I never thought someone would label me a "Permabull." This is particularly true of the numerous articles I wrote over the years about the risks of excess valuations, monetary interventions, and artificially suppressed interest rates. However, here we are. "Lance, you are just another permabull talking your book. When this market crashes you will still be telling people to buy all the way down." I get it. We have been bullish over the last couple of years, but...

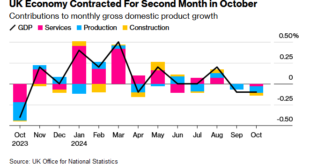

Read More »Britain And European Economic Growth Sputters

Yesterday's Commentary touched on the divergence between robust economic growth in the U.S. and near-recessionary conditions in Canada. We highlighted the importance of this to U.S. investors because of the historically strong correlation between the two economies. Unfortunately, Canada is not a one-off instance. Britain, Europe, and China also exhibit poor economic growth. Given the U.S. operates in a global economy, it's hard to imagine that economic stagnation...

Read More »The Role of Tax-Efficient Investing in Wealth Accumulation

When it comes to building long-term wealth, it’s not just about how much you earn but how much you keep. Taxes can significantly impact your investment returns, making tax-efficient investing a crucial component of any wealth accumulation strategy. By utilizing tax-advantaged accounts, employing strategies like tax-loss harvesting, and selecting tax-efficient funds, investors can reduce their tax burdens and maximize after-tax returns. Why Tax-Efficient Investing...

Read More »The Benefits of Starting Retirement Planning Early in Your Career

Retirement may seem like a distant milestone when you’re in the early stages of your career, with other financial priorities like paying off student loans, building an emergency fund, or saving for a home often taking center stage. However, starting your retirement planning early offers significant advantages that can make a profound difference in your financial future. By taking proactive steps now, you can harness the power of compound interest, establish...

Read More »Rosso’s Top 2025 Reads and Holiday Gift Idea.

As most know, books are my passion. For me, it's all about gifting knowledge for the holiday season. There's nothing more exciting to me than to peruse used book outlets and antique stores that sell ancient reads for pennies on the dollar. Also, new book releases excite me. My reading topic interests vary. However, most tend to be business or macroeconomic trend related. With that: Here are my top reads for 2025 and holiday gift idea for all the voracious...

Read More »CPI Was On The Screws: The Fed Has The Green Light

Yesterday's CPI report was seemingly the last hurdle for the Fed to cut interest rates. With the CPI index matching Wall Street forecasts, the Fed Funds futures market now implies a 97% chance the Fed will cut rates next Wednesday. The data was OK but elicits fears that the downward price progress has stalled. The CPI rate was 0.3%, a tenth higher than last month. The year-over-year rate rose from 2.6% to 2.7%. Core CPI was +0.3% monthly and +3.3% annually. The...

Read More »China Is No Longer The Marginal Buyer Of Oil

From 2010 through 2022, the US Energy Information Administration (EIA) calculates that global oil demand grew by 10 million barrels per day (Mb/d). Over 60% of the demand growth was due to China's phenomenal economic growth. For context, American demand increased by less than 10%. The graph below shows that China once drove global oil demand, but that is no longer true. Given the impact oil prices have on inflation, this is an essential macroeconomic factor to...

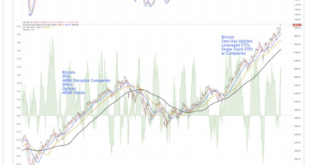

Read More »MicroStrategy And Its Convertible Debt Scheme

MicroStrategy (MSTR) stock is soaring alongside Bitcoin. In the wake of extreme confidence, we fear many MicroStrategy investors fail to grasp the inherent risks with its unique convertible bond funding and leverage scheme. A recent podcast featuring Tom Lee presented some positive facts about MicroStrategy's recent convertible bond offering but failed to tell the whole story. Left out of Tom Lee's enthusiastic outlook is that the "novel strategy" can also bankrupt...

Read More »Portfolio Rebalancing And Valuations. Two Risks We Are Watching.

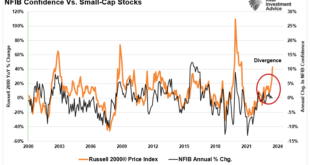

While analysts are currently very optimistic about the market, the combined risk of high valuations and the need to rebalance portfolios in the short term may pose an unanticipated threat. This is particularly the case given the current high degree of speculation and leverage in the market. It is fascinating how quickly people forget the painful beating of taking on excess risk and revert to the same thesis of why "this time is different." For example, I recently...

Read More »How to Build a Diversified Investment Portfolio for Long-Term Growth

Investing for the long term is a journey that requires careful planning, patience, and, most importantly, diversification. Building a diversified investment portfolio is essential for mitigating risk and ensuring steady growth over time. By spreading your investments across different asset classes, you can weather market fluctuations and achieve your financial goals more effectively. In this article, we’ll explore why diversification matters, outline key asset...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org