“Some market and economic volatility can be expected as this process unfolds,” Carney said in a televised statement in London after the referendum result. His comments followed Prime Minister David Cameron’s announcement that he will step down this year, which will inject political uncertainty into an already volatile period. His full announcement is below and his statement can be found here: [embedded content]...

Read More »Rule Britannia

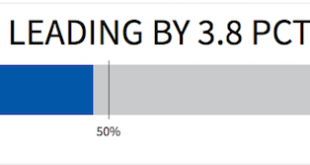

A Glorious Day What a glorious day for Britain and anyone among you who continues to believe in the ideas of liberty, freedom, and sovereign democratic rule. The British people have cast their vote and I have never ever felt so relieved about having been wrong. Against all expectations, the leave camp somehow managed to push the referendum across the center line, with 51.9% of voters counted electing to leave the...

Read More »The EU Begins to Splinter, a new Tsunami for Kuroda

Dark Social Mood Tsunami Washes Ashore Early this morning one might have been forgiven for thinking that Japan had probably just been hit by another tsunami. The Nikkei was down 1,300 points, the yen briefly soared above par. Gold had intermittently gained 100 smackers – if memory serves, the biggest nominal intra-day gain ever recorded (with the possible exception of one or two days in early 1980). Here is a...

Read More »FX Daily, June 24: Brexit Sends Shock Waves, SNB Intervenes

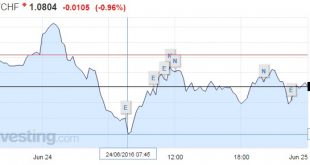

SNB interventions During the Brexit turmoil on Friday, the Swiss National Bank has intervened in markets. Just after they got into the office, at 7.45 am CET, they started the interventions. Apparently the Singapore office did not have a mandate to do interventions. The central bank drove the EUR/CHF price from a low of 1.0646 towards 1.08. FX traders might have moved it higher to 1.0850. We do not think that the...

Read More »Tourism balance of payments 2015: Tourism balance of payments affected by strong franc

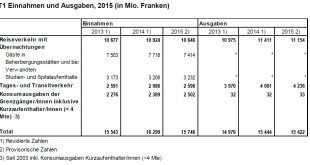

24.06.2016 09:15 – FSO, National Accounts (0353-1606-40) Tourism balance of payments 2015 Tourism balance of payments affected by strong franc Neuchâtel, 24.06.2016 (FSO) – The strong franc in 2015 made Switzerland less attractive to foreign tourists, whereas holidays abroad maintained their appeal to Swiss residents. Foreign tourists spent CHF 15.7 billion in Switzerland in 2015, 3.4% less than in 2014, while the...

Read More »Brexit shakes global markets and the SMI

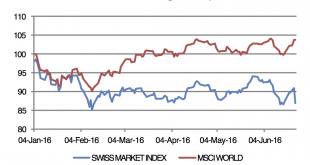

Investec Switzerland. Swiss Market Index The Swiss Market Index (SMI) is set to post a modest gain this week despite confirmation that the UK has decided to leave the European Union. The SMI opened almost 7% lower following the announcement before recovering. The Swiss franc strengthened the most since the Swiss National Bank (SNB) lifted its cap against the euro in 2015. click to enlarge Around...

Read More »In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal. Jeff Gundlach confirmed as...

Read More »FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK’s referendum is underway. The capital markets are continuing the move that began last week with the murder of UK MP Cox. The tragedy seemed to mark a shift in investor sentiment. Sterling bottomed on June 17 just ahead of $1.40. Earlier today in Asia, after more polls showed a move toward remain, sterlingrallied to almost $1.4845, its highest level since last December. The market continues to put anticipate...

Read More »The EU and Turkey: Unvarnished Truth and Stuffing

Summary Turkey and the EU will begin negotiations over financial and budget reform. It is one of 35 areas (chapters) of negotiations. Turkey is no where close to joining the EU, for which it initially applied in 1987. In the vitriolic debate over the UK’s membership of the EU, Turkey’s potential membership became one of the talking points. Prime Minister Cameron, who has advocated Turkey’s eventual membership,...

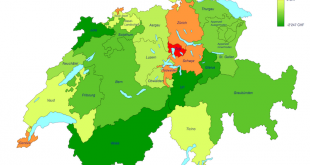

Read More »Swiss tax redistribution in 2017 – winners and losers

Swiss cantons have very different tax bases, tax rates and costs. To even things up, and temper tax rate competition between cantons that jockey to attract the wealthiest residents with the lowest tax rates, Switzerland has a system known as la péréquation financière nationale in French, or Finanzausgleich in German, which requires “rich” cantons to give money to “poor” cantons. Yesterday, the Swiss federal government...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org