In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth. For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter. When we say “for whatever reason” we don’t mean that the public shouldn’t be concerned about NIRP. In fact, we mean the exact opposite. The ECB, the Nationalbank, the SNB, and the Riksbank have all been mired in ineffectual NIRP for quite sometime and the public seemed almost completely oblivious. Indeed, even the financial media treated this lunacy as though it were some kind of cute Keynesian experiment that could be safely confined to Europe which would serve as a testing ground for whether policies that fly in the face of the financial market equivalent of Newtonian physics could be implemented without the world suddenly imploding.

Topics:

Tyler Durden considers the following as important: bank run, BOE, Central Banks, Crude, Equity Markets, Eurozone, Excess Reserves, Featured, fixed, Monetary Policy, newsletter, NIM, None, Norges Bank, Reality, Swiss Banks, Swiss National Bank, Twitter, Yen, zerohedge

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth.

For whatever reason, Haruhiko Kuroda’s move into NIRP seemed to spark a heretofore unseen level of public debate about the drawbacks of negative rates. Indeed, NIRP became so prevalent in the public consciousness that celebrities began to discuss central bank policy on Twitter.

When we say “for whatever reason” we don’t mean that the public shouldn’t be concerned about NIRP. In fact, we mean the exact opposite. The ECB, the Nationalbank, the SNB, and the Riksbank have all been mired in ineffectual NIRP for quite sometime and the public seemed almost completely oblivious. Indeed, even the financial media treated this lunacy as though it were some kind of cute Keynesian experiment that could be safely confined to Europe which would serve as a testing ground for whether policies that fly in the face of the financial market equivalent of Newtonian physics could be implemented without the world suddenly imploding.

We imagine the fact that equity markets got off to such a volatile start to the year, combined with the fact that crude continued to plunge and at one point looked as though it might sink into the teens, led quite a few people to look towards the monetary Mount Olympus (where “gods” like Draghi, Yellen, and Kuroda intervene in human affairs when necessary to secure “desirable” economic outcomes) only to discover that not only has all the counter-cyclical maneuverability been exhausted, we’ve actually moved beyond the point where the ammo is gone into a realm where the negative rate mortgage is a reality. That shock was compounded by Kuroda’s adoption of NIRP and another cut from the Riksbank, and before you knew it, everyone was shouting what we’ve been shouting for more than seven years: the emperors have no clothes!

But central banks aren’t willing to surrender just yet. Admitting that this entire experiment has been a mistake would be a disaster at this juncture. And while some brave sellside desks are indeed going full-tinfoil-hat-fringe-blog by daring to suggest that this whole damn thing simply isn’t working when it comes to reviving aggregate demand and boosting inflation, there are still those who want you to know that the “gods” are not out of lightening bolts just yet. Take HSBC for instance, where the fixed income team is out with an excellent - if rather disturbing for its references to helicopter money and even negative-er-er rates - summary of “life below zero.”

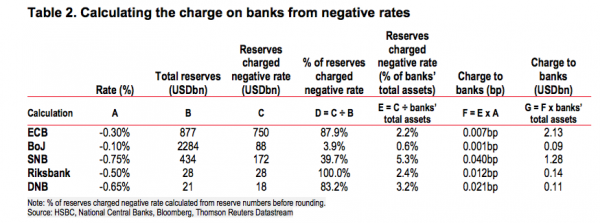

First off, HSBC doesn’t buy the idea that rates can’t go lower - even given the constraint imposed by physical bank notes (that damn barbarous paper relic). “The Swiss National Bank currently operates the most negative rate at -75bp (see table 2). If the costs incurred by Swiss banks – expressed as a proportion of total assets at the negative rate – were applied to the eurozone banking system, the ECB’s depo rate would be much more negative. A simple calculation would put the ECB’s repo rate at -180bp, assuming the current level of excess reserves would all be charged at the negative rat,” the bank writes. HSBC then moves to address the constraints that keep central banks from taking rates even lower. Those contraints (in order) are:

HSBC then moves to address the constraints that keep central banks from taking rates even lower. Those contraints (in order) are:

- Constraint 1: The ability to switch into cash, which yields zero

- Constraint 2: Downward pressure on the earnings of banks

- Constraint 3: Does it work?

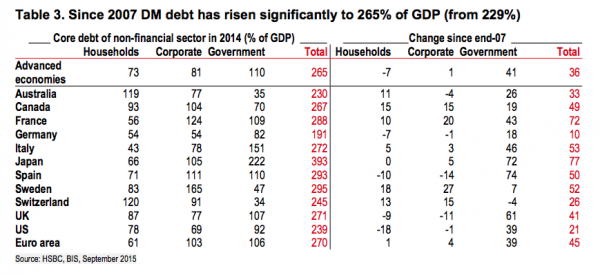

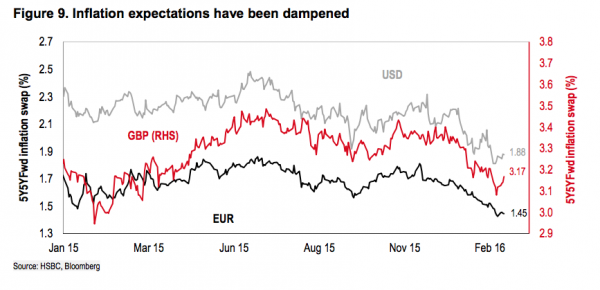

"Eight years after the financial crisis started, many global central banks are still looking to increase monetary accommodation. This follows 500bp of rate cuts by the Fed and BoE, 400bp by the ECB and rates held near zero at the BoJ. Add to this USD trillions of QE asset purchases and tightening moves that were subsequently reversed by a number of central banks. The challenge to the traditional central bank framework has come from the impact of structural factors, such as the debt overhang, which rather than disappearing over the last eight years, has actually got worse. If the role of ultra-loose monetary policy, combined with unconventional measures such as QE, was to facilitate an orderly deleverage, it has not worked."And while it's impossible to quantify how much MOAR we need, what we do know is that inflation expectations are no longer responding (and that language assumes they "responded" at some point post-2008 which is itself a dubious proposition):

And because you can count on policy makers to view this not as evidence that what they're doing not only isn't working but may in fact be contributing to deflation, but rather as proof of why they need to continue the experiment in an increasingly ludicrous example of Einsteinian insanity, you can bet that more accommodation is coming. The next to ease further will be the ECB and the Norges Bank (which, unlike other CBs, actually has a number of good reasons to cut) in March. Of course none of this will work. The problem isn't monetary conditions. There's not a shortage of liquidity - well, actually there is, ironically courtesy of central bank asset purchases, but the point is, it's not as though the financial sector doesn't have access to cash. The problem is that somewhere along the way, weak global growth and trade became systemic rather than cyclical and because the "gods" can't print trade, they're going to need to figure something else out to boost aggregate demand. As for what that "something" is, we'll simply close with one last quote from HSBC: "If central banks do not achieve their medium-term inflation targets through NIRP, they may have to adopt other policy measures: looser fiscal policy and even helicopter money are possible in scenarios beyond QE and negative rates."

And because you can count on policy makers to view this not as evidence that what they're doing not only isn't working but may in fact be contributing to deflation, but rather as proof of why they need to continue the experiment in an increasingly ludicrous example of Einsteinian insanity, you can bet that more accommodation is coming. The next to ease further will be the ECB and the Norges Bank (which, unlike other CBs, actually has a number of good reasons to cut) in March. Of course none of this will work. The problem isn't monetary conditions. There's not a shortage of liquidity - well, actually there is, ironically courtesy of central bank asset purchases, but the point is, it's not as though the financial sector doesn't have access to cash. The problem is that somewhere along the way, weak global growth and trade became systemic rather than cyclical and because the "gods" can't print trade, they're going to need to figure something else out to boost aggregate demand. As for what that "something" is, we'll simply close with one last quote from HSBC: "If central banks do not achieve their medium-term inflation targets through NIRP, they may have to adopt other policy measures: looser fiscal policy and even helicopter money are possible in scenarios beyond QE and negative rates."