Is the Economy a Machine? A Science Goes Astray Human beings have a strong tendency to look for patterns. The natural sciences have shown that the universe is governed by laws, the effects of which are observable and measurable in an objective manner. Mostly, anyway — there is, after all, the interesting fact that observers are influencing measurements at the quantum level by the act of observation. (For our lives in the “macro” world, however, this is not relevant. An engineer does not...

Read More »Nigeria Currency Devaluation Looms As FX Forwards Crash To Record Lows

Despite US equity investors’ exuberance over bouncing crude oil prices, the world’s crude producers continue to suffer and while Venezuela is in the headlines every day (having already collapsed into chaos), Nigeria appears the nearest to that abyss next. Having urged investors “don’t panic” last year, and seeing dollar reserves drying up rapidly earlier this year, recent “lies” about the nation’s statistics have raised fears of a looming devaluation as FX forwards have crashed to 291...

Read More »What the Greek Deal Does and Does Not Do

For investors, the most important thing about the successful review of Greece’s implementation of last year’s agreement is that it effectively removes it from the list of potential disruptive factors in the coming quarters. There will be no repeat of last year’s drama. Assuming Greece resolves a few outstanding issues in the next few days, it will be given roughly 7.5 bln euros next month and another three bln euros over the summer. The funds will be in Greece’s hands for the shortest...

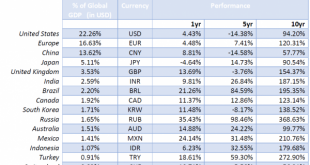

Read More »The Global Monetary System Has Devalued 47 percent Over The Last 10 Years

We have argued the inevitability of Fed-administered hyperinflation, prompted by a global slowdown and its negative impact on the ability to service and repay systemic debt. One of the most politically expedient avenues policy makers could take would be to inflate the debt away in real terms through coordinated currency devaluations against gold, the only monetize-able asset on most central bank balance sheets. To do so they would create new base money with which to purchase gold at...

Read More »FX Daily, May 25: Dollar Marks time

The US dollar is little changed against the major currencies as yesterday’s moves are consolidated and traders wait for fresh developments. Global equities were higher after Wall Street’s advance yesterday. Asia-Pacific bond yields were firm, following the US lead, but European 10-year benchmark yields are lower, led by the continued rally in Greek bonds after an agreement was struck that will free up a tranche of aid. Source Dukascopy The relative stable capital markets are itself...

Read More »Switzerland About to Vote on “Free Lunch” for Everyone

Photo credit: Peter Klaunzer Will the Swiss Guarantee CHF 75,000 for Every Family? In early June the Swiss will be called upon to make a historic decision. Switzerland is the first country worldwide to put the idea of an Unconditional Basic Income to a vote and the outcome of this referendum will set a strong precedent and establish a landmark in the evolution of this debate. The Swiss Basic Income Initiative in a demonstration in front of parliament. As we have previously reported (see...

Read More »The Yuan and Market Forces: Declaratory and Operational Policy

The Wall Street Journal is reporting that minutes of a meeting in China two months ago reveal that officials there have abandoned their commitment to give market forces greater sway in setting the yuan’s exchange rate. Reportedly, in response to economists and banks request that officials stop resisting market pressure, one PBOC official explained that “the primary task is to maintain stability.” The WSJ cites the minutes of the meeting and interviews with Chinese officials and...

Read More »LIBOR Alternatives Taking Shape

Since the LIBOR scandal erupted, US officials have been working toward an alternative benchmark. In 2014, the Fed set up a working committee that includes more than a dozen large banks and regulators Before the weekend the committee (Alternative Reference Rates Committee) proposed two possible replacements for LIBOR. There reportedly was some consideration of using the Fed funds as an alternative. However, Fed funds were rejected because it would have been made it more difficult to...

Read More »BSI: The End of a Swiss Private Bank

Authorities in Switzerland and Singapore are punishing BSI, the private bank based in the Ticino region of Switzerland, for alleged money-laundering offenses, shutting their activities in Singapore and seizing part of its profits. Switzerland’s attorney general has opened criminal proceedings against BSI Bank in connection with alleged money-laundering and corruption by Malaysia’s statement investment fund 1MDB. In a separate move, the country’s financial market regulator said the bank was...

Read More »Three unintended consequences of NIRP

Submitted by Patrick Watson via MauldinEconomics.com, Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues in the exactly opposite way: Falling prices are a consequence of low interest rates and not the opposite: We see two reasons why this can be true: High, maybe excessive investment is happening in China (alas not in Europe). Cheap costs of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org