Is immigration why employment reports from the Bureau of Labor Statistics (BLS) continue defying mainstream economists’ estimates? Many are asking this question as the U.S. experiences a flood of immigrants across the southern border. Concurrently, many young college graduates continue to complain about the inability to receive a job offer. As noted recently by CNBC: The job market looks solid on paper. According to government data, U.S. employers added 2.7...

Read More »Blackout Of Buybacks Threatens Bullish Run

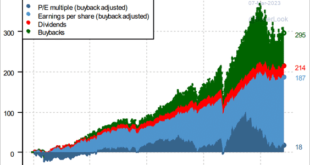

With the last half of March upon us, the blackout of stock buybacks threatens to reduce one of the liquidity sources supporting the bullish run this year. If you don’t understand the importance of corporate share buybacks and the blackout periods, here is a snippet of a 2023 article I previously wrote. “The chart below via Pavilion Global Markets shows the impact stock buybacks have had on the market over the last decade. The decomposition of returns for the...

Read More »Digital Currency And Gold As Speculative Warnings

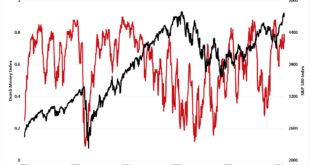

Over the last few years, digital currencies and gold have become decent barometers of speculative investor appetite. Such isn’t surprising given the evolution of the market into a “casino” following the pandemic, where retail traders have increased their speculative appetites. “Such is unsurprising, given that retail investors often fall victim to the psychological behavior of the “fear of missing out.” The chart below shows the “dumb money index” versus the S&P...

Read More »Presidential Elections And Market Corrections

Presidential elections and market corrections have a long history of companionship. Given the rampant rhetoric between the right and left, such is not surprising. Such is particularly the case over the last two Presidential elections, where polarizing candidates trumped policies. From a portfolio management perspective, we must understand what happens during election years concerning the stock market and investor returns. Since 1833, the S&P 500 index has...

Read More »Fed Chair Powell Just Said The Quiet Part Out Loud

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average American as follows. “New...

Read More »Navigating Financial Frontiers: A Deep Dive into the World of Private Credit

Investors constantly seek new avenues for diversification and higher returns in the ever-evolving finance landscape. One such frontier that has gained significant attention in recent years is private credit. This alternative asset class offers unique opportunities and challenges, attracting institutional investors, high-net-worth individuals, and fund managers. In this comprehensive guide, we’ll explore the intricacies of private credit, examining its definition,...

Read More »Exploring Self-Directed IRAs for Diversification

Finding the right retirement portfolio balance is an individual journey, especially in today’s ever-evolving environment. No two individuals are alike when it comes to investing and planning for financial security in retirement, which can make it daunting to find a suitable option that provides protection yet also offers growth potential. One less conventional alternative is opening a self-directed IRA through a custodian or trust company, seen as an increasingly...

Read More »Maximizing Tax Benefits with Life Insurance for Small Business Owners

As a small business owner, there are numerous benefits to taking advantage of the tax incentives associated with life insurance. It can provide you and your loved ones financial security and help you maximize profits for your business in the long run. This article will explain the basics of life insurance for small business owners and how to leverage its many tax benefits over time. Investing in lifelong stability is one of the most critical steps to becoming an...

Read More »Three Ideas to Tackle Financial Ghosts.

Is money distress part of your life? Do the dollars & cents of poor decisions past sneak up on you and rattle around your house like chains? What if I could provide three ideas to tackle 2022’s financial ghosts and put them at rest for good? Listen, ghosts of the financial past are notorious for creeping into the present, especially when holidays roll around. Oh, and watch out for the ghosts of the financial future. They’re dark and ominous and portend to money...

Read More »Employees Want Paychecks for Life: Pros and Cons of Guaranteed Lifetime Income

Annuities and similar products may help address retirement readiness in an aging workforce People are living longer, which means they may need their retirement savings to last decades. As a result, nearly half (48%) of participants are concerned about outliving their retirement savings. Many Americans don’t know how to transform their savings into retirement income. Guaranteed income offerings can help ease this concern by providing consistent, predictable payments...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org