China’s policy stimulus could continue to weigh on the renminbi in the near term, but fading support for the dollar and PBoC may limit downside risks for the Chinese currency.Since mid-June, the renminbi has come under severe downward pressure. The China Foreign Exchange Trade System (CFETS) renminbi index has lost roughly 4.7%, while the renminbi has dropped roughly 5.8% against the US dollar. As we are moving nearer to the psychological threshold of CNY7.00 per USD, concerns that the People’s Bank of China (PBoC) might be engineering currency depreciation are likely to increase. This is likely to have a significant impact on worldwide financial markets if similar episodes of renminbi weakness in August 2015 and June 2016 are of any guidance.In our view, the latest depreciation of the

Topics:

Luc Luyet & Dong Chen considers the following as important: Chinese currency, Chinese renminbi, Macroview, renminbi depreciation

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

China’s policy stimulus could continue to weigh on the renminbi in the near term, but fading support for the dollar and PBoC may limit downside risks for the Chinese currency.

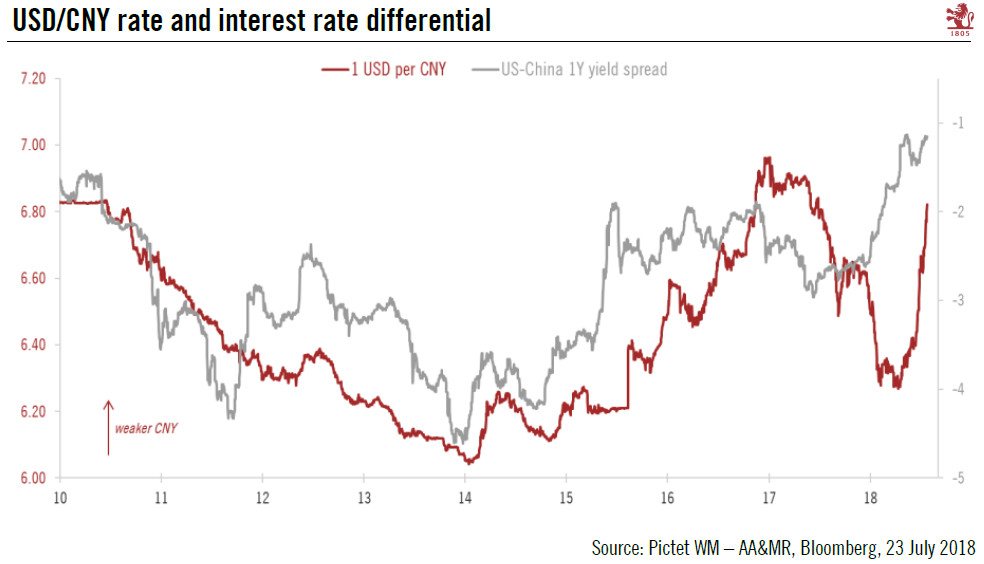

Since mid-June, the renminbi has come under severe downward pressure. The China Foreign Exchange Trade System (CFETS) renminbi index has lost roughly 4.7%, while the renminbi has dropped roughly 5.8% against the US dollar. As we are moving nearer to the psychological threshold of CNY7.00 per USD, concerns that the People’s Bank of China (PBoC) might be engineering currency depreciation are likely to increase. This is likely to have a significant impact on worldwide financial markets if similar episodes of renminbi weakness in August 2015 and June 2016 are of any guidance.

In our view, the latest depreciation of the renminbi simply unwinds its undue strengthening at the beginning of the year and reflects economic fundamentals. While the immediate trigger for the correction has been rising trade tensions with the US, we do not believe it represents a deliberate devaluation orchestrated by the Chinese authorities.

In the near term, the renminbi will likely face continued downward pressure as growth momentum weakens and the authorities continue to ease policy. However, the likelihood of central bank intervention to prop up the currency is also rising as the renminbi moves close to the CHY7.00 threshold.

Thus, given our core scenario of potential downside for the US dollar over the next 12 months, we expect the renminbi to begin to appreciate from its current level at some stage. Our three-month projection has been revised to CNY6.80 per USD (from a previous forecast of CNY6.60), while our 12-month projection remains unchanged at CNY6.35 per USD.