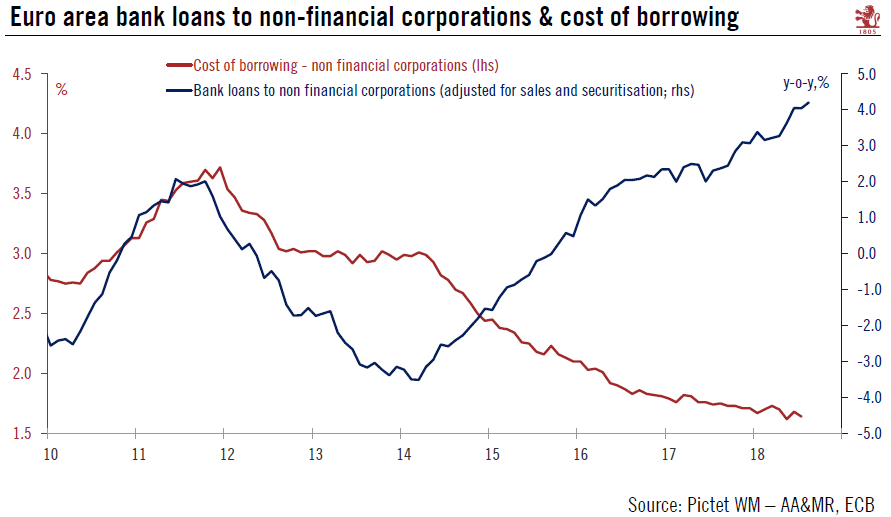

Financial conditions remain supportive and are not expected to tighten much in the coming months.Lending to non-financial corporations in the euro grew by an annual 4.2% in August, its fastest rate since April 2009. Forward-looking indicators suggest that euro area credit growth should remain strong over the coming months.Overall, domestic demand is likely to continue to be the main driver of growth in the euro area, helping to mitigate external weakness. Strong job growth combined with rising wages should continue to underpin household spending while accommodative financing conditions should further support investment.All in all, the European Central Bank’s M3 and credit report for August confirms that lending dynamics continue to be in a good shape in the euro area. Financial conditions

Topics:

Nadia Gharbi considers the following as important: euro area, euro area bank loans, euro area credit growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Financial conditions remain supportive and are not expected to tighten much in the coming months.

Lending to non-financial corporations in the euro grew by an annual 4.2% in August, its fastest rate since April 2009. Forward-looking indicators suggest that euro area credit growth should remain strong over the coming months.

Overall, domestic demand is likely to continue to be the main driver of growth in the euro area, helping to mitigate external weakness. Strong job growth combined with rising wages should continue to underpin household spending while accommodative financing conditions should further support investment.

All in all, the European Central Bank’s M3 and credit report for August confirms that lending dynamics continue to be in a good shape in the euro area. Financial conditions remain supportive and are not expected to tighten too much after the end of the ECB’s quantitative easing (QE) at the end of this year. This bodes well for domestic demand, notably for private investment.

Leading indicators are pointing to euro area GDP growth of around 0.4% in Q3 quarter on quarter, according to our estimates. This is consistent with our forecast of 2.0% GDP growth for 2018 as a whole.