While few will be trading in the week between Christmas and New Years, we thought it might be helpful to review the dollar’s technical condition. We make two overall points. First, although the dollar’s rally strengthened and extended after the November US election, this leg up of the dollar’s longer-term rally began at the end of Q3. The anticipation of new policies by the Trump Administration, part of the story, but other forces that were also impacting, such as the divergence of monetary policy. The US economy was approaching the Fed’s targets, and the December hike was telegraphed in earnest starting in September (when we had thought a hike was likely). The eurozone economy is expanding near trend, but the low price pressures meant that it was premature to expect the ECB to abandon its asset purchase operations. It is more difficult to assess BOJ monetary policy, which shifted toward targeting the 10-year yield. The BOJ appears to be buying fewer JGBs, so its balance sheet growth has slowed. Perhaps the significance will be better appreciated if the rise in US rates continues to exert a pull on Japanese bond yields. Second, the technical readings are getting stretched and the technical indicators suggest a correction is in the offing.

Topics:

Marc Chandler considers the following as important: Australian Dollar, British Pound, Canadian Dollar, Crude Oil, EUR-USD, EUR/CHF, Euro, Euro Dollar, Featured, FX Trends, Japanese Yen, MACDs, newslettersent, S&P 500 Index, S&P 500 Index, Swiss Franc Index, U.S. Treasuries, US Dollar Index, USD/CHF, USDJPY

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

policies by the Trump Administration, part of the story, but other forces that

were also impacting, such as the divergence of

monetary policy. The US economy was approaching the Fed’s targets, and the December hike was telegraphed

in earnest starting in September (when we had thought a hike was likely).

its asset purchase operations. It is more difficult to assess BOJ monetary policy, which shifted toward targeting the 10-year yield. The BOJ appears to be buying fewer JGBs, so its balance sheet growth has slowed.

a wall of worry. As they have for several weeks, many remain concerned that the market is getting ahead of itself. Trump, they say, will be

unable to deliver the kind of fiscal stimulus the market expects. Also, they argue that the market is gone a long distance toward pricing in three Fed hikes next year. Investors who put much stock in the dot plots could be disappointed (again).

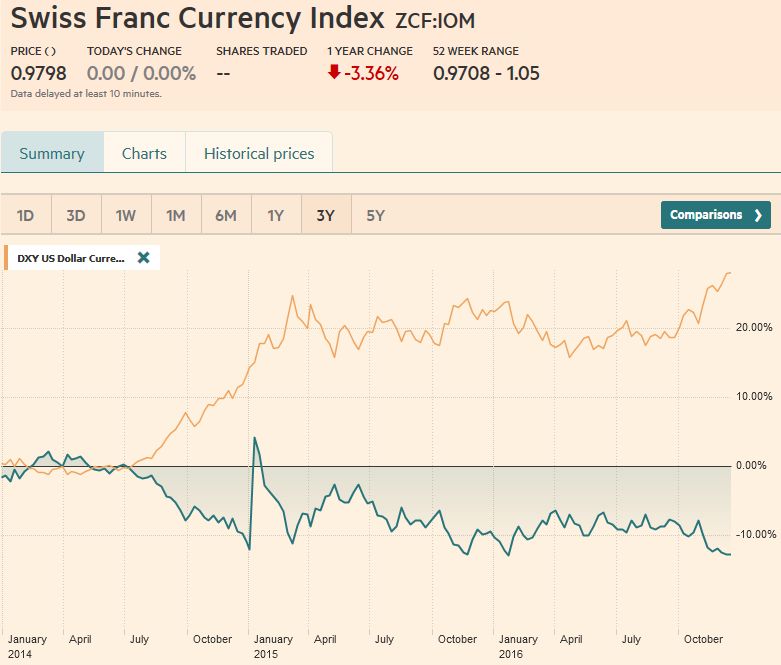

Swiss Franc Currency IndexOn a month basis the Swiss Franc index remains weak. I has fallen by 1%, while the dollar index improved by 2%. |

Trade-weighted index Swiss Franc, December 23(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge |

Swiss Franc Currency Index (3 years)The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. The dollar makes up 33% of the SNB portfolio and 25% of Swiss exports (incl. countries like China or Arab countries that use the dollar for exchanges).

|

Swiss Franc Currency Index (3 years)(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge |

USD/CHF |

US Dollar/Swiss Franc FX Spot Rate, December 23(see more posts on USD/CHF, ) Source: FT.com - Click to enlarge |

US Dollar IndexMost broadly, the Dollar Index rose in four of last week’s five sessions. It has risen seven of the past 10 sessions and 10 of the past 15. It has risen for three consecutive weeks, and in six of the past seven, and nine of the past 12 weeks. This could be a

definition of an uptrend. Yet a yellow light is flashing, meaning that the market is likely to have a proper correction soon. The Slow Stochastics and MACDs are about to turn down. What level would the Dollar Index have to break to suggest

a correction is at hand? The 102.50 area is notable. It corresponds to recent lows and a 38.2% retracement of the rally since the Fed’s hike. A break of that area could signal potential toward 101.00-101.50. |

US Dollar Currency Index, December 23(see more posts on Dollar Index, ) Source: FT.com - Click to enlarge |

EUR/USDThe euro did fall to new multiyear lows last week near $1.0350, but that seemed to be more a function of thin trading. Consolidative trading, even if choppy, characterized the euro’s price action. It closed little changed on the week. A move above $1.0510 would likely signal that the consolidation That level corresponds to a 38.2% retracement of the drop since the Fed’s hike. Above there, the $1.0550-$1.0570 area beckons, but corrective potential extends toward as |

Euro/US Dollar FX Spot Rate, December 23(see more posts on EUR / USD, ) Source: FT.com - Click to enlarge |

USD/JPYThe dollar broke down to JPY116.55 after finishing the previous week near JPY118, but it happened at the start of the week. And for the rest of the week, the greenback consolidated at However, our reading of the technical indicators suggests that maybe it is not a wedge but a gradual grind lower. |

US Dollar/Japanese Yen FX Spot Rate, December 23(see more posts on USD/JPY, ) Source: FT.com - Click to enlarge |

GBP/USDSterling fell each day last week.

It was the worse performing major currency, losing 2% against the dollar. It has fallen in 12 of the past 15 sessions in this three-week slide that has taken it to its lowest level since early November. It has the feel of year-end related adjustments more than fundamentally driven, though the rate discount to the US is historically large. How it performs near $1.2200, which is the

61.8% retracement of the rally since the flash crash in early October. A break could send it back into the $1.2080 area. The technical indicators are not in agreement. The MACDs recently turned lower, but the Slow Stochastics are overextended to the

downside. The RSI is tracking prices lower. |

UK Pound Sterling - US Dollar FX Spot Rate, December 23(see more posts on British Pound, ) Source: FT.com - Click to enlarge |

After sterling, the Australian and Canadian dollars were the poorest performers among the major currencies last week (-1.7% and -1.4% respectively). Although the unexpected contraction in Canada’s October GDP (-0.3%) weighed on the Canadian dollar before the weekend, the Australian dollar fell more. Recall that among the currency futures; the Australian dollar was the only one (that we track) in which speculators were net long.

AUD/USDThe Aussie has fallen in seven of the past eight sessions. It is down three consecutive weeks and eight of the past 12. Before the weekend it neared the May/June lows (~$0.7145). There weekly close below $0.7200 is important because it corresponds to the 61.8% retracement of this year’s rally. A move above there would help to stabilize the tone, but the technical indicators suggest this is unlikely. The next downside target is found around $0.7065. |

Australian Dollar / US Dollar FX Spot Rate, December 23(see more posts on Australian Dollar, ) Source: FT.com - Click to enlarge |

USD/CADThe US dollar has approached the 50% retracement of this year’s drop against the Canadian dollar from multiyear highs in January. The retracement is found near CAD1.3575 and repulsed the greenback last month. It has a running start, with oil |

US Dollar / Canadian Dollar FX Spot Rate, December 23(see more posts on Canadian Dollar, ) Source: FT.com - Click to enlarge |

Crude OilThe February light sweet crude oil futures contract was |

Crude Oil December 23(see more posts on Crude Oil, ) Source: Bloomberg.com - Click to enlarge |

U.S. TreasuriesUS 10-year Treasury yields drifted lower last week. Yields slipped a few basis points at the start of the week and then went sideways in narrow ranges. Unable to push through 2.52%, but the high yield print generally slipping to 2.56%. The low on the March 17 10-year futures contract has been steadily but slowly climbing since December 15. Indeed before the weekend the futures contract returned to the closing level on December 14 when the Fed announced its hike with the median dot plot suggesting three hikes next year. That level 123-13 also corresponds to the 50% retracement from the December 14 high. The next retracement objective is 123-21. The technical indicators favor additional near-term gains. |

Yield US Treasuries 10 years, December 23(see more posts on U.S. Treasuries, ) Source: Bloomberg.com - Click to enlarge |

S&P 500 IndexThe S&P 500 were virtually flat last week. Momentum has evaporated, but rather than correct lower, it is moving sideways. This may be serving to keep some nervous longs invested. A break of 2250 would be the first sign that the correction may have begun. Since November 4, the S&P 500 rallied 9.3% before the consolidation began. The Slow Stochastics rolled over first, It is also unusually rich relative to its 200-day moving average. It has been more than two standard deviations (2~253) above its 200-day moving average since December 7. |

S&P 500 Index, December 23(see more posts on S&P 500 Index, ) Source: FT.com - Click to enlarge |

Tags: Australian Dollar,British Pound,Canadian Dollar,Crude Oil,Dollar Index,EUR / USD,EUR/CHF,Euro,Euro Dollar,Featured,Japanese yen,MACDs,newslettersent,S&P 500 Index,Swiss Franc Index,U.S. Treasuries,USD/CHF,USD/JPY