Managing risk is one of the most critical aspects of successful investing. While all investments carry some degree of risk, effective investment portfolio risk management can help you preserve wealth, achieve financial goals, and weather market fluctuations. Understanding and employing strategies such as diversification, asset allocation, and hedging can significantly reduce your exposure to potential losses. This guide explores the concept of risk management,...

Read More »Truflation Data Points To A Coming Decline In CPI

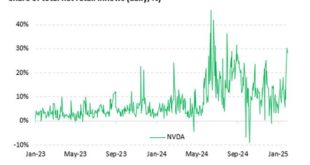

The graphs below, courtesy of Truflation, are very telling. The Truflation US Inflation Index uses over 30 million data points to assess price changes and, as a result, provide a robust forecast for the BLS CPI number. Moreover, their data have proven to be an incredibly accurate forecasting tool. As we share in the graph on the left, courtesy of Truflation, their index tends to lead CPI by 45 days. Their comparative analysis shown below stops at the end of 2024....

Read More »Growth And Value Are Not Mutually Exclusive

Might Nvidia and Tesla, with price-to-earnings ratios (P/E) nearly double and quadruple that of the S&P 500, respectively, be value stocks? Conversely, is it possible that Ford is not a value stock despite a P/E of 10, a price-to-sales ratio (P/S) of .20, and a 7.5% dividend yield? Based solely on that information, answering the question is impossible. Regardless, we bet most investors classify Nvidia and Tesla as growth stocks and Ford as a value stock. This...

Read More »Ethereum Falters Due To Massive Short Positions

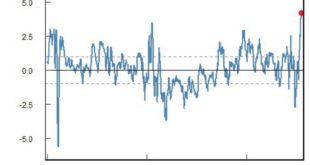

If one weren't paying attention to the cryptocurrency market, one would think that all cryptocurrencies were doing well. For instance, meme coins are all the rage, and Bitcoin has been up about 50% since the election. Donald Trump and his pro-crypto rhetoric help explain the rally. Moreover, Trump has nominated pro-crypto people to serve important financial roles within his administration. However, while most cryptocurrencies do very well, Ethereum is struggling....

Read More »Bull Bear Report – Technical Update

I could not produce our weekly Bull Bear Report this past weekend as I presented at Michael Campbell's Moneytalks Conference in Vancouver. However, I wanted to use today's technical update to review some of the statistical analysis we produce each week in that commentary. Such is mainly the case given last Monday's "tariff" shock and Friday's employment report. (Subscribe for free to the weekly Bull Bear Report.) It was a second volatile week of trading, which was...

Read More »The Benefits of Working with a Financial Advisor for Retirement Planning

Planning for retirement is one of the most important financial goals in life, yet it’s also one of the most complex. While creating a retirement plan on your own may seem feasible, the expertise of a financial advisor can make a significant difference. Financial advisors offer personalized strategies, help navigate complex financial decisions, and provide ongoing support to ensure your plan adapts as life circumstances change. Here’s an in-depth look at the...

Read More »Bessent Follows Yellens Strategy

Bond vigilantes had been questioning Janet Yellen's debt management tactics in her role as Treasury Secretary. Specifically, they accused her of shifting debt issuance away from longer-term maturities and toward shorter ones. We think her strategy made sense. Yellen was issuing more debt where demand was the greatest and trying to limit the amount of debt where demand was weaker. Secondly, she was making a bet on lower interest rates. She issued more shorter-term...

Read More »Small Cap Stocks Are Offering Outsized Returns

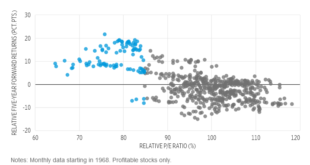

The Wall Street Journal published an interesting article For Small Cap Stocks, Look Past The Trump Trade. It is worth sharing the article's premise and the potential pitfalls in the analysis as quite a few articles seem to be popping up recently touting small-cap stocks. Let's start with the scatter plot below, courtesy of Fuery Research Partners and the Wall Street Journal. Data from 1968 shows that the lower the ratio of the P/E of small-cap stocks versus the P/E...

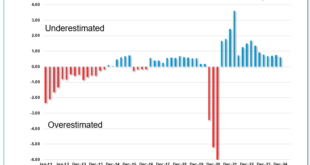

Read More »Forecasting Error Puts Fed On Wrong Side Again

The Federal Reserve's record of forecasting has frequently led it to respond too late to changes in economic and financial conditions. In the most recent FOMC meeting, the Federal Reserve changed its statement to support a pause in the current interest rate-cutting cycle. As noted by Forbes: "The policy-setting Federal Open Market Committee agreed unanimously to hold the target federal funds rate at 4.25% to 4.5%, the U.S. central bank announced Wednesday...

Read More »The Role of Annuities in a Retirement Income Plan

Planning for retirement involves building a diverse and stable income strategy that ensures financial security throughout your golden years. Among the tools available, annuities in retirement planning offer a unique advantage: the ability to create a reliable, guaranteed income stream. However, understanding their types, benefits, and potential drawbacks is essential to determining whether they fit into your retirement plan. What Are Annuities? Annuities are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org