Collectivism Across Party Lines “There is nobody in this country who got rich on his own — nobody.” – Elizabeth Warren, campaign speech 2011 “If you’ve got a business – you didn’t build that. Somebody else made that happen.” – Barack Obama, campaign speech 2012 Barack Obama - Click to enlarge If you acquire any possessions by economic means, this is to say by your own efforts, serving consumers in voluntary...

Read More »When It Comes To Household Income, Sweden & Germany Rank With Kentucky

Submitted by Ryan McMaken via The Mises Institute, Annual Median Equivalized Disposable Household Income in USD Last year, I posted an article titled “If Sweden and Germany Became US States, They Would be Among the Poorest States” which, produced a sizable and heated debate, including that found in the comments below this article at The Washington Post. The reason for the controversy, of course, is that it has nearly...

Read More »Und nun kommt der Nobelpreisträger daher und will uns weismachen, wir müssten den Mindestkurs wieder einführen

„Es kostet fast nichts, Franken im richtigen Umfang zu drucken.“ Das sagte der Wirtschaftsnobelpreisträger Joseph Stiglitz am World Economic Forum (WEF) in Davos anlässlich eines Interviews mit dem Tages-Anzeiger. Damit behauptet der Laureate, dass es für die Schweizerische Nationalbank fast nichts kostet, den Mindestkurs durchzusetzen. Er erwartet, dass die Schweiz zum Schluss kommen wird, dass die Nationalbank den...

Read More »FX Daily, October 31: Respite for Market Nerves Lifts Peso, Rand, and US Dollar

Comment on Swiss Franc by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Swiss Franc EUR/CHF - Euro Swiss Franc (see more posts on EUR/CHF, ). - Click to enlarge FX Rates The latest US political news before roiled thin pre-weekend markets, but cooler heads and more of them are prevailing today. Trump’s fortune in the polls...

Read More »Emerging Market: Week Ahead Preview

Stock Markets EM ended the week on a soft note, as markets were taken off guard by news that the FBI was reopening its investigation of Hillary Clinton’s emails. Risk off trading hit MXN particularly hard. FOMC meeting this week should be a non-event, but markets are likely to remain volatile ahead of the November 8 elections in the US. Individual country risk remains important. Brazil budget data is likely to provide...

Read More »Risk Happens Fast

By Chris at www.CapitalistExploits.at As a teenager brimming with testosterone my reptilian brain loved action movies. Top of my list were Steven Seagal movies. Clearly it wasn’t for his acting skills, which are only marginally better than Barney the dinosaur. What I loved about Seagal was that he was both deadly and terribly fast. His opponents had mere seconds before their arms, legs, or other bones were snapped like...

Read More »Are Foreign Investors Done Selling Japanese Equities?

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Foreign investors have sold more than JPY8 trillion of Japanese equities through September. Nikkei technicals have improved and the yen has softened. Foreign investors have been net buyers for the past four weeks. Foreign investors were significant...

Read More »FX Weekly Preview: Six Thumbnail Sketches of This Week’s Dollar Drivers

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Four central banks meet, but expectations for fresh action are low. The US latest election news does not appear to be altering the projected electoral college outcome. UK press are speculating about Carney possibly resigning. We are skeptical. The...

Read More »FX Weekly Preview: Six Thumbnail Sketches of This Week’s Dollar Drivers

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Four central banks meet, but expectations for fresh action are low. The US latest election news does not appear to be altering the projected electoral college outcome. UK press are speculating about Carney possibly resigning. We are skeptical. The...

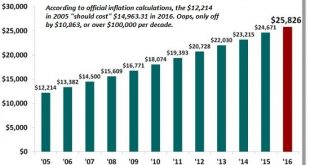

Read More »The Bankrupt U.S. Healthcare System

The good news is there is a way to avoid failure and stagnation: avoid the mainstream like the plague. The mainstream became mainstream because it worked: the mainstream advice to “go to college and you’ll get a good job” worked, the mainstream financial plan of buying a house to build equity to pass on to your children worked, the mainstream of government regulation worked to the public’s advantage at modest cost to...

Read More » SNB & CHF

SNB & CHF