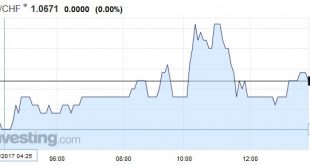

Swiss Franc EUR/CHF - Euro Swiss Franc, April 17(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Financial centers in Europe are closed for the extended Easter holiday. Australian and New Zealand markets were also closed. The drop in US 10-year Treasury yields in early Asia, with a brief push below 2.20%, appears to have kept the dollar under pressure. As the North American market prepares to...

Read More »Death Spiral for the LBMA Gold and Silver auctions?

In a bizarre series of events that have had limited coverage but which are sure to have far-reaching consequences for benchmark pricing in the precious metals markets, the LBMA Gold Price and LBMA Silver Price auctions both experienced embarrassing trading glitches over consecutive trading days on Monday 10 April and Tuesday 11 April. At the outset, its worth remembering that both of these London-based benchmarks are...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX was mostly firmer last week, helped by Trump comments and softer US data. Whilst this seems positive for EM, the global backdrop remains uncertain. Some in EM (Russia, Turkey, and Korea) remain vulnerable to geopolitical concerns. In addition, idiosyncratic domestic political risks remain in play for other EM countries, such as Brazil, South Africa, and Turkey. We expect the investment climate...

Read More »Monetary Policy is Important, but US Fiscal Stance Moving Center Stage

Summary: Monetary policy is off the table for at least the next two months. Several fiscal issues are coming to a head. Despite the GOP majority in Congress and White House, brinkmanship cannot be ruled out. The Federal Reserve hiked rates in March. Whatever gradual hikes mean, it seems to preclude moves in back-to-back meetings. There are two chances of a May hike: Slim and none and Slim left town. June...

Read More »What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency. There are, of course, various economic areas where estimates are going to...

Read More »Emerging Markets: What has Changed

Summary Malaysia’s central bank said it will allow investors to fully hedge their currency exposure. Egypt declared a 3-month state of emergency after two deadly church attacks. South Africa’s parliamentary no confidence vote has been delayed Argentina central bank surprised markets with a 150 bp hike to 26.25%. Brazil central bank accelerated the easing cycle with a 100 bp cut in the Selic rate. Stock Markets In the...

Read More »FX Weekly Preview: What to Watch in the Week Ahead

Many observers misunderstood US President Trump’s “American First” rhetoric. Trump’s earlier writings show that this is not a reference to the 1940s effort to keep the US out of WWII, with its isolationist tint. Rather, Trump’s use goes back to the original use by President Harding in the 1920s. It was a rejection of the Wilsonian multilateralism (e.g. League of Nations) and a robust defense of unilateralism. That...

Read More »Charles Hugh Smith On The Commercial Real Estate Bubble Caused By Financial Repression

Click here for the full transcript with slides: http://financialrepressionauthority.com/2017/04/16/the-roundtable-insight-charles-hugh-smith-on-the-commercial-real-estate-bubble-caused-by-financial-repression/

Read More »FX Weekly Review, April 10-14: Swiss Franc loses against the Yen, but wins against Dollar

Swiss Franc Currency Index Last week the Swiss Franc improved against both euro and dollar, but – compared to its safe-haven counterpart Japanese Yen – it had a bad performance. We expect strong SNB interventions, that reflect the demand for CHF safe-haven. Trade-weighted index Swiss Franc, April 14(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3...

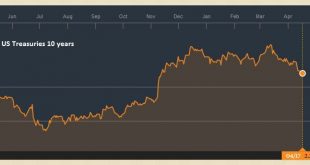

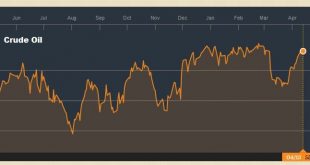

Read More »Decoupling of Oil and US Interest Rates

Summary: US yields have trended lower as oil prices have trended higher. The correlation between the 10-year breakeven and oil has also weakened considerably. Technicals readings are getting stretched, but no compelling sign of a top. Rising oil prices traditionally boost inflation expectations and US interest rates. The May futures contract for light sweet crude oil is up today for the sixth consecutive...

Read More » SNB & CHF

SNB & CHF