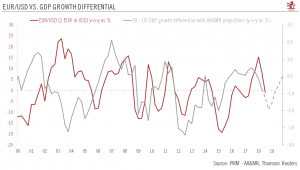

Competing forces mean the two currencies could remain in a holding pattern for a while.

The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way.

The growth differential (based on leading indicators) has barely budged since March after a sharp decline that began in late 2017. Although we still forecast a narrowing of the gap between the US and the euro area going forward, growth should remain slightly supportive of the greenback, unlike interest rate differentials. Should global growth continue to be sluggish, we believe there is more scope

Articles by Luc Luyet

Euro/USD: things look pretty stable

September 20, 2019Competing forces mean the two currencies could remain in a holding pattern for a while.The euro has remained relatively stable relative to the US dollar in the wake of the European Central Bank (ECB) and US Federal Reserve (Fed) September policy meetings. Growth and interest rate differentials, two key drivers for the EUR/USD rate, suggest things could stay this way.The growth differential (based on leading indicators) has barely budged since March after a sharp decline that began in late 2017. Although we still forecast a narrowing of the gap between the US and the euro area going forward, growth should remain slightly supportive of the greenback, unlike interest rate differentials. Should global growth continue to be sluggish, we believe there is more scope for a decline in yields in

Read More »Scandi currencies hurt by moderating global growth

August 27, 2019Loss of global economic momentum and elevated global uncertainties cast a shadow over Scandinavian currencies.The ongoing moderation in global growth continues to weigh on Scandinavian currencies despite their undervaluation. In particular, the weak Q2 GDP figure for Sweden is a reminder that weak economic activity in Germany and the UK (two key trading partners) is spreading to other countries. Furthermore, despite Sweden’s and Norway’s defensive features, such as a structural current account surplus and a positive net international investment portfolio (NIIP), their currencies remain cyclical. Low market liquidity makes Scandinavian currencies unsuitable as safe havens.The Norges Bank has already toned down its previous hawkishness because of increasing uncertainty. Furthermore, the oil

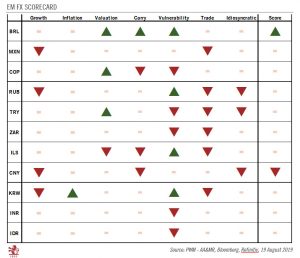

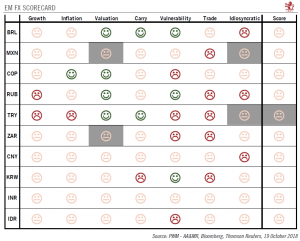

Read More »Brazilian real stands out in EM currency scorecard

August 21, 2019Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others.

In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More hopefully, the global decline in yields could be supportive of EM currencies by providing more space for EM central banks to cut rates at a time of low domestic inflationary pressure. Furthermore, a dovish Fed should eventually weigh on the US dollar through a less supportive interest rate

Brazilian real stands out in EM currency scorecard

August 20, 2019Prospects for emerging-market currencies look cloudy. The currencies of countries with sound external buffers and limited exposure to global trade should fare relatively better than others.In recent months, the global environment has become more challenging for EM currencies. Trade tensions have increased and are weighing on economic activity. Commodity prices have also fallen. Such developments tend to weigh on global appetite for relatively risky EM assets. More hopefully, the global decline in yields could be supportive of EM currencies by providing more space for EM central banks to cut rates at a time of low domestic inflationary pressure. Furthermore, a dovish Fed should eventually weigh on the US dollar through a less supportive interest rate differential.Overall, however, barring

Read More »Update on gold – bad news is good news

August 12, 2019Increased trade tensions have boosted the gold price to above USD 1,500.

The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce.

The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled with strong demand from central banks, the medium-term outlook of the yellow metal has improved.

However, in the short term, we see a high probability of a mild correction because the recent sharp rise in gold may suffer from less supportive news flows than of recent days.

In the medium term, rising

Update on gold – bad news is good news

August 12, 2019Increased trade tensions have boosted the gold price to above USD 1,500.The increased trade tensions following Trump’s 1 August tweet threatening additional tariffs on Chinese goods has boosted the gold price above USD 1,500 per troy ounce.The recent developments are supportive of gold investment demand because of a lower opportunity cost associated with holding gold and greater demand for safe haven assets. Coupled with strong demand from central banks, the medium-term outlook of the yellow metal has improved.However, in the short term, we see a high probability of a mild correction because the recent sharp rise in gold may suffer from less supportive news flows than of recent days.In the medium term, rising trade tensions are likely to weigh further on global growth and elicit more

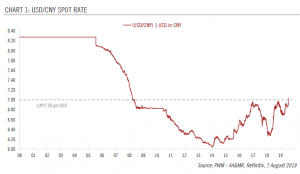

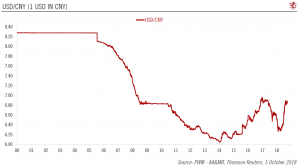

Read More »The US labels China a currency manipulator

August 10, 2019The near-term impact will likely be limited but this is a clear negative for trade negotiations.

Shortly after the renminbi’s sharp depreciation on Monday, the US Treasury Department labelled China a currency manipulator. This is the first time in 25 years that the US government has designated a country as a currency manipulator.

According to the US Treasury Department, the decision was triggered by the perceived lack of action by the PBoC to resist the renminbi depreciation. Given that the US government has already imposed (or promised to impose) significant tariffs on virtually all Chinese imports while sanctions on some Chinese technology companies are also already in place, the likelihood of

Currency update – the Chinese renminbi

August 9, 2019Despite the CNY’s recent fall, we believe the People’s Bank of China will refrain from competitive devaluation

Following US President Donald Trump’s announcement of a new 10% tariff on USD300 billion of Chinese goods, the Chinese renminbi (rmb) weakened sharply and breached CNY7.00 per USD.

The recent rmb move, in our view, represents a major shift in the People’s Bank of China’s (PBoC) currency policy, reflecting the deteriorating outlook for trade negotiations with the US and the resulting additional downward pressure on the Chinese economy.

Consequently, we have decided to change our forecasts for the rmb against the US dollar to CNY7.10 per USD for the entire time horizon (three, six and twelve months) from

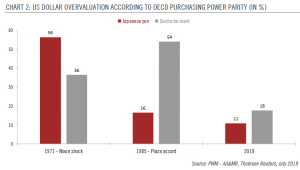

US FX intervention still someway off

July 19, 2019The likelihood of active FX intervention by the US authorities remains low but is increasing and the Trump administration can be expected to continue to pressure the Fed to cut rates.

The Trump administration has been focusing on the US’s trade deficit with some of its main trading partners such as China and Germany. A strong dollar is exacerbating this deficit and has visibly exasperated President Trump. Indeed, the Fed’s broad dollar index was recently back close to its December 2016 high. In response, and in a break with his predecessors, Trump has adopted an avowedly mercantilist approach to improving the trade balance.

In the near term, the Trump administration is likely to put further pressure on the Fed to

US FX intervention still someway off

July 18, 2019The likelihood of active FX intervention by the US authorities remains low but is increasing and the Trump administration can be expected to continue to pressure the Fed to cut rates.The Trump administration has been focusing on the US’s trade deficit with some of its main trading partners such as China and Germany. A strong dollar is exacerbating this deficit and has visibly exasperated President Donald Trump. Indeed, the Fed’s broad dollar index was recently back close to its December 2016 high. In response, and in a break with his predecessors, Trump has adopted an avowedly mercantilist approach to improving the trade balance.In the near term, the Trump administration is likely to put further pressure on the Fed to cut rates in a bid to weigh on the value of the US dollar. Trump could

Read More »Gold boosted by dovish central banks

June 26, 2019Bar a further major escalation in trade tensions, it is hard to see much more upside for gold in the short term. We remain more upbeat over the medium term.

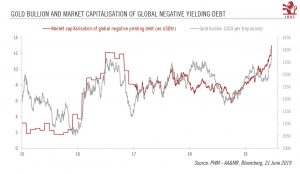

The gold price soared to a fresh five-year high on 20 June following a dovish Fed monetary policy meeting. Indeed, the dovish shift among major central banks (with the sole exception of the Norges Bank) and high global uncertainty have pushed global yields lower recently, reducing the opportunity cost of holding gold. Indeed, since late-2018, a correlation can be seen between the price of gold (which offers no yield) and the volume of negative-yielding bonds outstanding.

Given relatively resilient global risk appetite (at least when looking at implied volatility

Gold boosted by dovish central banks

June 21, 2019Bar a further major escalation in trade tensions, it is hard to see much more upside for gold in the short term. We remain more upbeat over the medium term.The gold price soared to a fresh five-year high on 20 June following a dovish Fed monetary policy meeting. Indeed, the dovish shift among major central banks (with the sole exception of the Norges Bank) and high global uncertainty have pushed global yields lower recently, reducing the opportunity cost of holding gold. Indeed, since late-2018, a correlation can be seen between the price of gold (which offers no yield) and the volume of negative-yielding bonds outstanding.Given relatively resilient global risk appetite (at least when looking at implied volatility in the US stock market), the reason for the recent upward pressure on gold

Read More »US dollar update – path of least resistance remains to the downside

May 31, 2019Given a deteriorating global growth outlook and higher trade tensions, we are reducing our bearish stance on the US dollar. However, we believe that most factors suggest the US dollar continues to face downside risks.Despite a more dovish Fed, the US dollar has remained strong since the start of the year (as of 28 May, only the Canadian dollar and the Japanese yen had fared better). Weak global economic growth, notably as a result of trade tensions, has favoured the US dollar given its safe-haven status and high carry.Taking stock of the deterioration in the global growth outlook and higher trade tensions, we are reducing our bearish stance on the US dollar. However, we are of the view that most factors (e.g. growth and interest rate differentials, capital flows, fiscal health and

Read More »Limited room for Swiss franc depreciation

April 12, 2019Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings.

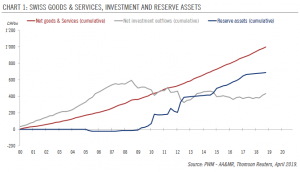

The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest rate differentials less unfavourable to the franc.

The upward pressure on the franc has forced the SNB to intervene repeatedly in the FX market to rein in franc strength in recent years. While, in theory, there is no limit to the scope of these interventions, an increase in investment flows out of

Limited room for Swiss franc depreciation

April 11, 2019Even should global economic momentum stabilise in the coming months and political risks abate, the franc still has important structural underpinnings.The Swiss franc has been supported by a structural current account surplus and by reduced investment flows out of Switzerland since the 2008 financial crisis. In addition, the decline in global yields since the Fed’s dovish shift early this year has rendered interest rate differentials less unfavourable to the franc.The upward pressure on the franc has forced the SNB to intervene repeatedly in the FX market to rein in franc strength in recent years. While, in theory, there is no limit to the scope of these interventions, an increase in investment flows out of Switzerland would definitively help reduce the upward pressure on the Swiss

Read More »Euro slides against the dollar on ECB dovishness

March 15, 2019The euro has declined further against the dollar but should strengthen over next 12 months

The euro fell to a 20-month low against the US dollar following the European Central Bank’s (ECB) March policy meeting, given the revised forward guidance that suggests that the interest rate differential is unlikely to provide much upside to the euro in the next few months.

That being said, recent euro area PMI surveys tend to favour a stabilisation of economic activity (after a relentless decline since December 2017), which supports our rather more constructive scenario on the euro area (GDP growth at 1.4% in 2019) based on resilient domestic demand and abating external threats (China, car tariffs and Brexit). This expected

Euro slides against the dollar on ECB dovishness

March 14, 2019The euro has declined further against the dollar but should strengthen over next 12 monthsThe euro fell to a 20-month low against the US dollar following the European Central Bank’s (ECB) March policy meeting, given the revised forward guidance that suggests that the interest rate differential is unlikely to provide much upside to the euro in the next few months.That being said, recent euro area PMI surveys tend to favour a stabilisation of economic activity (after a relentless decline since December 2017), which supports our rather more constructive scenario on the euro area (GDP growth at 1.4% in 2019) based on resilient domestic demand and abating external threats (China, car tariffs and Brexit). This expected improvement could also lead to a less dovish ECB later this year, reigniting

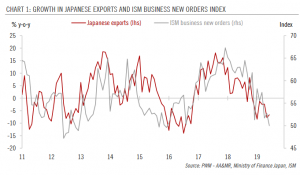

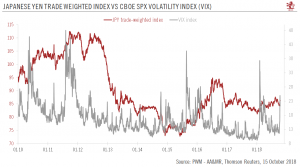

Read More »Limited upside for USD/JPY but significant downside

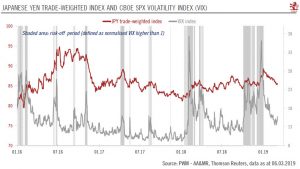

March 7, 2019Our baseline scenario suggests limited upside potential for the dollar against the yen, given the current low stock market volatility environment.The Japanese yen has been weak recently, as volatility in the US stock market has receded. Indeed, the sharp increase in US stock market volatility at the end of last year favoured the yen through short-covering and repatriation flows, whereas the subsequent rebound in global risk appetite has penalised the defensive yen (see chart).This recent depreciation of the Japanese currency relative to the greenback is unconfirmed by the interest rate differential in 2019, which is unlikely to be as supportive of the dollar relative to the yen as it was in 2018. We also see its recent divergence with the USD/JPY rate as temporary.Our scenario for 2019 on

Read More »Gold to consolidate before further leg up

February 20, 2019Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.

Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018, continuing a structural trend in place for the past decade.

It is worth stressing that US dollar movements were not an important factor in gold’s performance. Indeed, the US dollar index appreciated slightly in Q4 (by around 1%) and gold also performed very well in other currencies during the same period

Gold to consolidate before further leg up

February 19, 2019Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018, continuing a structural trend in place for the past decade.It is worth stressing that US dollar movements were not an important factor in gold’s performance. Indeed, the US dollar index appreciated slightly in Q4 (by around 1%) and gold also performed very well in other currencies during the same period (8.8% in euros and 7.7% in Swiss francs).Overall, while concerns about the

Read More »Reserve Bank of Australia’s upbeat stance turns upside down

February 13, 2019Dovish signals on monetary policy reduce upside for the Australian dollar.On 6 February, Philip Lowe, governor of the Reserve Bank of Australia (RBA), sent clear dovish signals, indicating that a rate cut was now as probable as a rate hike. This led to a significant decline in the Australian dollar. This change in the RBA’s stance highlights increasing concerns around the Australian economic outlook.This change in monetary stance mostly reflects increasing concerns over the accumulation of downside risks. On the external front, the slowdown in Chinese economic growth is the main worry, given the strong linkage through trades between the two countries (Australia’s exports to China amounted to roughly 35% of total exports in December 2018). On the domestic front, the outlook for consumption

Read More »Emerging market currencies: idiosyncratic risks strike back

December 15, 2018The environment will remain challenging for EM currencies next year.

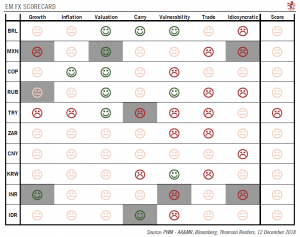

Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latest EM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single attractive EM currency among the 10 it monitors on a 12-month horizon.

Being undervalued and offering decent real rates, while offering strong external buffers and low idiosyncratic risks increases the attractiveness of an EM currency. The Brazilian real comes close, but we anticipate that Brazil’s

Emerging market currencies: idiosyncratic risks strike back

December 13, 2018The environment will remain challenging for EM currencies next year.Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latestEM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single attractive EM currency among the 10 it monitors on a 12-month horizon.Being undervalued and offering decent real rates, while offering strong external buffers and low idiosyncratic risks increases the attractiveness of an EM currency. The Brazilian real comes close, but we anticipate that Brazil’s incoming president, Jair Bolsonaro, will find it difficult to enact meaningful

Read More »Emerging market currencies show encouraging signs for investors

October 22, 2018Up to now, emerging market (EM) currencies have been resilient in the face of market turmoil.Our EM FX scorecard, which ranks 10 EM currencies according to key criteria (such as growth and vulnerability to external shocks) saw few changes over the past month. The Fed’s current hawkish attitude remains a headwind for EM currencies, at it increases funding costs. That being said, the weakest EM currencies have seen some stabilisation, particularly for the Turkish lira and the Argentinian peso. We also expect China to keep the USD/CNY rate stable, given political pressure and risk of increased capital outflows.We have upgraded the Mexican peso’s idiosyncratic factor from negative to neutral, as the new United-States-Mexico-Canada (USMCA) agreement relieves concerns about the country’s

Read More »USD/JPY: a difficult balance

October 17, 2018Limited upside for the dollar against the yen, but significant downside will take time.While widening interest rate differentials are supportive of the US dollar against the yen, if rates rise too far and too fast, they can help the yen against the dollar, as recent financial market volatility has shown. In October, the Japanese yen appreciated by 1.9% against the dollar and outperformed all other major currencies.Coupled with extreme fundamental yen undervaluation, the potential for the greenback to rise above JPY115 seems limited. Indeed, interest rate differentials and global risk appetite favour the yen versus the dollar, as a rapid leap in bond yields tends to lead to a pick-up in volatility. While widening USD/JPY interest rate differential acts as a tailwind for the dollar against

Read More »Renminbi nears a psychological threshold

October 8, 2018The People’s Bank of China is unlikely to welcome further currency weakness.Having dropped more than 5% year to date, our scenario of weaker growth in China in 2019 (we expect GDP growth to decline to 6.1% from 6.6% in 2018) is likely to further weigh on the renminbi through the interest rate differential. The Chinese current account is unlikely to provide much relief, as it has moved into deficit in 2018. However, given that the renminbi is around 10% off its recent peak, a further sharp depreciation remains unlikely in our view, especially as it would foster herd behaviour, instead of the healthy two-way movements sought by the People’s Bank of China (PBoC). The risk of capital outflows from China increases when the renminbi’s decline relative to the dollar is sustained. Given that

Read More »Further consolidation of EUR/USD rate likely

October 5, 2018Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafter

We have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term.

Indeed, economic growth in the US is likely to be strong thanks notably to an upswing in US capex but also because of a potential boost from consumption ahead of a rise in the tariff rate applied to Chinese goods at the start of 2019. Furthermore, the US Federal Reserve is subtly turning more hawkish, which has led us to change our baseline scenario on the number of

Further consolidation of EUR/USD rate likely

October 3, 2018Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafterWe have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term.Indeed, economic growth in the US is likely to be strong thanks notably to an upswing in US capex but also because of a potential boost from consumption ahead of a rise in the tariff rate applied to Chinese goods at the start of 2019. Furthermore, the US Federal Reserve is subtly turning more hawkish, which has led us to change our baseline scenario on the number of rate hikes we expect in 2019 (from two to three). Consequently, GDP growth

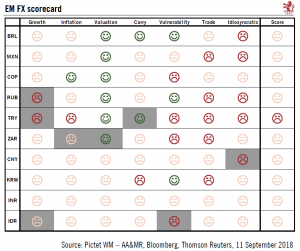

Read More »Sombre scorecard for EM currencies

September 13, 2018A challenging global environment has sapped the appeal of all the EM currencies we track.There have been few changes in our emerging market (EM) currencies scorecard over the past month. Currently, it suggests that no EM currency at present is particularly attractive on a 12-month horizon.August was a particularly harsh month for EM currencies, with the Argentinian peso and the Turkish lira both dropping 25% against the US dollar. While these two currencies were particularly vulnerable to a shift in investors’ sentiment given their weak external buffers (e.g. large current account deficit and inadequacy of FX reserves to short-term external debt), risk-off sentiment spread to other EM currencies. In particular, despite having strong external buffers, the Brazilian real and the Russian

Read More »