“Some market and economic volatility can be expected as this process unfolds,” Carney said in a televised statement in London after the referendum result. His comments followed Prime Minister David Cameron’s announcement that he will step down this year, which will inject political uncertainty into an already volatile period. His full announcement is below and his statement can be found here: [embedded content] More from the central bank governor who is now scrambling to undo all the scaremongering he had unleashed to prevent precisely this outcome: But we are well prepared for this. The Treasury and the Bank of England have engaged in extensive contingency planning and the Chancellor and I have been in close contact, including through the night and this morning. The Bank will not hesitate to take additional measures as required as those markets adjust and the UK economy moves forward. These adjustments will be supported by a resilient UK financial system – one that the Bank of England has consistently strengthened over the last seven years. The capital requirements of our largest banks are now ten times higher than before the crisis. The Bank of England has stress tested them against scenarios more severe than the country currently faces.

Topics:

George Dorgan considers the following as important: Bank of England, Brexit, David Cameron, Featured, Kerplunk, Mark Carney, negative interest rates, negative rates, newsletter, Spot the Brexit

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

“Some market and economic volatility can be expected as this process unfolds,” Carney said in a televised statement in London after the referendum result. His comments followed Prime Minister David Cameron’s announcement that he will step down this year, which will inject political uncertainty into an already volatile period. His full announcement is below and his statement can be found here:

More from the central bank governor who is now scrambling to undo all the scaremongering he had unleashed to prevent precisely this outcome:But we are well prepared for this. The Treasury and the Bank of England have engaged in extensive contingency planning and the Chancellor and I have been in close contact, including through the night and this morning. The Bank will not hesitate to take additional measures as required as those markets adjust and the UK economy moves forward.These adjustments will be supported by a resilient UK financial system – one that the Bank of England has consistently strengthened over the last seven years. The capital requirements of our largest banks are now ten times higher than before the crisis.

The Bank of England has stress tested them against scenarios more severe than the country currently faces. As a result of these actions, UK banks have raised over £130bn of capital, and now have more than £600bn of high quality liquid assets.

If you’d asked any observer four or five years ago which country would be the first to leave the European Union, few would have guessed it would be the UK. Of all the countries in the EU, the UK is probably the one with the least to gain from meaningful changes in its economic relationships with its neighbours. Yet here we are.

London’s stock markets, priced in sterling, probably understate the expected impact on the UK economy given the sectoral and geographic earnings mix of the listed companies. So we looked at the short-term interest rate markets to get a sense of how traders think the Bank of England will react to the vote.

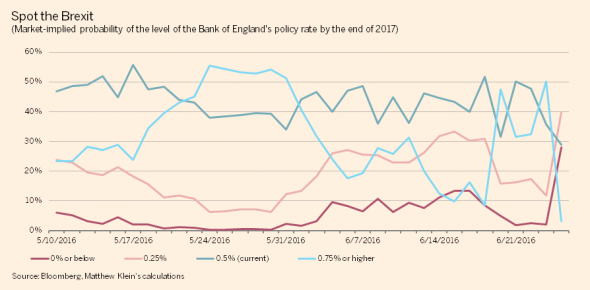

First, the implied probability of the level of the Bank of England’s policy rate at the end of next year, based on the relative prices of overnight indexed swaps:

Spot the BrexitThe current level of Bank Rate is 0.5 per cent, the same level it’s been since March, 2009. As recently as one month ago, traders priced in a greater than 50 per cent chance the BoE would have raised its policy rate by at least a quarter of a percentage point by the end of 2017. As the polls tightened, this implied probability fell. In the final week, when polling seemed to indicate Remain would squeak by with a win, the probability rose again, peaking at just over 50 per cent on the day of the referendum. |

|

| As of pixel time on the day after, the odds of at least one rate hike have dropped to just 3 per cent. Meanwhile, the odds of at least one rate cut have soared from 14 per cent on the day of the referendum to 68 per cent today.

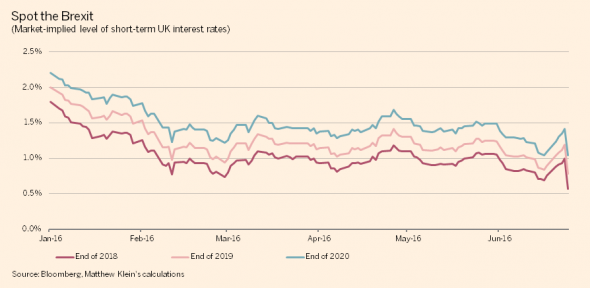

Short sterling futures (the confusing name for the British equivalent of eurodollar futures) implied significant changes in the longer-term outlook. The implied level of Bank Rate dropped about 0.4 percentage points as far forward as the end of 2020: |

|

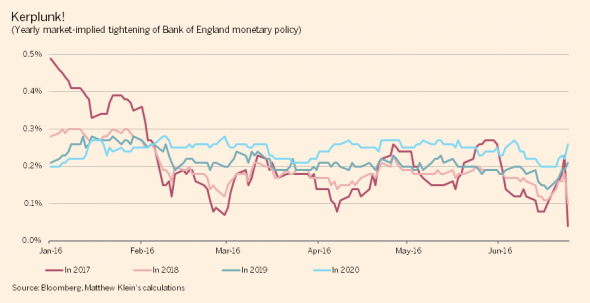

Kerplunk!This isn’t just a one-off postponement to an eventual tightening but part of a sustained expectation of fewer rate hikes years into the future. The implied amount of tightening in 2017 fell to essentially zero, which fits with what we saw above from OIS prices. But the implied amount of tightening in 2018 also plunged, while no additional tightening has been priced in further into the future: |