Dear Investors! Because the stock market is currently strongly correlated to the energy sector, Friday’s rally responded in kind on the news of a surge of 12.3% in the NYMEX WTI sweet crude market after a report had suggested that OPEC may finally agree to cut its production to reduce the world glut. The news instantly oiled the S&P 500’s rise of 1.95%. However despite the strong daily gain, oil prices still ended the week down in spite of being the best one-day gain since February 2009, when WTI had gained 14.04%. On the other side of the oil coin the number of U.S. oil rigs dropped by 30, or 5%, for the week! Notwithstanding the rally, the S&P 500 remained in a loss position for the week of -0.81% and the market is still in correction with the worst performer, the Nasdaq, down since its peak on 20 July 15 by -16.89%, closing this week at 4337.51 points. But could Friday’s action be the start of something beautiful? Unfortunately it was not accompanied by a corresponding increase in high volume. In fact it slipped from Thursday by 15%. Up days in declining volume and down days in rising volume are bad signals for bulls, as most of this month has shown. The depressed oil prices are also rattling the banks, because of their credit exposure to the industry with rumours of liquidity drying up and losses mounting.

Topics:

John Henry Smith considers the following as important: Featured, Grail Securities, newsletter, oil drigs, stock market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Dear Investors!

Because the stock market is currently strongly correlated to the energy sector, Friday’s rally responded in kind on the news of a surge of 12.3% in the NYMEX WTI sweet crude market after a report had suggested that OPEC may finally agree to cut its production to reduce the world glut. The news instantly oiled the S&P 500’s rise of 1.95%. However despite the strong daily gain, oil prices still ended the week down in spite of being the best one-day gain since February 2009, when WTI had gained 14.04%.

On the other side of the oil coin the number of U.S. oil rigs dropped by 30, or 5%, for the week!

Notwithstanding the rally, the S&P 500 remained in a loss position for the week of -0.81% and the market is still in correction with the worst performer, the Nasdaq, down since its peak on 20 July 15 by -16.89%, closing this week at 4337.51 points.

Notwithstanding the rally, the S&P 500 remained in a loss position for the week of -0.81% and the market is still in correction with the worst performer, the Nasdaq, down since its peak on 20 July 15 by -16.89%, closing this week at 4337.51 points.

But could Friday’s action be the start of something beautiful? Unfortunately it was not accompanied by a corresponding increase in high volume. In fact it slipped from Thursday by 15%. Up days in declining volume and down days in rising volume are bad signals for bulls, as most of this month has shown.

The depressed oil prices are also rattling the banks, because of their credit exposure to the industry with rumours of liquidity drying up and losses mounting. Thus any oil price rally in the direction of $40 per barrel would help smooth their ruffled feathers.

Optimistically speaking, if OPEC were to cut production, a sustainable rally in the sector and perhaps the stock market too could be triggered, which would enable the surgical separation of the stock market from its Siamese twin.

Whether it will or it won’t, the market still has another four white feathers to worry about, such as (1) the threat of a contagious recession and (2) to what extent and how frequent interest rates ought to rise, (3) the declining health of U.S. manufacturing, and (4) the profit recession confronting corporate America.

It must be remembered that the American consumer accounts for 70% of its economy, so any good news coming from the retail sector is always welcomed by investors. Retail sales rose from January by 0.2% vs. the previous month, and the December figure was revised up from -0.1% to +0.2%. This means that retail sales have risen for three consecutive months. Backing out petroleum, sales for January rose 0.4%!

At this sensitive time of increased uncertainty even when a thin scattering of ‘green seedlings’ are appearing here and there, it is still for the majority of prudent investors a waiting game to see if the seeds of bullish optimism can still the hunger of the rampant bears, or not!

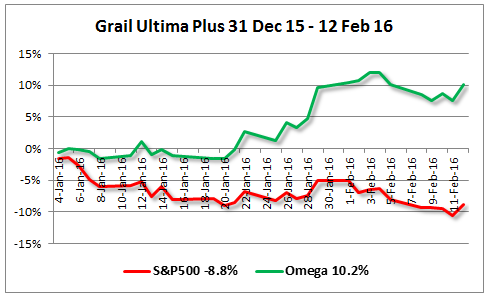

Of course Grail-driven portfolios are also affected by the current bearish trend, but not as much as those of passive investors, who may wait a long time just to breakeven. Not only are all portfolios in positive territory, but as per the beginning of this year I am pleased to announce the inception of the Grail Ultima Plus Portfolio. This Alpha portfolio contains 37 stocks and is outperforming the S&P 500 by a margin of 19% in just 30 trading days!

This is because of the highly systematic fundamental and technical analysis and risk-aversion features of the Grail Equity Management System (GEMS), which is at the core of our advisory services, a key feature of which is its buy and sell alerts. The range of the 10.2% gain is from Newmont Mining Group (NEM) (+43.3%) down to Simulations Plus (SPL) (+0.4%) per 12 February and is diversified into 18 industries.

To test performance, I am offering a mini-portfolio of at least 6 stocks in the expectation of achieving a 15% gain in just two months completely without further obligation on your part. You will receive weekly updates, a short market comment and where necessary prompt alerts. If you make use of this introductory offer it is strongly recommended that you keep it as a virtual portfolio, although of course the choice and risk is up to you. The offer will be terminated by either the portfolio reaching the said +15% or by the expiry of the two month period, whichever is the earliest.

I look forward to your agreeing to my proposal. Of course, in the interest of transparency I will answer any questions by return email.

Yours truly,

John Henry Smith