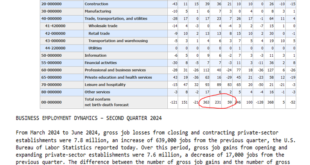

When formulating its monthly employment data, the BLS includes an adjustment for the net number of new jobs coming from new businesses and those lost by companies that have shut down. This adjustment is logical, as neither new nor closing firms are included in their surveys. While the so-called birth death adjustment is rational, the number of net jobs added due to the estimate can be incredibly flawed. The latest example is in the latest BLS Business Employment...

Read More »DOGE Deficit Reductions

The newly formed Department of Government Efficiency (DOGE), headed up by Elon Musk, is tasked with reducing government waste and increasing efficiency and productivity. The big question bond investors are keying on is how effectively DOGE can reduce the deficit. Tracking DOGE savings is now easy. As we share below, the US Debt Clock shows a running total of cumulative DOGE savings. Thus far, in less than a month, DOGE has saved $56 billion, as shown below (box in...

Read More »Where Does Money Come From?

All money is lent into existence. The Federal Reserve or the government does not print money. Those two facts are vital to understanding our lead question: where does money come from? Furthermore, knowing who does and doesn't print money and the incentives and disincentives that change the money supply are critical to inflation forecasting. Some so-called bond vigilantes are running around like Chicken Little, warning that the Fed's recent rate cuts will...

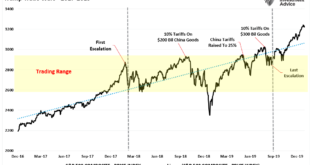

Read More »Tariffs Roil Markets

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. Such was not unexpected, as contained in the Trump tariff Executive Order {SEE HERE}. Specifically, that order stated: "[Sec 2, SubSection (h)]: Sec. 2. (a) All articles that are products of Canada as defined by the Federal Register notice described in subsection (e) of this section (Federal Register notice), and except for those products...

Read More »New Tariffs Torpedo Global Markets

Investors woke up Monday morning to a sea of red. On Friday, after the markets had closed for the weekend, President Trump announced a new series of tariffs levied against Mexico, Canada, and China. Moreover, he threatened that those tariffs could increase and that new tariffs would be announced for the Euro-region. Cryptocurrencies, technology, and the currency markets took the brunt of the initial selling reaction. For our latest thoughts on the tariffs, please...

Read More »The Comprehensive Approach to Crafting a Future Financial Plan

Securing your financial future begins with a comprehensive plan. This guide explores the fundamentals of financial planning, building a holistic strategy, and effective retirement techniques. Readers will learn how to navigate financial statements, manage tax planning, and engage with a financial advisor for wealth planning. Whether dealing with a single audit or seeking to enhance your financial strategy, RIA Advisors offers the insights needed to address these...

Read More »Can Musk Be The Bond Whisperer

The media holds bond vigilantes out as do-gooders looking to force the government to be fiscally responsible. In reality, these vigilantes are traders who are short bonds, and use the fear of deficits and inflation to drive yields higher. While the term has been around for 25+ years, their recent success is unlike any past. As we wrote in Why Are Bond Yields Rising?, and show below, the term premium, or additional yield on Treasury bonds, is the highest since at...

Read More »More Revisions Coming To Employment Data

In August, the BLS revised 2024 employment growth lower by 818k jobs in its preliminary revision of its Current Employment Statistics (CES). Despite the substantial revision, more reductions to the official employment data are likely to come next month. In January, the BLS will release its final benchmark revision. The preliminary and final revisions to BLS data are done annually. The revisions bridge the gap between the monthly BLS survey data used to report the...

Read More »Global Conditions Portend A Catch-Down In America

For $20,000, you can buy a global airline pass to see the world. Or, for the low price of free, you can take a quick trip with us worldwide. Unfortunately, our global trip is not as exciting as an around-the-world pass. Still, it may enlighten you about some economic struggles abroad. Moreover, why, in time, they may be problematic for the US. China, Britain, Europe, and other countries and regions are experiencing sluggish economic growth and, in some cases,...

Read More »The Dollar And Domestic – International Relative Stock Returns

The U.S. dollar index is up over 6% this year, almost all attributable to a post-election surge. As many developed nations show stagnant economic growth or even contraction, the U.S. economy continues to hum. Further bolstering the dollar is the likelihood that the Fed will slow rate cuts or stop them after this Wednesday's FOMC meeting. Consequently, the Fed is considered more hawkish than other large central banks. Wall Street thinks the dollar will peak and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org