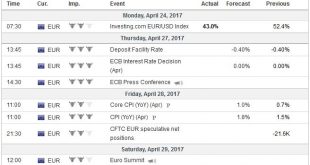

Summary: Provided Le Pen and Macron or Fillion make to the second round, the market response to the French election results may be short lived. BOJ, Riksbank and ECB meetings. Spending authorization and some announcement from the White House on tax policy are in focus as Trump’s 100th day in office approaches. The results of the French presidential election will be known prior to the open of the Asian...

Read More »FX Weekly Review, April 17 – 22: Dollar Technicals Trying to Turn, but…

Swiss Franc Currency Index While the dollar index had another bad week with a 0.75% less, the Swiss Franc currency index could accumulate the corresponding gains. Main reason is that the EUR/CHF rose over 1.07. The euro is still the main component of the Swiss Franc index, but the dollar is recovering thanks to rising pharmacy exports to the U.S. Trade-weighted index Swiss Franc, April 22(see more posts on Swiss...

Read More »Big bonuses contrast big losses at Credit Suisse, despite bonus haircuts

© Denis Linine | Dreamstime.com The management of Credit Suisse Credit Suisse reduced their bonuses by 40% after severe criticism from shareholders. The reduction amounts to around CHF 20 million. Some are still outraged. The group made a loss of CHF 2.7 billion in 2016 and one of CHF 2.9 billion in 2015. In an interview published in Le Matin Dimanche and SonntagsZeitung, Vincent Kaufmann, the CEO of Ethos described the...

Read More »Simple Math of Bank Horse-Puckey

The Raw Deal We stepped out on our front stoop Wednesday morning and paused to take it all in. The sky was at its darkest hour just before dawn. The air was crisp. There was a soft coastal fog. The faint light of several stars that likely burned out millennia ago danced just above the glow of the street lights. After a brief moment, we locked the door behind us and got into our car. Springtime southern California...

Read More »Marx, Orwell and State-Cartel Socialism

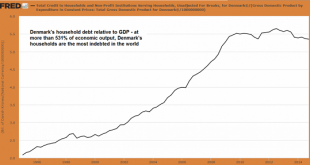

When “socialist” states have to impose finance-capital extremes that even exceed the financialization of nominally capitalist economies, it gives the lie to their claims of “socialism.” OK, so our collective eyes start glazing over when we see Marx and Orwell in the subject line, but refill your beverage and stay with me on this. We’re going to explore the premise that what’s called “socialism”–yes, Scandinavian-style...

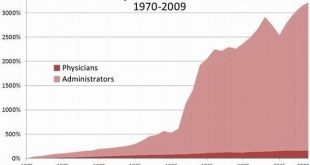

Read More »Our Intellectual Bankruptcy: The “Religion” of Economics, UBI and Medicare For All

1. Mainstream neo-classical/ Keynesian economics. As economist Manfred Max-Neef notes in this interview, neo-classical/ Keynesian economics is no longer a discipline or a science–it is a religion. It demands a peculiar faith in nonsense: for example, the environment–Nature– is merely a subset of the economy. When we’ve stripped the seas of wild fish (and totally destroyed the ecology of the oceans), no problem–we’ll...

Read More »RMR: Exclusive Interview with Charles Hugh Smith (04/18/2017)

"V" and CJ are joined by Charles H Smith to discuss the power and future of bitcoin. Charles also shares his thoughts on the current economic outlook and effective ways to prepare for various economic hardships. Link to Charles's work at "Of Two Minds" http://www.oftwominds.com/ We are political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize our civil liberties. Please...

Read More »Swiss employers continue to discriminate against over 50s

Travail Suisse, an association representing Swiss employees, highlights once more the age discrimination faced by those over 50 in the Swiss job market. In March 2017, 26.8% of unemployed in the this age group had been without work for more than a year, compared to 2.3% of those between 15 and 24 and 14.1% of those aged 25 to 49. According to RTS, the unemployed over 50 take twice as long to find a new job. The number...

Read More »State of Dollar Bull Market

Summary: The dollar market is intact, despite the pullback here at the start of 2017. We have seen similar pullbacks in 2016 and 2015. Divergence remains the key driver. The Federal Reserve’s real broad trade-weighted dollar fell for the first three months of 2017, and the greenback’s heavy tone this month has raised questions about the state of the bull market. Despite this recent weakness, we think the...

Read More »Swiss authorities clamp down on cannabis products

A large number of shops are illegally selling cannabis products containing the active ingredient, cannabidiol (CBD). The Bern cantonal chemist has strongly criticised the sale of these products, and the government is now adopting a tougher stance against illegal sales. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles,...

Read More » SNB & CHF

SNB & CHF