary base: With the money multiplier effect, money on Swiss banks have a higher influence on Swiss lending and inflation. Therefore the two categories are separated. For monetarists, a big rise in Swiss sight deposits would be a bigger issue than the increase of the second item, which is:

“Other Sight Deposits”

are the ones of other counter-parties with an account at the SNB. These include loans from the Swiss confederation and federal authorities like the state pension fund (In German “AHV”). Other counter parties are insurances, private pension funds, settlement agencies, foreign banks, investment companies, hedge funds and foreign central banks and institutions. These other sight deposits are not part of M0, because they are not able to “multiple money” with loans to the public (no money multiplier effect).

Negative Rates on Sight Deposits

Since December 2014, sight deposits above the threshold of around 320 bln. are “punished” with negative rates (20 times more than the minimum reserves, visible in “compliance in %” on the monetary data). The punishment fee is currently 0.75%. Hence by End of November 2015, around 148 bln. CHF are concerned by the negative rates, while the 320 bln. are “exempted”.

Weekly SNB Intervention Watch: Sight Deposits

| Date (+ link to source) |

avg. EUR/CHF during period | avg. EUR/USD during period | Events | Net Speculative CFTC Position CHF against USD | Delta sight deposits if >0 then SNB intervention |

Total Sight Deposits | Sight Deposits @SNB from Swiss banks |

"Other Sight Deposits" @SNB (other than Swiss banks) |

|---|---|---|---|---|---|---|---|---|

| Feb12, 2016 | 1.1020 | 1.1252 | SNB interventions for 0.9 bln. CHF | -7268x125K |

+0.9 bln. per week | 473.4 bln. | 409.2 bln. | 64.2 bln. |

| Feb5, 2016 | 1.1078 | 1.1071 | Falling sight deposits, Speculators are short CHF | -4695x125K |

-0.2 bln. per week | 472.5 bln. | 406.2 bln. | 66.3 bln. |

| End Jan 2016 | 1.0942 | 1.0866 | Some distortion in sight deposits with the End December "tax effect". | -4506x125K (Short CHF) |

+4.8 bln. per month | 472.7 bln. | 403.1 bln. | 69.2 bln. |

| End Dec,2015 | 1.0828 | 1.0900 | With "dovish" Fed hike, short CHF pos. evaporates, SNB selling | +3564x125K | - 0.5 bln. per month | 467.9 bln. | 403.8 bln. | 64.1 bln. |

| End Nov 2015 | 1.0840 | 1.0735 | Speculation about lower Swiss neg. rates: high spec. pos. against CHF | -15329x125K | +1 bln. per month | 468.4 bln. | 401.7 bln. | 66.7 bln. |

| End Oct 2015 | 1.0857 | 1.1004 | Draghi threads with more QE, SNB with lower neg. rates | +1499x125k |

+2.1 bln. per month | 467.4 bln. | 401.3 bln. | 66.1 bln. |

| End Sep2015 | 1.0922 | 1.1237 | Greek elections and Volkswagen neg. for Euro | -2715x125k |

+1.4 bln. per month | 465.3 bln. | 399.1 bln. | 66.1 bln. |

| End August 2015 | 1.08 | 1.1250 | China crisis negative for CHF and pos. for USD (see more) | -12597x125k (CHF short) |

+3 bln. per month |

463.9 bln. | 396.0 bln. | 67.9 bln. |

| July 17, 2015 | 1.0426 | 1.0904 | Deal with Greece achieved | +3100x125k (CHF long) |

+0.8 bln. each week |

460.9 bln. | 396.8 bln. | 64 bln. |

| End June | 1.0400 | 1.1100 | Greek Referendum | +6900x125k | +3.4 bln. per month |

457.9 bln. | 391.1 bln. | 66.7 bln. |

| End May 2015 | 1.0405 | 1.1160 | Ascent of EUR/USD with rising German inflation | +8300x125k | +5.5 bln. per month |

454.5 bln. | 380.5 bln. | 73.5 bln. |

| End April 2015 | 1.03 | 1.09 | Weak US GDP let Euro and CHF rise. | +1300x125k | +6 bln. per month |

449 bln. | 384 bln. | 65 bln. |

| End March,2015 | 1.0602 | 1.0831 | Euro falls thanks to Greek and Draghi fool game (GR= 1.5% of EU GDP) | +706x125k | 0 | 443 bln. | 379.3 bln. | 64 bln. |

| End Feb, 2015 | 1.0617 | 1.1353 | Greeks continue fooling Germany | -5085x125k (CHF short) |

0 | 443 bln. | 383.6 bln. | 59.7 bln. |

| Jan 30, 2015 | 1.04 | 1.1340 | Greek crisis again: Run to safety continues | -7373x125k | +14.8 bln. per week |

443 bln. | 383.3 bln. | 59.7 bln. |

| Jan 23, 2015 | 0.99 | 1.1340 | Neg. CHF rate of 0.75% introduced | -9809x125k | +26.2 bln. per week |

428.2 bln. | 365.5 bln. | 62.7 bln. |

| Jan 16,2015 | 0.9988 | 1.1578 | End of EUR/CHF peg | -26444x125k (before end peg) |

+13.1 bln. per week |

402 bln. | 339.6 bln. | 62.4 bln. |

| Jan 9,2015 | 1.2009 | 1.18 | ECB QE Onset, Brent: 47$ | -24171x125k | 2.4 bln. per week |

388.9 bln. | 329 bln. | 59.7 bln. |

| End Dec,2014 | 1.2020 | 1.2099 | Rouble crisis, Brent: 54$, neg. CHF interest 0.25% | -16545x125k | 16.5 bln. per month |

386.5 bln. | 327.7 bln. | 58.8 bln. |

| End Nov, 2014 | 1.2026 | 1.2436 | Gold referendum,Brent:69$ | -23424x125k | 3.6 bln. per month |

370.6 bln. | 319 bln. | 51.4 bln. |

| End Oct, 2014 | 1.2028 | 1.2525 | Brent: 84$ | -20283x125k | 0 | 367 bln. | 310 bln. | 56.4 bln. |

| End Sep, 2014 | 1.2115 | 1.2632 | Brent:91$ | -12557x125k | 0 | 368 bln. | 310 bln. | 58 bln. |

| August, 2014 | 1.2060 | 1.3128 | Brent: 101$ | -13039x125k | 0 | 367 bln. | 310 bln. | 57 bln. |

| July 2014 | 1.2150 | 1.2832 | ECB QE Talk taking effect on markets | -11764x125k | 0 | 368 bln. | 310 bln. | 58 bln. |

| June, 2014 | 1.2158 | 1.3596 | First ECB easing | -6813x125k (CHF spec.pos turns neg.) |

0 | 368 bln. | 301 bln. | 67 bln. |

| May, 2014 | 1.2192 | 1.3642 | +13703x125k | 0 | 367 bln. | 304 bln. | 63 bln. | |

| End Q1, 2014 | 1.2227 | 1.3703 | Ukraine crisis | +14819x125k | 0 | 368 bln. | 316 bln. | 52 bln. |

| End Q4, 2013 | 1.2303 | 1.3588 | US recovery despite gov. shut-down | +10889x125k | 0 | 364 bln. | 319 bln. | 45 bln. |

| Previous Record High | 1.2047 | 1.2927 | Nov2012:-3367x.. June2013:-28972x |

12 bln. per month total 256 bln. CHF |

373 bln. (Nov 2012) |

321 bln. (June 2013) |

||

| March 16, 2012 | 1.2040 | 1.3300 | Temporary low in sight deposits | -19812x125k | -4 bln. (SNB selling Euros) | 217 bln. | 159 bln. | 58 bln. |

| Dec, 2011 | 1.2040 | 1.2948 | Markets perceive higher floor thread | -10978x125k | -26 bln . (SNB selling Euros) | 221 bln. | 180 bln. | 41 bln. |

| Sept 16, 2011 (first record) | 1.2155 | 1.2940 | After establishment of 1.20 floor | +5400x125k (CHF long despite floor) |

58.4 bln. (sept 2011) | 247.4 bln. | 206 bln. | 42 bln. |

| August 2011 | 1.18 | 1.4379 | US Downgrade, ECB intervention | +9342x125k | 159 bln. (Aug 2011) | 189 bln. | 164 bln. | 25 bln. |

| July 2011 | 1.12 | 1.4396 | SNB absorbs liquidity with SNB bills | +7877x125k | -71 bln . (SNB sterilizes via SNB bills) | 30 bln. (Thirty) |

||

| May/June 2010 | 1.40 | 1.2306 | SNB abandons interventions | -12810x125k | 24 bln. | 101 bln. | ||

| May 02 2009 | 1.5164 | 1.41 | First high during fin. crisis | -4922x125k | 77 bln. | |||

| Remarks

Italic print: Recent data estimated based on SNB balance |

Italic print: Recent data estimated based on SNB balance |

Italic print: Recent data estimated based on SNB balance |

Full list of Swiss institutions with sight deposits |

Italic print: Recent data estimated based on SNB balance sheet of October 2014 |

The relationship between CFTC speculative position and sight deposits

Headlines, CFTC and Comments

The following headlines are added each week. They reflect the movement in the table above.

Headlines 2016

Second week of February:

Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.

Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.

FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12.

First week of February:

Speculators are closing down their short positions on the euro– both against the dollar and against CHF. The carry trade is breaking down into a reverse carry trade. This leads to a strengthening of the euro versus CHF. Given that US data was better than expected, the speculative USD against CHF position should further augment. It was at 4600 contracts versus CHF.

No SNB interventions: Sight deposits decreased slightly by 0.2 billion CHF, this implies that the SNB is selling FX into the collapsing euro short carry trade. It is buying CHF, i.e finally reducing its debt.

February 1, 2016: In January sight deposits have risen by 4.5 bln. CHF. However, this might not only be caused by central bank interventions, but also by an inflow of cash, that some people withdrew at the end of year for tax reasons.

Read also about the Joseph Cycle, and why during the fat years of the Joseph Cycle, CHF is poised to weaken.

Headlines December 2015

End December: The SNB seems to have sold foreign FX, because sight deposits have fallen by 0.5 billion CHF in December. However, many people withdraw cash at the end of year, this reduces sight deposits at Swiss banks and therefore also sight deposits at the SNB. According to the SNB, this is for tax reasons.

The speculative position USD against CHF has evaporated in the meantime. Traders are net long CHF again.

Early December: Height of a speculative position against euro and CHF (short 24K contracts on Wednesday). Draghi disappointed. And logically the speculative position against EUR and CHF started to unwind. For the first time in months, sight deposits fell. The SNB was able sell currency reserves, most probably dollars, while the speculators had to buy francs.

Q&A

Roger: Are there other explanations than interventions for increased sight deposits?

George Dorgan: There are two means of financing for current interventions:

1) Sight Deposits (electronic printing)

2) Bank notes (“traditional” money printing)

So when cash is converted into sight deposits at the SNB, then this may happen without interventions. But sight deposits increase.

Roger: The SNB buys in any case, even if the rate is high. Why?

George Dorgan: Yes you are right. But interventions at too high levels, is a potential risk for SNB’s solvability. But why does she do it?

1) If the SNB sells the EUR/CHF or does not buy at all, then the EUR would move downwards. The bank does not like this.

2) The SNB wants to support the carry trade, the upwards trend of EUR/CHF.

The conclusion is that the SNB will sell euros from a certain level. In an earlier post, I thought they sell at 1.10 but I got wrong, for now…

Remember that the SNB sold euros in early 2012 so that the euro went slowly towards 1.20.

Roger: Is it possible that money isn’t credited to an account instantly but after a few days, right? Last week the deposits increased. This could be because of interventions in the last week or the week before, right? But in the last two weeks the Euro-Franc exchange rate was pretty high.

George Dorgan:

Speculative positions against CHF (CHF short) may be higher than CHF sight deposits (CHF Long). The CFTC position is only a part of the total spec position. Brokers and foreign banks hedge some of their client EUR long positions with SNB sight deposits or indirectly via Swiss banks like UBS. When and how much they hedge, depends. As January 15th shows, banks are usually not completely hedged.

You might get confused with this answer, read more here why sight deposits can be viewed in two ways, depending who creates them, the central bank SNB or the commercial banks that deposit funds.

Older Headlines

Headlines October/November 2015

October/November 2015: As response to Draghi’s QE thread, the SNB threatens to lower rates further. A big speculative position USD long and CHF short is building up.

October 23: Draghi announces that the ECB could continue QE. Logically the EUR/CHF continued its descend and fell under 1.07. The SNB had to intervene for 1.1 bln. CHF.

October 16: EUR/CHF trends downwards, because US rate hike hopes fade after the FOMC. This implies that rate hike hopes for the ECB fade too. Another 600 million CHF of interventions, this time absorbed mostly by other counter parties.

Sight deposits of Swiss banks rise over 400 bln. CHF. This is 36 bln. more than the 365 bln. on January 22 when negative interest rates of 0.75% were introduced. At the time, the existing sight deposits were not paid, but the delta of 36 bln. costs the banking sector 0.75% per year. Hence it reduces income/GDP by nearly 300 million CHF.

Bad US job data: both euro and CHF rise against the dollar, given that the US rate hike might be delayed to 2016.

Sight Deposits October

Other sight deposits: the ones of non-Swiss banks, institutions like foreign banks, hedge funds or independent asset managers, are falling again after a quick rise after the US job data. They are nearly unchanged since January 22.

Speculative position USD against CHF: Remains long USD despite bad US job data and fading hopes on a rate hike.

End September: Volkswagen scandal

EUR/CHF rate: EUR/CHF fell with the Greek elections but the euro is rising again. The Volkswagen scandal may weaken the German trade surplus. We know that Switzerland is a proxy for the German economy. Via trading algos this implies some CHF weakness.

September 21

EUR/CHF rate: When FX speculators hear the word “Greece”, then they often sell euros and buy CHF. That the Greek GDP is only tiny part of euro zone GDP does not matter. According to the CFTC, speculators were long CHF and short USD.

September 7

Strangely EUR/CHF continues its ascent on September 7, despite the ECB threat with more QE.

Until End August

Shortly before January 15th, 2015, the speculative position was at it highest. Remember that all such carry trades – a strong speculative position that counters real money, collapse one day. In our view, the carry trade should continue until EUR/CHF reaches 1.10 or 1.15. The carry trade could run 3 to 5 years, before it should collapse again to EUR/CHF 0.90. Time for the SNB to collect some dividends and coupons to avoid a bankruptcy.

July 15th to August, 15th: Sight deposits have risen by 2.5 bln. in the course of one month. But a big speculative position is building up against CHF. Sight deposits do not capture these movements because they are not portfolio investments for the balance of payments. They happen at FX brokers. But long-term investors still like Swiss stocks.

July 13th: Another 2.1 bln CHF of interventions, a deal with Greece is not yet achieved. Inflows mostly came from local banks They seem not to fear negative rates. This delta in sight deposits, is probably punished by negative rates. But the SNB seems to be convinced to keep EUR/CHF over 1.04, without considering that many exporters (like pharma and chemicals) take advantage of the stronger dollar.

July 6th: Surprisingly only a small intervention of 1.4 bln. CHF during the Greek referendum week. Reasons might be that the European recovery still avoids inflation. See more in the two phases of CHF appreciation.

June 29th: Greek referendum announced and talks on Greek ended. According to Forexlive.com, the SNB has intervened. For us, this must have been at the lower area of 1.0312 in Asian trade, but not at 1.04.

June: The pace of SNB intervention is slowing. Sight deposits rise by 0.5 billion francs per week.

April and May: Sight deposits rise by 1.5 billion CHF per week, hence the SNB seems to intervene with a pace of 1.5 billion francs weekly. Recently the SNB increased the loans with the Swiss confederation.

Between Feb 21 and April 3: No major change, no SNB interventions

The biweekly bigger IMF data release will contain infos about money supply, in particular M0, next issue is on May 14th.

The last one, the one for March, is the following: