While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed. At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its...

Read More »A spanner in the works

While Trump’s weekend tweets have created fresh uncertainties around US trade talks with China, some perspective is needed.At the weekend, US President Trump threatened to increase the tariff rate on Chinese imports as he believes that US-China trade negotiations are going “too slowly”. Importantly, Trump’s threats do not mean bilateral talks are breaking down. Indeed, the Chinese government confirmed today that its trade delegation would still go to Washington DC this week for another round...

Read More »US corporates happy, and investing

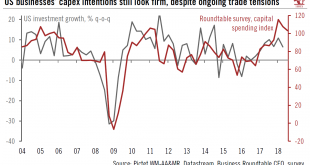

The upswing in US capex defies negative trade headlines.The torrent of coverage about trade tensions hides an important positive development: US corporate investment is flourishing, and there are increasing signs this upswing in capital expenditure (capex) could persist. This could in turn mean that the US business cycle has further room to run, despite its advanced age, and that recession is still some way off.A survey we like to watch, particularly to gauge capex trends, is the quarterly...

Read More »Trade Tensions Special

Download issue:English /Français /Deutsch /Español /ItalianoFresh US tariffs against Chinese imports, followed swiftly by Chinese retaliation, are casting a shadow over prospects for the global economy. But just how much could they hurt growth? And what are the implications for various asset classes and for investors?In this special edition of Perspectives, experts at Pictet Wealth Management (PWM) set out to answer these questions.Christophe Donay, PWM’s Chief Strategist and Head of Asset...

Read More »Contrasting Fortunes within the Euro Area

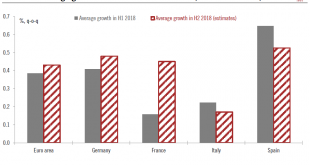

While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes. The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators...

Read More »Contrasting fortunes within the euro area

While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes.The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators show that Italy is the only of the four major euro area economies to face...

Read More »Weekly view—The Fed steams ahead, regardless

The CIO office’s view of the week ahead.Trade disputes between the US and almost everybody else are reaching a climax, with US tariffs on imports prompting inevitable retaliation. Things could get worse before they get better, if President Trump puts his words into action. At this stage, global growth indicators are still flashing green and we have some hope that tough negotiations will yield to trade deals, but trade is a risk to upbeat scenarios for global economy and markets alike.It is...

Read More »Weekly view—Central banks and Korea make for a busy week

The CIO office’s view of the week ahead.The ECB’s chief economist, Peter Praet, hinted that there could be an announcement on the winding-down of the bank’s bond-buying programme this week rather than in July, as many had thought, with Praet expressing confidence that inflation would rise toward the ECB’s 2% target. Coming at a particularly sensitive time, with the euro area economy continuing to work through a prolonged soft patch and the new populist government in Italy still an unknown...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org