Dark Social Mood Tsunami Washes Ashore Early this morning one might have been forgiven for thinking that Japan had probably just been hit by another tsunami. The Nikkei was down 1,300 points, the yen briefly soared above par. Gold had intermittently gained 100 smackers – if memory serves, the biggest nominal intra-day gain ever recorded (with the possible exception of one or two days in early 1980). Here is a picture of Haruhiko Kuroda in front of his Bloomberg monitor this morning: The War Street Journal immediately exhorted the poor man to “go big or go home” – in an article brimming with the usual Keynesian central planning clap-trap (we need more inflation, a strong currency is “bad”, rev up the printing presses, yada-yada…): Touching less than 99 yen to the dollar, this brings Japan’s currency back to where it started just as Abenomics was ramping up in 2013. With interest rates already negative, a weak currency is one of the few tools Japan has at its disposal. A strong currency will be devastating for efforts to engineer inflation. Japan will need to prepare a response. […] Bank of Japan Gov. Haruhiko Kuroda will be under pressure to go deeper on negative rates, even though doing so in the first place, in January, has seen the yen strengthen, not weaken. [ed.

Topics:

Pater Tenebrarum considers the following as important: Breaking News, British Pound, Debt and the Fallacies of Paper Money, Featured, Haruhiko Kuroda, Jim Walker, newsletter, On Economy, On Politics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Dark Social Mood Tsunami Washes AshoreEarly this morning one might have been forgiven for thinking that Japan had probably just been hit by another tsunami. The Nikkei was down 1,300 points, the yen briefly soared above par. Gold had intermittently gained 100 smackers – if memory serves, the biggest nominal intra-day gain ever recorded (with the possible exception of one or two days in early 1980). Here is a picture of Haruhiko Kuroda in front of his Bloomberg monitor this morning: The War Street Journal immediately exhorted the poor man to “go big or go home” – in an article brimming with the usual Keynesian central planning clap-trap (we need more inflation, a strong currency is “bad”, rev up the printing presses, yada-yada…):

|

|

| (emphasis and ed notes added)

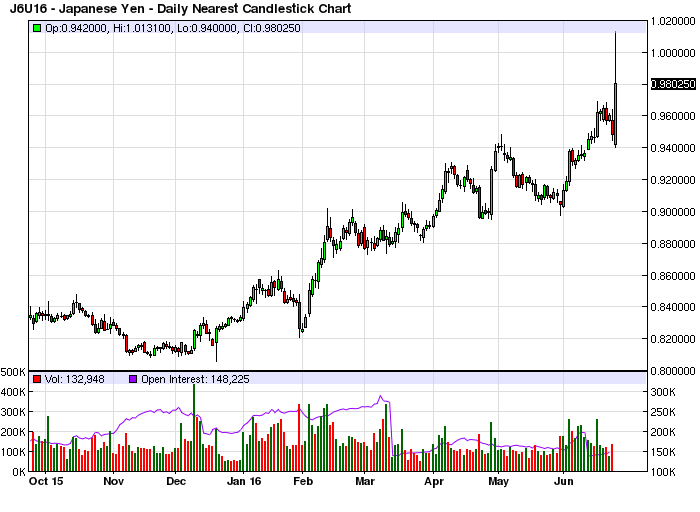

Yes, helicopter money is going to do the trick! We are mainly bringing this up to remind readers of the one certainty after the “Leave” campaign has surprised complacent markets around the world by winning: Our vaunted central planners are now going to flood the world with even more “liquidity”, i.e., money from thin air, deepening the enormous economic damage they have already done. As we always stress: better hang on to your gold, and preferably keep at least some of it within grabbing distance. Japanese YenThe yen at the time of writing – there will be a lot of volatility today, so by the time you are reading this, this chart will probably be obsolete. Nevertheless, it illustrates nicely how big a surprise the outcome of the UK’s EU referendum apparently was. |

|

Taking a Big ScalpLate last year we pointed out that the social mood was darkening globally – illustrated by the fact that nearly every incumbent politician lost in elections last year – all over the world (see: Incumbents Swept from Office Around the World for the details). Thereafter, several more incumbents got kicked out, even the seemingly eternal Ms. Kirchner! Now what does it mean when the “social mood” is deteriorating? Historically it has meant that “togetherness” and harmony will give way to isolation and a splintering of society into smaller groups. Big projects like the EU are sitting ducks when this kid of backdrop prevails. The “Brexit” is merely the continuation of a trend that has accelerated all over the world in recent years. |

|

For investors it means that if there is a bull market in “risk” somewhere, the bulls probably have it wrong, because an avalanche of bad news lies dead ahead. If one looks at global stock markets, most of the big ones have been in a bear market for some time actually – only the US stock market has held up.

S&P 500Stock markets have been weak all over the world – only the US market has really held up. Emerging markets look kind of interesting, chart-wise , but obviously, the road is likely to be bumpier from here on out. As we have noted on previous occasions, 2016 was always likely to be a slightly more challenging year for the markets. With the outcome of the UK referendum on EU membership, the deteriorating social mood has taken its biggest scalp yet – but probably not the last. |

|

Repricing RiskOne of the effects of the Brexit vote will be a profound reassessment of the risk posed by European markets, including the common currency. Naturally, the world will keep turning, but markets will perceive a heightened probability that more countries might eventually break away from the EU and will have to price it in. This wouldn’t be a big problem, except for the fact that the entire ramshackle bail-out duct-tape construction that is currently holding the euro zone together is likely to come under scrutiny again. Readers may remember that European governments have off-book contingent liabilities for these bail-outs that would make a complete mockery of the “stability pact” were they to lose their adjective (i.e., “contingent”). So beyond the initial volatility in the wake of the Brexit vote, there will be a longer term effect on various assets, particularly in Europe. The pound has incidentally been hit rather forcefully, but as Dr. Jim Walker of Asianomics has pointed out to us, it was actually quite overvalued prior to the vote already (in his words: “the most overvalued currency in the world”). We think it may now be a short term trading buy though, in the wake of the recent walloping. In fact, a “buy the news” effect has already set in after the initial wave of panic selling: The British poundThe UK has a large current account deficit and has experienced blistering money supply growth since 2012. This is no surprise – when Mr. Carney is your central bank chief, blistering money supply growth and giant property bubbles are a certainty (for some color on this central planning “superstar” and as a bit of an antidote to the praises he receives in the mainstream press, see “Carney’s Legacy: Canada’s Credit and Housing Bubble”, “If There’s A Bubble, It’s Not Our Fault”, and “We Know Better Than The Market”). Anyway, it will take some time for the markets to sort out the significance of recent events – and to discount what is yet to come. |

|

Political DispensationsLastly, we personally always thought it would be best if the world consisted of a collection of territories the biggest of which was Switzerland. The Germany we like best politically is the one that consisted of more than 360 independent sovereign states, prior to 1794. Citizens could literally “vote with their feet” – and nothing is better to keep one’s rapacious and power-hungry rulers in check. However, we are not “isolationist” by any means – as our readers know, we fully support free markets, free trade, and free movement of people and capital. In fact, one can have all these things, even if there is no central political power imposing them (actually: especially when there is no such central power!). For instance, the 360 German states mentioned above all used the same money (the coins all had different pictures, but the mints had gotten together to standardize weights), and traded freely with each other. As to the free movement of people – no-one would even have thought to wonder about that point or would have considered “should people be free to go where they want” a legitimate question – passports didn’t even exist yet! Locking up people within the territory ruled over by a specific force monopolist and forcing them to carry papers and ask their bureaucratic overlords for permission to travel is an invention of the modern “free world”. |

|

| Due to scientific, technological and economic progress we are all trained to believe that whatever comes later must be better. But this just isn’t so (the science of economics is a pertinent example). We have gained many valuable things, even liberties, we didn’t have before – but we have also lost a great many things that would have been well worth preserving.

The Dark Ages weren’t as dark as most people assume, so to speak…in fact, the darkest of all ages was the 20th century, when governments murdered more people than in all of the rest of history combined – all for the “greater good”! As an aside to this, what ended the brief period of economic liberty that followed on the heels of the Western Roman Empire’s collapse? Charlemagne – the first medieval central planner, who at the synod of Aachen in AD 789 and at the Council of Nijmegen in AD 806 introduced a “usury ban”, price controls, and a “ban on speculation”. In short, as soon as a new central power arose in Europe, it was all over with leaving people alone to do their thing in peace. |

Medieval central planner Charlemagne. As soon as the first emperor after the fall of West Rome was firmly ensconced in power, he significantly curtailed the economic freedom people had enjoyed over the previous three centuries (erroneously dubbed the “Dark Ages”). A prime example for why big centralized states are really bad for the common man. |

| If Europeans want to have free trade, do they really need a bureaucratic Leviathan in Brussels regulating every nook and cranny of their lives? No. All they need is the back of a napkin, on which they could write: “Henceforth, there will be no more tariffs between us” – and then shake hands on it.

Alas, they probably won’t sleep as well anymore. Brussels has ensured that Europe’s citizens all sleep like babies: There are 109 EU regulations concerning pillows, 5 EU regulations concerning pillow cases, and 50 EU laws regulating duvets and sheets. Yo, Brits! You can get those beds of nails down from your attics now! No need to hide them away anymore! |

|

ConclusionWe will have more to say on the Brexit in coming days – for now, we just want to point out that the times have become a lot more “interesting”. As we have said previously, we believe shaking off the Brussels yoke will be quite positive for the UK – although it is by no means enough. The country’s own bureaucrats are no slouches either when it comes to regulating everything to death. Much will therefore depend on the choices that are made from here on out. It is a dark day for the citizens in the rest of the EU though, as they are losing the strongest supporter of subsidiarity and economic liberalism (relative to the rest, that is). The biggest danger is actually that with the UK gone, the political elites of continental Europe will try to accelerate the socialist super-state project in a kind of flight forward. However, it may well be too late for that. More on this to come – stay tuned. |

Charts by: BarChart, StockCharts