The upswing in US capex defies negative trade headlines.The torrent of coverage about trade tensions hides an important positive development: US corporate investment is flourishing, and there are increasing signs this upswing in capital expenditure (capex) could persist. This could in turn mean that the US business cycle has further room to run, despite its advanced age, and that recession is still some way off.A survey we like to watch, particularly to gauge capex trends, is the quarterly Business Roundtable CEO survey, and especially its capital spending subindex (see Chart). This slowed to 103.2 in Q3 from 107.6 in Q2 and a historic high of 115.4 in Q1 (reflecting the December corporate tax cuts).While many observers have highlighted the decline of this indicator of capital spending in

Topics:

Thomas Costerg considers the following as important: Macroview, Trade tensions, US business cycles, US capex

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The upswing in US capex defies negative trade headlines.

The torrent of coverage about trade tensions hides an important positive development: US corporate investment is flourishing, and there are increasing signs this upswing in capital expenditure (capex) could persist. This could in turn mean that the US business cycle has further room to run, despite its advanced age, and that recession is still some way off.

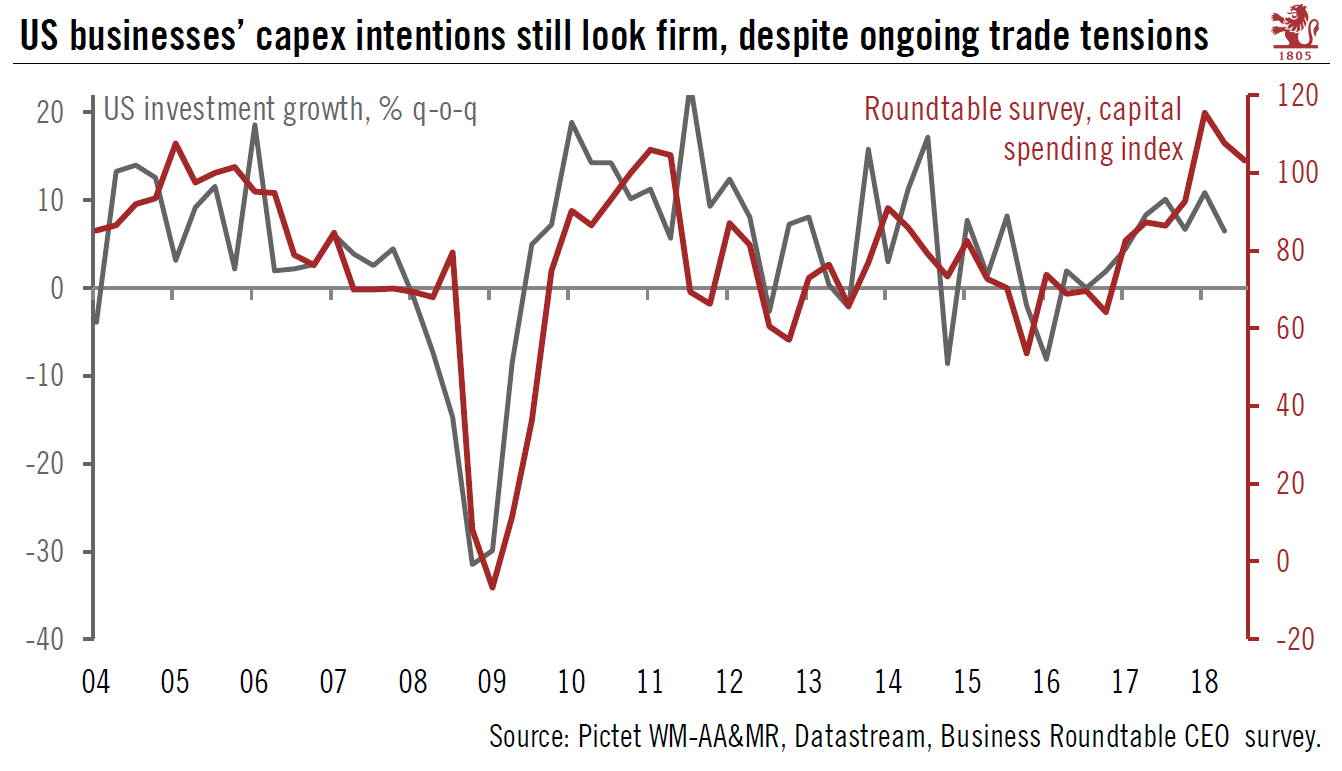

A survey we like to watch, particularly to gauge capex trends, is the quarterly Business Roundtable CEO survey, and especially its capital spending subindex (see Chart). This slowed to 103.2 in Q3 from 107.6 in Q2 and a historic high of 115.4 in Q1 (reflecting the December corporate tax cuts).

While many observers have highlighted the decline of this indicator of capital spending in the past two quarters, the real surprise is why it has not fallen more given the sizeable, and worsening, uncertainty around foreign trade. We prefer to see the glass as half full. We note that 103.2 is the sixth-highest value for the capital spending subindex since the series began, and that it is at a level broadly consistent with very solid quarterly growth in capex of over 10%.

The Business Roundtable survey is not alone in painting an optimistic picture on that front. A survey by the Richmond Fed showed ‘current manufacturing capex’ for September rising to its highest level since September 2014. Orders for capital goods measured by the US Census Bureau have also ticked up in recent months. Importantly, they seemed to show increasingly broad-based capex across the US economy, i.e. not just in the oil and gas sector.