Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legislative majority to start holding the government to account. Right on cue, Mr. Maduro just railed a decree through the Supreme Court (TSJ) giving him total control over budgetary measures, utilize any property, suspect constitutional rights and if needs be mobilize the military for a period of 60 days (effective from 15th January) with another 60 day extension not only ‘Constitutionally possible’, but increasingly likely. The ‘good news’ from that, is President Maduro is at least starting to take some tepid measures that might help to get Venezuela onto a more realistic track, including 37% devaluation with a view to bringing Venezuela’s three tiered exchange rate into a dual system. Looks good on ‘paper’, but don’t be fooled. It merely leaves official rates of 10 bolivares to the US dollar, 200 bolivares (likely floated as the second tranche), compared to black market rates that’s more like 1000 to the greenback. Unsurprisingly, domestic price reforms got similarly ‘piecemeal treatment’, where memories of the 1989 Caracozo riots still ring loud in the PSUV’s ears. Going from 0.

Topics:

Eugen von Böhm Bawerk considers the following as important: Bawerk, commodities, Economics, emerging markets, Energy, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

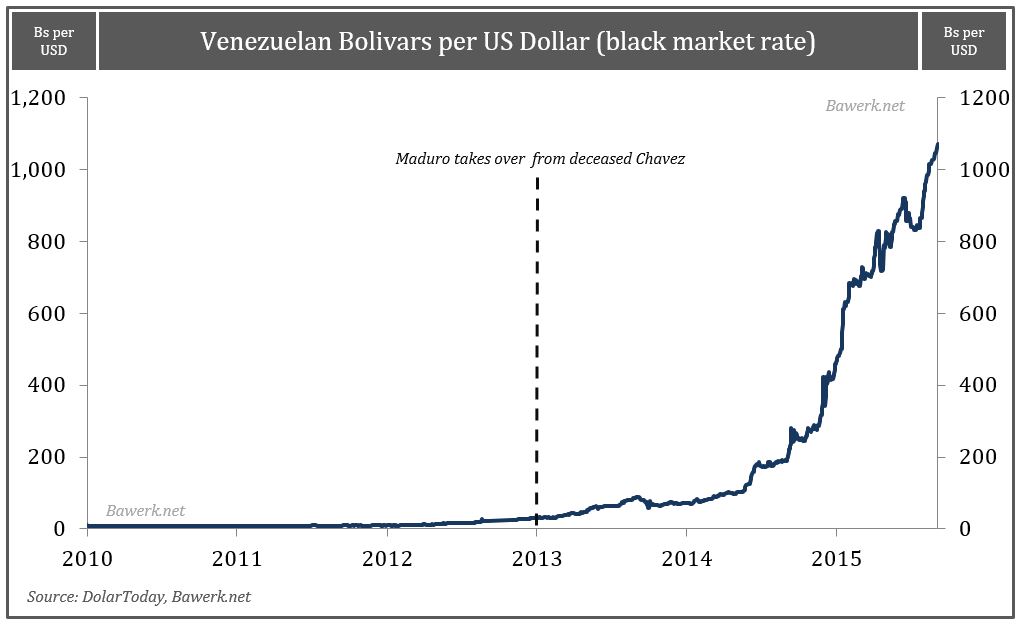

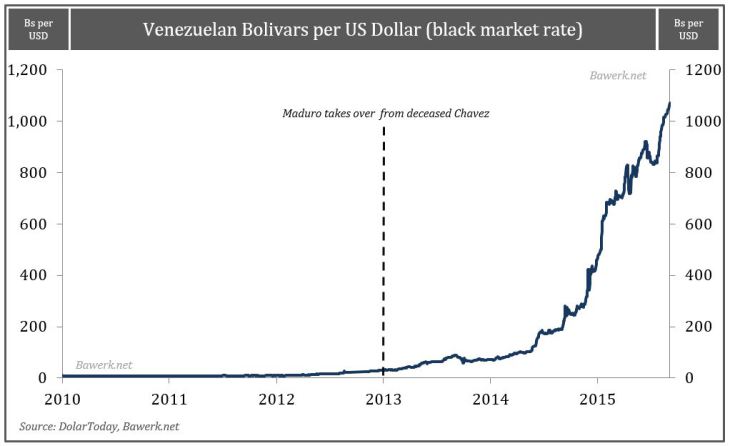

Things are turning increasingly ugly in Venezuela between President Maduro and the opposition MUD. The core political problem after December 2015 elections is the PSUV are now using the courts to neuter any opposition voices that formally hold a legislative majority to start holding the government to account. Right on cue, Mr. Maduro just railed a decree through the Supreme Court (TSJ) giving him total control over budgetary measures, utilize any property, suspect constitutional rights and if needs be mobilize the military for a period of 60 days (effective from 15th January) with another 60 day extension not only ‘Constitutionally possible’, but increasingly likely. The ‘good news’ from that, is President Maduro is at least starting to take some tepid measures that might help to get Venezuela onto a more realistic track, including 37% devaluation with a view to bringing Venezuela’s three tiered exchange rate into a dual system. Looks good on ‘paper’, but don’t be fooled. It merely leaves official rates of 10 bolivares to the US dollar, 200 bolivares (likely floated as the second tranche), compared to black market rates that’s more like 1000 to the greenback. Unsurprisingly, domestic price reforms got similarly ‘piecemeal treatment’, where memories of the 1989 Caracozo riots still ring loud in the PSUV’s ears. Going from 0.07 bolivar a litre to 1 bolivar sounds huge at 1,329% price hikes for 91 octane, but it still makes Venezuelan gasoline the cheapest in the world. PDVSA will only save around $800m from the move, and that’s assuming the government continues to adjust prices give Mr. Maduro’s measures will send inflation into the 1000% stratosphere. The IMF was already being very polite with 720% estimates on basic goods, including fabled toilet paper and condoms in increasingly short Venezuelan supply these days.

But so much for the ‘economic story’, what about the political backdrop? Unsurprisingly, Mr. Maduro’s Supreme Court stunt has left the opposition with little choice but to push for regime change at this stage. To be clear, the Venezuelan constitution is explicitly worded that any emergency Presidential enabling powers should have the approval of the Supreme Court and the National Assembly. The fact they’ve run roughshod straight over them and made up their own rules, basically renders the Assembly dead in the water at this stage. Regime change is the only card the MUD now have left to play. The question is how to pull it off? The preferred option would almost certainly be to hold a constituent assembly to re-write the constitution, including shortening and limiting presidential terms. The snag is that the MUD needs a two-thirds assembly majority to do so. And it’s the same ‘super-majority’ the PSUV and TSJ evidently blocked from the December 2015 poll, which makes a so called ‘recall referendum’ the obvious plan B against Mr. Maduro in April 2016 once the President is officially half way through his term. The MUD will need to garner 25% of registered voters to trigger the process, in what’s then a five month ordeal from start to finish, with multiple National Election Board (CNE) hurdles along the way. It’s almost certain the CNE and Courts will drag their heels as long as they can, mimicking previous 2003-04 tactics to forestall Chavez’s removal. The key reason for that is by early 2017, the PSUV can legitimately remove Maduro themselves where they could essentially put its own puppet back into office. And far more importantly, protect their own (and military) patronage networks in what’s left of an economically gutted Venezuela. The ailing bus driver soaks up all the bad PSUV news along the way, while the Party gets to work jailing more MUD figures, dividing and ruling all the way.

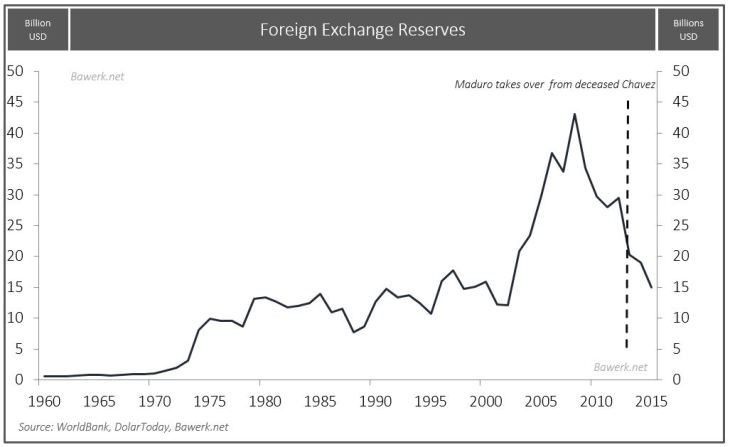

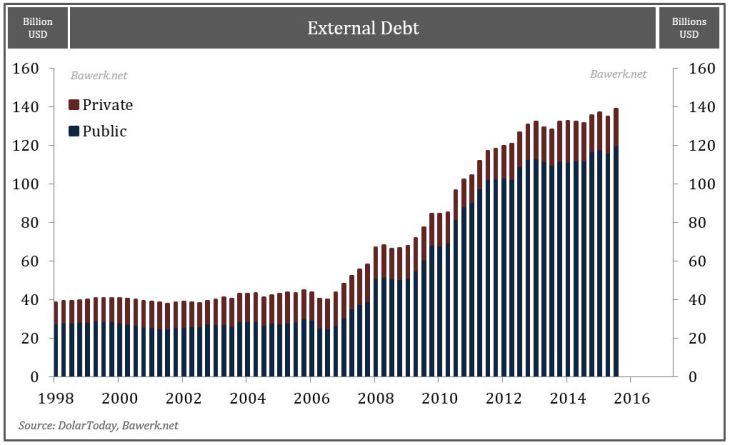

Whether things can realistically be strung out that far frankly remains contingent on the ‘Venezuelan street’, somewhat ironically mirrored by what’s happening within military elites, where the Generals are getting increasingly nervous they might have to oversee a ‘transitional’ period of military rule to safeguard their own interests. Try as his might, President Maduro can politically run, but he can’t economically hide from the fact that Venezuelan will see another 5% contraction this year, with around $20bn of debt payments due by the end of 2016 with little foreign reserves left to do it.

A third of that is owed by the Central Bank, a third owed by PDVSA, and another tranche directly payable to China under oil for loans. To its ‘credit’ Venezuela has tried to honour its international obligations, even to the point of squeezing imports to avoid the political embarrassment of tanker seizures to date. But under current benchmark prices, Venezuela will have to spend around 90% of oil export revenues purely servicing debts to get through the year. Our take is that’s going to be politically impossible to do given some of those scarce dollars will be needed to provide the most basic of basic goods. That means structural default is inevitable sooner or later, at least without any fundamental regime change to try and chart a new course. On that ironic note, anyone expecting things to get better under a drastically fractured MUD consisting of 27 internal groups will prove very disappointed. Cut to the chase, and that ultimately leaves the ball in China’s court given its massive ($50bn) sunk costs in Venezuela where it’s thrown caution to the Caracas wind over the past decade. Sure, CNPC can directly tie new capital to its operations all it likes, but at some point, Beijing needs to decide between propping up the PSUV with more cash, or just let the house of cards fall and take their chances with a hostile MUD. Then again, ‘plan C’ might prove the most attractive for Beijing: Ditch the democratic niceties and do what China does best, cut a deal with the military to maintain status quo interests. Either way, Beijing will have a key role on what does or doesn’t happen with Maduro’s Mayhem in 2016-17. Force us to make a call, Mr. Maduro ultimately won’t be part of the Sino script over the longer term….

On that ironic note, anyone expecting things to get better under a drastically fractured MUD consisting of 27 internal groups will prove very disappointed. Cut to the chase, and that ultimately leaves the ball in China’s court given its massive ($50bn) sunk costs in Venezuela where it’s thrown caution to the Caracas wind over the past decade. Sure, CNPC can directly tie new capital to its operations all it likes, but at some point, Beijing needs to decide between propping up the PSUV with more cash, or just let the house of cards fall and take their chances with a hostile MUD. Then again, ‘plan C’ might prove the most attractive for Beijing: Ditch the democratic niceties and do what China does best, cut a deal with the military to maintain status quo interests. Either way, Beijing will have a key role on what does or doesn’t happen with Maduro’s Mayhem in 2016-17. Force us to make a call, Mr. Maduro ultimately won’t be part of the Sino script over the longer term….