Rising bank credit flows confirm that domestic fundamentals remain solid across most of the euro area.The ECB’s M3 and credit report for June just published confirms that lending dynamics continue to be in a good shape in the euro area, boding well for private investment. Bank credit flows to non-financial corporations (adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in May. Corporate-sector lending increased 4.1% year-over-year in June, its...

Read More »In midst of trade frictions, China imports more US oil than ever

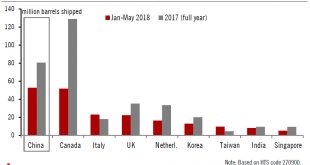

While US trade deficit with China has reached a record high, so have US exports of crude oil to the Middle Kingdom.China has overtaken Canada as the dominant destination for US crude oil this year, potentially becoming an important bargaining chip in the trade dispute between the two countries.Exports of crude oil to China rose from 0 in 2015 (when such exports were still banned) to 80.7 million barrels in 2017. In the first five months of 2018, oil exports to China rose 85% to 52.8 million...

Read More »Another hot summer for the renminbi

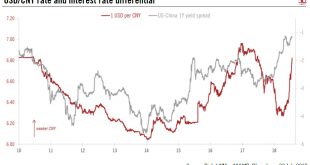

China’s policy stimulus could continue to weigh on the renminbi in the near term, but fading support for the dollar and PBoC may limit downside risks for the Chinese currency.Since mid-June, the renminbi has come under severe downward pressure. The China Foreign Exchange Trade System (CFETS) renminbi index has lost roughly 4.7%, while the renminbi has dropped roughly 5.8% against the US dollar. As we are moving nearer to the psychological threshold of CNY7.00 per USD, concerns that the...

Read More »Euro area PMIs on the soft side

Fundamentals remain solid but the decline in some forward-looking indicators in July signal downside risk in the coming months.Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline.The services PMI declined to 54.4, but this followed a 1.4 points jump...

Read More »Weekly View – why isn’t Trump happy?

The CIO office’s view of the week ahead.After recent criticism of the Fed from Donald Trump’s top economic advisor, Larry Kudlow, last week the US president himself said that he was “not happy” about the Fed’s rate-hiking campaign. Traditionally, US presidents have refrained from commenting on Fed decisions as a way of affirming the central bank’s independence, but these apparently casual remarks increase the suspicion that the political heat on the US central bank is being cranked up.And...

Read More »Services dent euro area core inflation in June, but no reason to panic

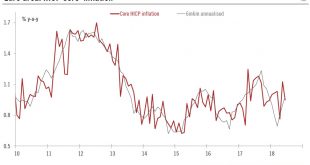

We expect core inflation to rise gradually later this year.The final reading for headline inflation in the euro area (HICP) was confirmed at 2.0% y-o-y in June (up from 1.9% in May), reflecting higher energy price inflation. This is the highest rate of inflation since February 2017.However, core inflation (HICP ex-energy, food, alcohol and tobacco) was revised down to 0.95% y-o-y, (rounded down to 0.9%) from a flash estimate of 0.97%. By comparison, core inflation in May was 1.13% y-o-y. The...

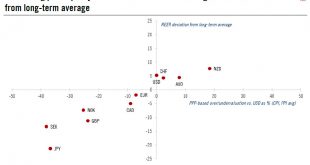

Read More »Swiss franc’s defensive features likely to come back into fashion

Trade tensions and heavy short positioning should pave the way for appreciation against the US dollar.The Swiss franc has been relatively weak since the end of June (depreciating 1.3% vs USD) despite increasing trade tensions. Yet the defensive feature of the Swiss currency, stemming from a structurally large current account surplus and elevated stock of foreign assets (i.e. its net international investment position), favour some appreciation of the franc.For the moment, as highlighted by...

Read More »China dominates many US supply chains

The US consumer may end up being subject to a de facto ‘tax’ as the scope for finding alternative suppliers is limited.Last week, the Trump administration said it would add USD200 billion of Chinese imports to its tariff net, possibly taking effect as soon as September. These tariffs come on top of the tariffs on USD50 billion of Chinese goods already announced (of which USD34 billion already kicked in early July). By way of comparison, the US imported USD506 billion worth of merchandise...

Read More »Chinese growth moderates as expected

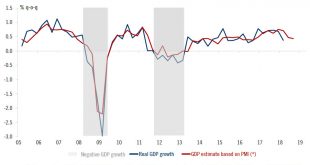

We expect the authorities to adapt fiscal and monetary policies to deal with downward risks to growth prospects.Chinese GDP for Q2 came in at Rmb22.0 trillion (about USD3.4 trillion), rising 6.7% year-over-year (y-o-y) in real terms. This represents a moderate deceleration from Q1 (6.8% y-o-y), largely in line with our expectations (see chart). For the first two quarters of the year as a whole, the economy expanded by 6.8% compared to the same period last year.The data show that China’s...

Read More »Powell provides some clues to Fed thinking

Alongside clear signals that policy rates will continue to rise in the near term were some dovish hints about policy further down the road.Chairman Jerome Powell’s congressional testimony on 17 July contained limited new information about the Federal Reserve’s monetary policy intentions. Conveying the impression that he maintained a steady hand on the tiller, Powell seemed unfazed by the recent escalation in trade. Instead, Powell remained positive about the global economy. He also...

Read More » Perspectives Pictet

Perspectives Pictet