We expect the authorities to adapt fiscal and monetary policies to deal with downward risks to growth prospects.Chinese GDP for Q2 came in at Rmb22.0 trillion (about USD3.4 trillion), rising 6.7% year-over-year (y-o-y) in real terms. This represents a moderate deceleration from Q1 (6.8% y-o-y), largely in line with our expectations (see chart). For the first two quarters of the year as a whole, the economy expanded by 6.8% compared to the same period last year.The data show that China’s long-term transition towards a service- and consumption-driven economy is well underway, although in the near term household consumption may face more cyclical headwinds. The government’s deleveraging campaign has weighed on the real economy, most notably in the area of infrastructure investment. In

Topics:

Dong Chen considers the following as important: China GDP growth, Chinese exports, Chinese Q2 GDP, Macroview, us china trade

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We expect the authorities to adapt fiscal and monetary policies to deal with downward risks to growth prospects.

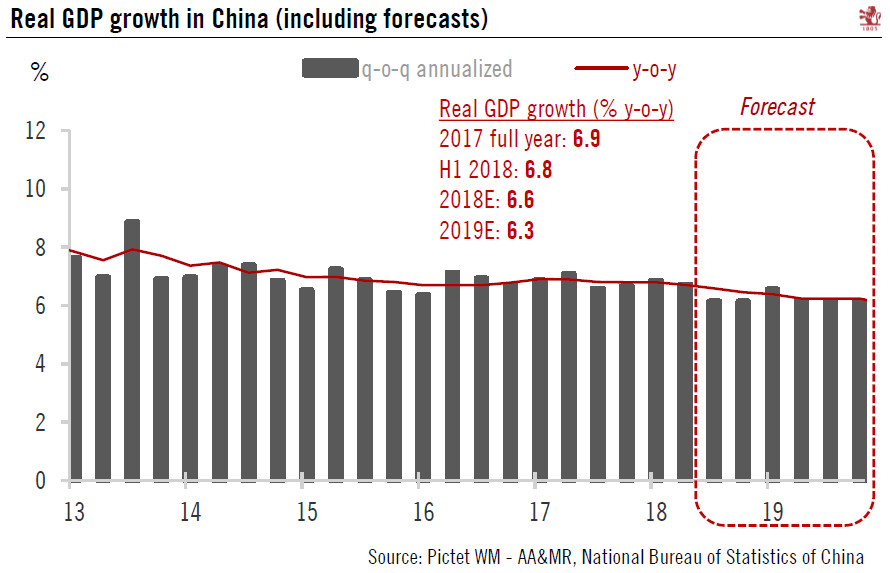

Chinese GDP for Q2 came in at Rmb22.0 trillion (about USD3.4 trillion), rising 6.7% year-over-year (y-o-y) in real terms. This represents a moderate deceleration from Q1 (6.8% y-o-y), largely in line with our expectations (see chart). For the first two quarters of the year as a whole, the economy expanded by 6.8% compared to the same period last year.

The data show that China’s long-term transition towards a service- and consumption-driven economy is well underway, although in the near term household consumption may face more cyclical headwinds. The government’s deleveraging campaign has weighed on the real economy, most notably in the area of infrastructure investment. In addition, rising trade tensions with the US may put more downward pressure on Chinese exports going forward and likely on the broad economy as well.

To mitigate the potential downside risks to growth, we expect the Chinese government to adjust monetary and fiscal policies further in H2 2018.

For the moment, we have decided to keep our full-year Chinese GDP forecast unchanged at 6.6% for 2018 and 6.3% for 2019. But we recognise that the risks are tilted to the downside if the Trump administration’s threats of further tariffs materialise.