Ye olde tattered Crash Alert flag… should it be unfurled again? Image by fmh Black-and-Blue Crash Alert Flag Let us begin the week “on message.” The Diary is about money. Today, we’ll stick to the subject. Old friend Mark Hulbert has done some research on the likelihood of a crash in the stock market. Writing in Barron’s, he points out that the risk – or, more properly, the incidence – of crashes, historically, has been very small: “[…] consider that the 1987 and 1929 crashes were...

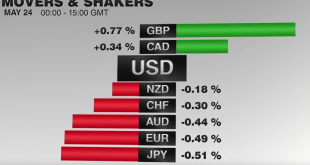

Read More »FX Daily, May 24: Dollar Regains Momentum, Sterling Resists

The US dollar lost momentum on May 24 but has regained it on May 25. The euro has been pushed through last week’s lows near $1.1180. The next immediate target is $1.1145, which corresponds to the lower Bollinger Band today, though the intraday technical readings suggest some modest upticks are likely first. The $1.1200-$1.1220 area may cap upticks. Source Dukascopy The greenback held above JPY109 and bounced to recoup 38.2% of its decline since the pre-weekend high near...

Read More »Austria’s Presidential Elections – Europe’s Social Mood Keeps Worsening

Photo credit: Georges Schneider / APA Trapped in the EU Austria is a small European nation that has made the grievous mistake of needlessly joining the EU in 1995, together with Finland and Sweden. Austria’s neighbor Switzerland, which is of roughly similar size and likewise militarily neutral, proved to have far better instincts. The Swedes subsequently at least had the good sense to stay out of the euro zone. It seems if there is a mistake to be made, Austrian governments will...

Read More »Academic Skulduggery – How Ivory Tower Hubris Wrecks your Life

In the 1970s economists started to incorporate rational expectations into their models and not long after the seminal Kydand & Prescott (1977) article named Rules Rather than Discretion: The Inconsistency of Optimal Plan was published. Their work has been driving the mainstream macroeconomic debate ever since. The question raised in this debate is how policy-makers can credible commit to promises made today when future events may cause short-term pain if restricted by stringent rules...

Read More »Great Graphic: Dollar Pushes Back Below JPY110

The yen is the strongest of the major currencies. It has gained about 0.65% against the dollar. It has been grinding lower throughout the Asian and European session and has remained in narrow ranges near its highs in the US morning. Japan still seems isolated in terms of it desire to intervene. Ahead of the G7 heads of state summit this coming, the risk of intervention remains slight. Asian and European shares were lower, which favors the yen. US yields are flat, while the US...

Read More »Revolution at the Ranch

Originarios on the march… Photo credit: cta.org.ar Alarming News BALTIMORE, Maryland – An alarming email came on Tuesday from our ranch in Argentina: “Bad things going on… We thought we had the originarios problem settled. Not at all. They just invaded the ranch.” To bring new readers fully into the picture, Northwest Argentina, where we have our ranch, has a revolution going on. Some of the indigenous people – that is, people with Native American blood – believe they have a claim on...

Read More »Revenge of the Fundamentals

Illustration via irs.com A Wake-Up Call The price of gold moved down about twenty Federal Reserve Notes, and the price of silver dropped $0.57. The big news is that the gold-silver ratio moved up about 1.5. We hate to say “we told you so,” well, OK. Actually… sometimes there’s a certain je ne said quoi about gloating. *Achem* In all seriousness, the dollar is going up. We measure it in gold, or alternatively in silver. In gold, the dollar rose 0.4mg gold to 24.84. In silver, it was up...

Read More »Cool Video: Bloomberg Surveillance: Dollar to trend higher

Video, Chandler: Dollar Will Continue to Trend Higher, click to open Returning from a two-week business trip to Asia, I was invited to appear on Bloomberg Surveillance with Tom Keene and Francine Lacqua. Check out the video clip here. Key Points My key points include,the driver now is changing perceptions of the trajectory of Fed policy and the reemergence of divergence. I suggest that “real news” from the G7 meeting was not about intervention, as neither the US, Europe, nor...

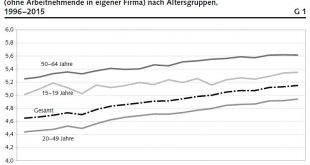

Read More »Working Hours worked increased in 2015

23.05.2016 09:15 – FSO, Labour Force (0353-1605-40) Swiss Labour Force Survey and its derivative statistics: working hours Hours worked increased in 2015 Neuchâtel, 23.05.2016 (FSO) – The total number of hours worked in Switzerland reached 7.889 billion in 2015, representing an increase of 2.3% compared with the previous year. According to the Federal Statistical Office (FSO), between 2011 and 2015, the actual weekly hours worked by full-time employees declined very slightly and stood at...

Read More »FX Daily May 23

The capital markets are off to a mixed start to start the last week of the month. Asian shares were mostly higher, though the Nikkei shed 0.5%. European shares are also higher, extending the three-week high seen last week. FX Rates The US dollar is mixed. The yen is the strongest of the majors. The media continues to play up tension between the US and Japan at the weekend G7 meeting over the appropriateness of intervention, but Europe is not very sympathetic either. Today’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org