On June 1, Angela Merkel and Francois Hollande will take a break from their respective domestic crises and attend a ceremony to inaugurate the Gotthard Base Tunnel (GBT) in Switzerland. While the US has been focused on resolving LGBT rights issues and deciding whether or not the Confederate flag can fly in cemeteries, Switzerland has focused on something that’s actually productive. After 17 years of work, and at a cost of $12 billion, Switzerland has engineered and constructed the world’s...

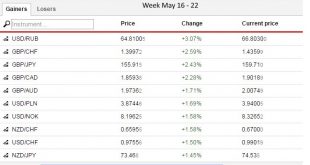

Read More »Emerging Market Preview for the Week Ahead

EM had another rocky week, but managed to end on a slightly firmer note Friday. Market repricing of Fed tightening risk was the big driver last week, and that could carry over into this week. There are several Fed speakers in the days ahead, capped off with Fed chief Yellen on Friday. Several EM central banks meet this week, including Israel, Turkey, Hungary, and Colombia. There is some risk of a dovish surprise from Turkey, while Hungary is expected to continue easing. Colombia is...

Read More »FX Week Ahead: Evolving Investment Climate

The US dollar’s weakness in recent months, despite negative interest rates in Europe and Japan likely had many contributing factors. These factors include shifting views of Fed policy, weaker US growth, the recovery in commodity prices, including oil, gold and iron ore, and market positioning. A new phase began in late-April/early May. The dramatic rally in iron prices reversed, and the Australian dollar, bottomed against the US dollar in mid-January, seemingly to anticipate the...

Read More »Sentiment Shift Evident in Speculative Adjustment in Currency Futures

Speculative positioning in the currency futures began to adjust before the latest signals from the Federal Reserve about the prospects for a summer hike and the widening of interest rate differentials. In the CFTC reporting week ending May 17, the day before the FOMC minutes were released speculators mostly reduced gross long currency positions and added to gross short positions. There were a few exceptions. Speculators added less than 500 contracts to the gross long euro position...

Read More »Daily FX, May 20: Divergence Reasserted, Extends Greenback’s Recovery

The combination of stronger US economic data and signals from the Federal Reserve that it is looking to continue the normalization process helped the dollar extended its recovery. The dollar posted a significant technical reversal against many of the major currencies on May 3. The Dollar Index rose for its third week, as the greenback climbed against all the major currencies but sterling (+0.9%). Sterling was aided by some polls indicating a shift toward the Remain camp. The...

Read More »Emerging Markets: What has Changed

The Philippine central bank moved to an interest rate corridor Saudi Arabia is preparing to sell its first global bond ever Transport Minister Yildirim, a close ally of President Erdogan, will become Turkey’s new Prime Minister The new Brazil cabinet continues to take shape with a market-friendly bias In the EM equity space, South Africa (+2.2%), Singapore (+1.1%), and Taiwan (+1.0%) have outperformed this week, while UAE (-3.4%), Brazil (-2.2%), and Colombia (-2.0%) have underperformed....

Read More »How to Maximize Economic Potential

Scratching the Surface Problems, as people commonly perceive them, require solutions. Broken shoelaces must get fixed. Regrettably, in today’s democracy this means the candidate who offers the most fixes – in the form of goodies – to the most people wins the election. The Gallup poll reported earlier this week that 18 percent of U.S. adults believe the “economy in general” is the most important problem facing the country. This was followed by 13 percent who believe “dissatisfaction...

Read More »How the Deep State’s Cronies Steal From You

Expanding in Ireland DUNMORE EAST, Ireland – We came down the coast from Dublin to check on our new office building. For this visit, we wanted to stay somewhere different than we normally do. So we chose a small hotel on the coast, called the Strand Inn. Irish landscape with alien landing pads. Even the guys from Rigel II have heard about Ireland’s corporate tax rate. Photo credit: Tourism Ireland It is an excellent place for seafood and soda bread on a rainy day. Later, you can go to the...

Read More »The Japanese Popsicle Affair

Shinzo Abe and Haruhiko Kuroda, professional yen assassins Photo credit: Toru Hanai / Reuters Policy-Induced Contrition in Japan As we keep saying, there really is no point in trying to make people richer by making them poorer – which is what Shinzo Abe and Haruhiko Kuroda have been trying to do for the past several years. Not surprisingly, they have so to speak only succeeded in achieving the second part of the equation: they have certainly managed to impoverish their fellow Japanese...

Read More »Pareto’s Wily Foxes

Smart Money Fleeing Stocks DUBLIN – The Dow dropped 180 points on Tuesday – or about 1%. And another clever billionaire says he is looking elsewhere for profits. Reuters: “Activist investor Carl Icahn on Monday said there was a chance the stock market could suffer a big decline, saying valuations are rich and earnings at many companies are fueled more by low borrowing costs than management’s efforts to boost results. “I am very cautious on equities today. This market could easily have...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org