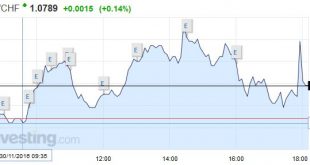

Swiss Franc EUR/CHF - Euro Swiss Franc, December 01(see more posts on EUR/CHF, ). - Click to enlarge Sterling has made steady gains against the CHF over the past month, in line with improvements made against other major currencies. The Pound has benefited from a strong run of economic data and more positive market sentiment. Whilst the UK economy remains fragile in the eyes of investors, there is no doubt...

Read More »Six Narratives on the Ascendancy of Trump

Perhaps the masses have (finally!) reached the point where the pain of maintaining the status quo now exceeds that of breaking it. A remarkably diverse array of “explanations” of Donald Trump’s presidential election victory have been aired, representing both the conventional political spectrum and well beyond. Let’s start with the conventional mainstream media “explanations”: #1: Trump was elected by intolerant...

Read More »Brexit Minister Sends Sterling Higher

Summary: UK could pay for single market access. UK’s position still seems fluid. The Supreme Court will hear the government’s appeal next week. Sterling has been lifted to its best since October 6 on the back of comments by UK’s Brexit Minister Davis. In answer to questions in Parliament, Davis acknowledged that access to the EU single market might be secured by the UK paying for it. He talked about making a...

Read More »New lease of life for historic radio transmitter

Many older Swiss still remember the Beromünster national transmitter from the golden days of radio. Those days are gone, but the iconic structure is experiencing a new lease of life. (SRF/swissinfo.ch) Of the two transmitters above Beromünster in canton Lucerne, only one remains today and is under cultural heritage protection. The 220 metre steel tower was built 80 years ago with a 60 kW AM transmitter, replacing local radio stations at Zurich, Basel and Bern. Radio signals stopped emitting...

Read More »The US military plane crash that led to better rescues

In November 1946 an American military airplane made an emergency landing on the Gauli glacier in the Bernese Alps. All 12 people on board were rescued in a spectacular mission that marked the birth of the Swiss air rescue service REGA. (SRF/swissinfo.ch) On its way from Munich to Marseille a Douglas DC-3 Dakota US military plane crash-landed on a glacier above Meiringen. The US military plane wasn’t allowed to enter neutral Swiss air space. This is why no one expected the Dakota to get...

Read More »Swiss Retail Sales -0.9% percent nominal (YoY) and 1.3 percent real (YoY)

The Used Goods Question Retail sales in several countries like Germany, Italy, Japan and Switzerland continue to fall. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so that used goods do not...

Read More »Austrian Presidential Election is Important even if Overshadowed by Italy’s Referendum

Summary: Italy’s referendum defeat is not simply a victory for populist-nationalist forces. Freedom Party victory in Austria is a victory for said forces. Even if Hofer wins, there are sufficient checks that make it difficult to hold EU or EMU referendum. The ADP private sector employment estimate will steal some thunder from the official estimate on Friday. Although the two times do not line up tightly in the...

Read More »Switzerland UBS Consumption Indicator: Retailers are hoping for good Christmas business

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. In October, the UBS consumption indicator rose from 1.47 to 1.49 points. Positive developments in the automobile market and robust domestic tourism continue to support private consumption. However, the slump...

Read More »FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Swiss Franc EUR/CHF - Euro Swiss Franc, November 30(see more posts on EUR/CHF, ). - Click to enlarge Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked...

Read More »FX Daily, November 30: Renewed OPEC Hopes and Month End Featured

Swiss Franc EUR/CHF - Euro Swiss Franc, November 30(see more posts on EUR/CHF, ). - Click to enlarge Rates for buying Swiss Francs dollars remain incredibly subdued post Brexit but there has been a general improvement over the last month. Rates for the moment appear to have found support over 1.24 for GBP CHF and this has largely come about following the Trump US presidential election victory. Despite a leaked...

Read More » SNB & CHF

SNB & CHF