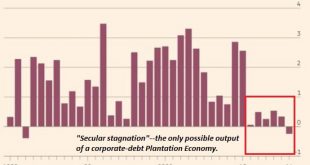

We’ve been persuaded that the state-cartel Plantation Economy is “capitalist,” but it isn’t. It’s a rentier skimming machine. I have often discussed the manner in which the U.S. economy is a Plantation Economy, meaning it has a built-in financial hierarchy with corporations at the top dominating a vast populace of debt-serfs/ wage slaves with little functional freedom to escape the system’s neofeudal bonds. Since I...

Read More »Switzerland UBS Consumption Indicator March: Problem child in retail

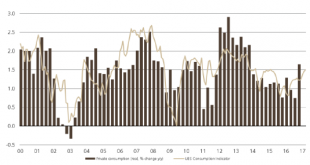

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS consumption indicator registered at 1.50 points in March, indicating private consumption growth around the long-term average. Solid automotive demand drove this figure. Domestic tourism, on the other...

Read More »To Frexit or Not to Frexit – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Mathematics of Frexitology This was also a holiday-shorted week. As we write this, the big news comes from the election in France. The leading candidate is a banker named Emmanuel Macron, with about 24% of the vote in a 4-candidate race. The anti-euro Marine Le Pen came in second with just over 21%. From the sharp...

Read More »Weekly Speculative Positions: CHF Position Stands at same Position

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »FX Daily, April 25: Euro Consolidates Gains, Bond Market Sell-Off Continues

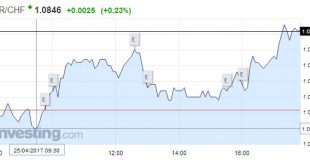

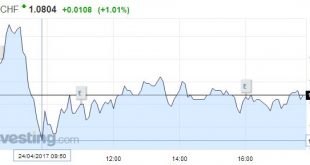

Swiss Franc EUR/CHF - Euro Swiss Franc, April 25(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF We have seen small gains made by the Euro against the Swiss Franc since the result of the first round of the Presidential elections in France, and indeed the Swiss Franc has generally weakened against most major currencies over the course of this week. The SNB (Swiss National Bank) have recently commented...

Read More »Bi-Weekly Economic Review

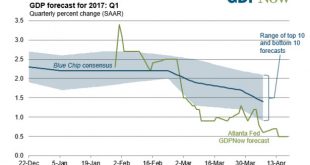

It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is about the art of the possible and that is proving a short list for now. Republicans can’t agree among...

Read More »Gold Sovereigns – ‘Treasure’ Trove Found In UK – Don’t Be The Piano Owner

Gold Sovereigns – ‘Life Changing’ ‘Treasure’ Trove Found In UK The gold sovereigns – semi-numismatic gold coins made up of both gold sovereigns and half gold sovereigns dating from the reigns of Victoria, Edward VII and George V – were discovered inside an old piano after it was donated to a school last year. A gold sovereign from that period is currently valued at between £200-250, with a half sovereign worth between...

Read More »Euro gains against Swiss franc on French election result

The official French presidential election results place Emmanuel Macron (23.8%) and Marine Le Pen (21.5%) in first and second places in the first round of the French presidential race. The run off between these two will take place on 7 May 2017, when most forecasters expect Macron to win and become France’s next president. How votes are expected to split between MACRON and LE PEN in the 2nd round. This according to...

Read More »FX Daily, April 24: Dramatic Response to French Election

Swiss Franc EUR/CHF - Euro Swiss Franc, April 24(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The results of the first round of the French election spurred a dramatic response in the capital markets. Our thesisthat there is no populist-nationalist wave sweeping the world is supported by the previous results in Austria, the Netherlands, and now France. The AfD in Germany is wilting in the polls, and...

Read More » SNB & CHF

SNB & CHF