Bill Kristol – the Gartman of Politics? It has become a popular sport at Zerohedge to make fun of financial pundits who appear regularly on TV and tend to be consistently wrong with their market calls. While this Schadenfreude type reportage may strike some as a bit dubious, it should be noted that it is quite harmless compared to continually leading people astray with dodgy advice. To answer the question posed in the picture with the benefit of hindsight: not really…. (look at the...

Read More »Getting it Wrong on Silver

Erroneous Analysis of Precious Metals Fundamentals We came across an article at Bloomberg today, talking about silver supply troubles. We get it. The price of silver has rallied quite a lot, so the press needs to cover the story. They need to explain why. Must be a shortage developing, right? At first, we thought to just put out a short Soggy Dollars post highlighting the error. Then we thought we would go deeper. Here’s a graph showing the price action in silver since the beginning of...

Read More »Peak Data: When Not Enough Is Already Too Much

The Wild 1990s Not so long ago, during 1990’s, the connecting world of the connected world we now know was literally and comprehensively in the development stage during those wild crazy go go years before the crash in technology stocks in 2000. Nasdaq Composite, 1995 – 2003, The technology bubble and crash The infamous tech bubble of the 1990s – to this day the greatest stock market bubble ever seen in the US (in terms of multiple expansion, intensity, public participation, speed and...

Read More »Old School Investment Lessons

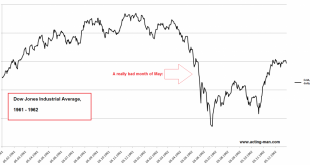

Laughing at Blue Monday On May 28, 1962 – dubbed “Blue Monday” – the market fell 6%… its worst single-day slide since 1929. Peter Stormonth Darling was an investment manager at investment bank S. G. Warburg & Co. at the time. He strolled in to tell his boss, Tony Griffin, how much the market had fallen. Dow Jones Industrial Average, 1961-1962 The DJIA in 1961 – 1962. March – June 1962 delivered quite a scare to investors – in May the decline accelerated, as panic began to spread –...

Read More »Wall Street In Pain: 163 Hedge Funds Are Long AAPL Stock

First it was the blow up of hedge fund darling Valeant that crushed countless funds who were long the name. Then, one month ago after the collapse of the Allergan-Pfizer deal, we showed (one of the reasons) why the hedge fund world continued to underperform the broader market: Allergan was one of the most widely held hedge fund stocks. And now, following the biggest Apple debacle in years, here is the reason why the hedge fund community is about to see even more redemption requests and...

Read More »US Economy – Gross Output Continues to Slump

The Cracks in the Economy’s Foundation Become Bigger Decay… Photo credit: bargewanderlust Last week the Bureau of Economic Analysis has updated its gross output data for US industries until the end of Q4 2015. Unfortunately these data are only available with a considerable lag, but they used to be published only once every few years in the past, so the current situation represents a significant improvement. As Ned Piplovic summarizes in his update on the situation on Dr. Mark...

Read More »Schaeuble Channels Meghan Trainor: No

My name is noMy sign is noMy number is noYou need to let it goDebt relief is noGerman stimulus is noECB easing is noYou need to let it go German Finance Minister Schaeuble appears to have taken on a new role: chief obstructionist. Schaeuble seems to be reveling in the fact that due to Chancellor Merkel’s immigration stance, and perhaps also because of her accommodation of Turkey, her public support has fallen below his. According to a recent ZDF poll, Merkel is now the fifth most...

Read More »Great Graphic: Measuring Cost of Extend and Pretend

There is a debate. On one hand is Summers, who argues that modern economies have entered an era of secular stagnation. Full utilization of the factors of production and particularly capital and labor is not possible without stimulating aggregate demand in a way that facilitates bubbles. The broad strokes of the argument can be found implicitly or explicitly in much of the commentary and economic analysis. The other side of the debate includes economists like Bernanke, and Rogoff and...

Read More »Greenback Mostly Softer, Sterling Shines

The gains the US dollar registered in the second half are being pared, but it is sterling’s strength that stands out. It is difficult to attribute it to Obama’s push against Brexit, but there does appear to have been a change in sentiment. Sterling is the best-performing currency not only today but for the past five sessions, rising 1.25% against the US dollar to its best level since mid-February. The next target is $1.4600 and $1.4670, the high from early February. Sterling is rising...

Read More »The “Canary in the Coal Mine” for Chinese Stocks

The Largest Online Marketplace in the World This company is twice the size of Enron at its peak ($100 billion). Pharmaceutical giant Valeant, which blew up in the last year, was only $90 billion at its peak. Before I get to what the stock is, let me tell you where it is: China. CEO Jack Ma, wagging a finger (bad sign) Photo credit: Kiyoshi Ota / Bloomberg I recently heard an excellent presentation by Anne Stevenson-Yang at Grant’s Spring Investment conference. Stevenson-Yang is the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org