Last week’s 50 bps Fed rate hike was not a surprise. Indeed, Fed chairman Jerome Powell’s assertion that a 75 bps hike had not been actively considered was enough to spark a stock rally. But it proved short-lived, with markets quickly returning to their fears about inflation. With the US labour market remaining tight and with inflation running well ahead of wage growth (the consumer price index rose an annual 8.5% in March, a four-decades high, compared with a 5.5% rise in average hourly earnings in April), markets may not be fully assured we won’t have a wage-price spiral, even as US credit growth continues to surge and consumers are still sitting on cash accumulated during the pandemic. With markets preferring the inflation threat to be tackled swiftly, they

Read More »Articles by Perspectives Pictet

House View, October 2021

October 5, 2021ASSET ALLOCATION

We maintain our tactically neutral position on equities, with the notable exception of Japan, where we see scope for a re-start to Abenomics and for Japanese stocks to continue to close their performance gap with their peers in other developed markets.

Though recourse to options trades, we are prepared for an increase in volatility as markets adjust to slowing growth momentum. While they may consolidate in the short term, we remain broadly optimistic on equities longer term.

With bond yields rising again, the negative performance of government bonds is helping justify our underweight stance on these instruments. But we are overweight local-currency Chinese bonds, which offer attractive carry and a stable renminbi and should benefit from policy

House View, April 2021

April 6, 2021Asset Allocation

We believe that robust earnings growth will overcome concerns about rate increases. Within a neutral position on developed-market equities, we believe sectoral rotation will continue and we remain overweight cyclical markets like the UK and Japan. But while we believe the attractiveness of stocks subject to wild valuation swings will fade, we continue to like cash-rich ‘structural grower’ stocks.

The rise in the correlation between bonds and equities is underlining the importance of portfolio diversification into alternative assets such as hedge funds.

The case for government bonds is being increasingly challenged by growing debt supply and inflation expectations. We are also conscious of the increased sensitivity of corporate credits,

House View, November 2020

November 10, 2020Macroeconomy

The upsurge in covid-19 cases will likely hurt global economic prospects in the current quarter. With a Democrat ‘blue wave’ failing materialise in the US elections, hopes of a substantial spending bill have faded and there is risk that US household incomes suffer as existing support measures fade. In the meantime, covid-19 infections continue surge in the US.

The Chinese recovery continues, supported by strong exports and solid improvement in fixed investment and consumption. We have revised up our Chinese GDP forecast for 2020 is to 2.1% from 1.8%, with our headline inflation forecast revised down slightly to 2.6% from 2.7%.

In Europe, after a better-than- expected rebound in Q3 GDP, new restrictions in the face a resurgence of the virus will

House View, October 2020

October 5, 2020Asset Allocation

Rising coronavirus cases accompanied by flagging recovery momentum and a fractious run-up to the US elections make prospects for equities highly reliant on 3Q results and further policy stimulus. Against this background we have downgraded our stance on euro area equities from neutral to underweight, following a similar downgrade for US equities in August.

We continue to like structural growth drivers and select, high-quality cyclical stocks. We also prefer companies with sufficiently strong balance sheets and pricing power to make them resilient to volatility.

The stability provided by the European Central Bank and EU recovery fund is making us more upbeat on peripheral euro area bonds. With base rates remaining low, reasonable growth and low

House View, September 2020

September 11, 2020Macroeconomy

A surge in new covid-19 cases in a number of countries has interrupted progress towards normality, yet the effects of the virus are becoming more manageable and positive world H2 growth is achievable.

Prospects for the US economy hinge on the ability of Washington to agree a new fiscal support package. While we have raised out 2020 GDP projection for the US we remain prudent. We expect the Fed to provide more stimulus via increased asset purchases, possibly as early as this month.

Spikes in covid-19 cases in Europe have hit tourism hard, particularly tourism-dependent southern countries. China leads in terms of a return to normality but tensions with the US continue to rise. A continuance of Abenomics is expected in spite of the resignation of prime

Weekly View – Reality check

June 19, 2020[embedded content]

The short-term pull-back in stock prices last week on the back of persistent virus concerns in the US and elsewhere shows the market remains jittery despite the massive run-up in prices since late March. May data from China showed a relatively fast rebound on the supply side of the economy, but a much slower take-off in consumption, suggesting a ‘reverse square root’ kind of recovery for economies rather than the ‘v’-shaped one markets have been pricing. We therefore maintain our cautious tactical stance on equities. Further short-term challenges lie ahead such as Q2 corporate earnings, although upcoming vaccine trials could diminish fears about a ‘second wave’ of the pandemic in the coming weeks.

The sharp decline in markets on Thursday was

House View, May 2020

May 19, 2020Macroeconomy

With leading economies likely facing double-digit declines in GDP in Q1 and Q2, we expect Brent oil in the USD10–20 range in Q2 before reaching a long-term equilibrium of USD18 at year’s end.

With consumers tempted to remain cautious, the oil sector in deep difficulty and a big rise in unemployment, we expect dire Q2 GDP figures for the US. We have reduced our GDP forecast for 2020 as a whole to -7.7%. Likewise, we expect the biggest hit to euro area growth to occur in Q2, and are now pencilling in full-year GDP growth of -9.5%.

Dragged down by weak external demand, we see the Chinese recovery being gradual and uneven. We expect 1.2% GDP growth in China this year. As business surveys reveal the impact of the coronavirus, we have revised down

A reality check on China’s return to work

April 14, 2020The recent recovery in industrial activity seems to have stalled, probably because of the collapse in external demand and high levels of vigilance inside China.

Since the large-scale coronavirus infection was contained, the Chinese government has been trying hard to get the economy back on track. The end of the lockdown in Wuhan after two in a half months is an important milestone in that respect. But in the past couple of weeks, economic recovery has come up against a couple of roadblocks.

At first, supply-side constraints posed by various containment measures were the main obstacle. Migrant workers had difficulty returning from their hometowns to factories after the extended Chinese New Year holidays. This led to massive supply-chain disruption, which was

Central banks to the rescue

April 12, 2020While expecting long-term yields to be capped, we remain neutral on US Treasuries. We think peripheral euro area bonds to avoid the levels of stress seen during the sovereign debt crisis.

On 23 March, the Fed announced unlimited quantitative easing (QE), or “QE infinity”. Ramping up its purchases of Treasuries to a daily pace of USD75 bn, it currently owns 18% of all US Treasuries outstanding, but could easily own between 40%-50% by the end of the year. We remain neutral on US Treasuries, expecting the 10-year yield to remain around 0.7-0.8% over the coming months, but rebounding slightly above 1% in H2 as economic activity picks up. A sharper rise is unlikely in our view, as the Fed will probably cap long-term yields through its QE purchases.

On 18 March, the

Weekly View – Merkel under pressure

February 19, 2020.

Euro-area growth has hit a slow patch. Following promising signs of having turned a corner, economic data released last week revealed that Q4 growth in the euro area reached its slowest pace since the European debt crisis. German growth was flat for Q4, in line with expectations. As far as Germany’s outlook goes, dark clouds have taken the form of an uncertain political environment and China’s recent weakness. We expect German politics to be even more inward-looking following Annegret Kramp-Karrenbauer’s resignation from the CDU leadership. Snap German elections in 2021 are now more likely. Meanwhile, weakened Chinese demand could take a tangible toll, given German exports to China account for close to 3% of German GDP.

European banks have benefitted from a

House View, January 2020

January 13, 2020Asset Allocation

Our asset allocation is dominated by a wish to stay diversified in a fragile environment. Continued ‘noise’ around trade is likely to leave markets alternating between disappointment and hope. With this in mind, we have a neutral stance on government bonds and developed-market equities alike, although we still see select opportunities in equities and appreciate the protective function of safe-haven bonds. Geopolitical events such as the tensions between the US and Iran will lead to volatility, which can be exploited tactically. Potential spikes in volatility also mean we have a positive stance on gold.

We also favour illiquid assets to mitigate volatility and boost returns in a low-return environment. As equities’ 2019 performance is unlikely

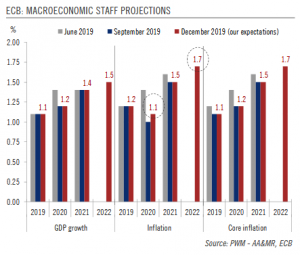

ECB: Preview of the review

December 14, 2019We see the ECB remaining on hold throughout next year although we believe it could tweak some of the technical parameters of its toolkit.

The first press conference of any new ECB President is an event in itself, and this time will be no different. Christine Lagarde’s debut this week will understandably attract a lot of attention as the media and market participants scrutinise both form and substance. Indeed, the ECB’s ‘transition’ goes beyond the change in leadership as the central bank is facing a deluge of challenges, from risks to the economic outlook to the side-effects of its policies and from internal dissensions to external political pressure.

The timing could not be better for President Christine Lagarde to launch a comprehensive review of the central

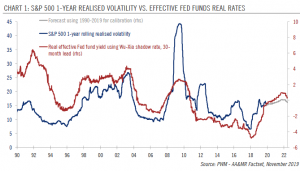

Upward pressure on equity volatility mitigated by fund flows

December 7, 2019Whereas inflation is expected to be dormant next year, our expectation of real GDP growth of just 1.3% in the US in 2020 could put upward pressure on equity volatility. Since monetary policy tends to lead volatility by two and a half years, the Fed’s turn toward quantitative tightening in 2017 is also continuing to exert upward pressure on volatility levels for now.

But there are also countervailing forces at work. Although there is not a perfect correlation, decreasing margins tend to translate into higher volatility. As we outline in our 2020 outlook for equities, we expect margins to remain elevated in 2020, as wage increases are offset by benign raw material prices. Volatility also increases when consensus dispersion on future earnings is high. Consensus

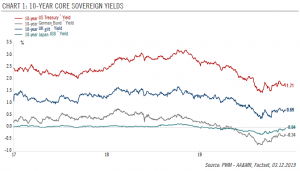

Core sovereign bonds 2020 Outlook

December 6, 2019Neutral US Treasuries. We expect the US 10-year yield to fall towards 1.3% in H1 as US growth falters and the US Federal Reserve starts signalling additional rate cuts. However, continued monetary easing and election promises (i.e. fiscal stimulus) could boost inflation expectations in H2, with the 10-year yield ending 2020 at around 1.6% in our central scenario. Overall, we expect a positive single-digit total return for 10-year Treasuries next year and a steepening of the yield curve.

Underweight core euro sovereign bonds. We expect the 10-year German Bund yield to remain negative in 2020, although our central scenario sees it ending next year slightly heigher (-0.2% compared with -0.36% currently). European Central Bank (ECB) rate expectations have recently

Euro Area 2020 Macro Outlook

November 29, 2019.

After an estimated 1.2% in 2019, we expect GDP growth of 1.0% in the euro area in 2020. Country wise, we expect more manufacturing-intense countries to underperform more domestically driven ones. Thus, we project weak growth of 0.7% in Germany and 0.4% in Italy in 2020, while we expect France and Spain to remain relatively resilient, growing by 1.2% and 1.7%, respectively.

Domestic demand, particularly household consumption, is expected to remain the main growth driver next year. Ongoing job creation, combined with rising wages, should continue to underpin household spending. Credit conditions should remain supportive of business investment and construction. Favourable bank-lending conditions and fiscal policy should also support momentum in consumer

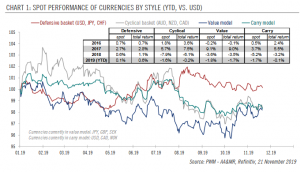

Currencies: do it with style

November 25, 2019Our scenario of ongoing global growth moderation and elevated political uncertainties should, we believe, support defensive currencies. We consider a currency ‘defensive’ if it is likely to remain resilient should global risk appetite falter.

Among major currencies, the US dollar, the Japanese yen and the Swiss franc are usually considered as defensive. Indeed, the structural current account surplus and large net foreign assets of both Japan and Switzerland make them less vulnerable during periods of low risk appetite. By contrast, the defensive nature of the US dollar mostly stems from its wide international usage and its link to the world’s most liquid safe haven: US Treasury bonds. Overall, defensive currencies are very close to a safe haven and therefore

Perspectives Pictet

September 23, 2019This website uses cookies to enhance user navigation and to collect statistical data. To refuse the use of cookies, change your settings or for more information, please click on the following link: Cookies policy. By continuing to browse this website, you accept the use of cookies for the above purposes.

Read More »House View, September 2019

September 6, 2019Pictet Wealth Management’s latest positioning across asset classes and investment themes.Asset allocationWe remain underweight global equities, but continued stimulus and an economic backdrop that is not catastrophic mean this is nuanced by neutral positions in some regions. We favour stocks of companies that have pricing power as well as those showing healthy dividend growth and low leverage.We are neutral US Treasuries as a way to protect portfolios, but underweight negative-yielding European and Japanese bonds. We remain cautious about ongoing yield compression, preferring to focus on quality and to limit duration. We are underweight US high yield, where leverage is high and default levels have been creeping up.The opportunity cost of holding gold, on which we remain neutral, although

Read More »The era of economic slowbalisation

August 26, 2019Download issue:Sisyphus was punished by the gods by having to repeatedly roll a boulder up a hill after it rolled back down each time he reached the summit. Today, markets are subjecting the world’s central bankers to the same punishment. According to César Pérez Ruiz, PWM’s Head of Investments & CIO, “each time central banks attempt to normalise monetary policy, the ‘market gods’ compel them to revert to easing mode and lower rates. The result is we are living in an era of economic slowbalisation.”Today, “the global economy is flying on one engine, with manufacturing in recession and services keeping the economy airborne. Populism-driven fiscal stimulus is keeping services afloat for now and central banks are doing everything possible to support their economies. He concludes that he

Read More »Exceptional Swiss hospitality and haute cuisine

August 8, 2019This independently managed, family-owned hotel in the City of Basel attracts guests from all over the world for its luxurious accommodation, its superb restaurant with three Michelin stars, and its talented staff team offering superior serviceThe Grand Hotel Les Trois Rois, which sits on the Rhine in the historic centre of Basel, is one of the oldest city hotels in Europe. The first record of The Three Kings dates back to 1681 when it was described as an inn for gentlemen. Rebuilt in 1844 in Belle Époque style, it was redesignated as a Grand Hotel, and began to attract distinguished guests from the worlds of politics and the arts.Over the next 160 years, Les Trois Rois was run by a succession of owners, some of whom sold off parts of the building. In 1936, its owners started to appoint

Read More »House View, August 2019

August 5, 2019Pictet Wealth Management’s latest positioning across asset classes and investment themes.Asset allocationWhile dovish central banks have resulted in an impressive ‘everything rally’ this year, we now need to see an improvement in fundamentals, as 12-month forward earnings for global equities are still 2% below their highs of October 2018. We therefore remain generally cautious on equities, waiting for a correction before we increase exposure.Trading volumes have declined and market gains are narrowly concentrated. However, we continue to see opportunities in some high-quality cyclical sectors such as industrials. Selection is paramount.As more developed-market yields turn negative, we are upbeat on local-currency emerging-market debt. Deleveraging could also spell opportunities in EM

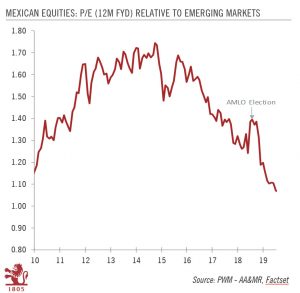

Read More »Uncertainty mounts over Mexico’s direction

July 12, 2019The resignation of the Mexican finance minister raises further questions over prospects for Mexican assets.Carlos Urzúa, the Mexican Finance Minister, unexpectedly quit on Tuesday. His resignation, announced in a letter in which he set out the “many” disputes he had had with the administration of president Andrés Manuel López Obrador (AMLO), is meaningful from several standpoints. A respected official, Urzúa was seen by financial markets as a moderate, whose commitment to fiscal prudence reassured investors struggling to decipher AMLO’s economic north star. His departure also reveals profound tensions within the government between those aiming for ideology-led policies – which Urzúa denounced – and those advocating orthodox economic policies.Arturo Herrera, the current Deputy Finance

Read More »House View, July 2019

July 5, 2019Pictet Wealth Management’s latest positioning across asset classes and investment themes.Asset allocationAlthough the US-China ‘trade truce’ and dovish central banks are giving a short-term fillip to equities, our analysis suggests that expansion of valuations from here is limited, making us globally cautious on equities. But we see opportunities in high-quality stocks in individual sectorsWe remain underweight government bonds given low yields, except US Treasuries, on which we are neutral. We have moved from an underweight to neutral stance on euro high yield in recognition of ECB support, including a possible resumption of bond buying.A resilient US economy, low inflation, limited downward pressure on the dollar and a lessening of trade tensions after the G20 summit mean we are neutral

Read More »House View, June 2019

June 6, 2019Pictet Wealth Management’s latest positioning across asset classes and investment themesAsset allocationWe have turned tactically underweight on global equites, including US equities, given elevated valuations, mixed economic data and rising trade tensions. We remain neutral on euro area equities, where valuations are generally more reasonable than in the US. We have also moved from an overweight to neutral stance on Asian emerging-market equities.At the same time as we remain focused on quality companies rather than on speculative plays, portfolios are partially hedged against the risk of further equity market consolidation.We remain underweight government bonds given low yields, except US Treasuries, on which we are neutral. We have shifted from an underweight stance on top-rated

Read More »Swiss start-up grows diamonds of exceptional purity

May 20, 2019Physicist Pascal Gallo co-founded a company in partnership with Lausanne’s Federal Institute of Technology to create ultra-pure lab-grown diamonds for demanding high-tech applications, longer lasting watches and high-quality jewelleryThe reason for developing the lab-grown diamonds was a search for ultra-pure stones that could enhance the power of energy transmission using lasers. Diamonds have extraordinary properties: they are the best conductors of heat which means they can create intense laser beams without overheating. Research scientist Pascal Gallo and Professor Eli Kapon of the Swiss Federal Institute of Technology (EPFL) found that using diamonds in lasers broke the world record for laser energy transmission.The two colleagues patented their discovery, and wanted to start up a

Read More »A premium mode of transport for urban commuters

May 15, 2019Technological innovations offer a Swiss solution to modern traffic problems in the form of a powerful e-bike capable of long-distance, high-speed urban commuting with full connectivity modelled on global brands such as TeslaSwitzerland may not feature on lists of the world’s leading carmakers, but it is home to the manufacturer of a state-of-the-art form of commuter transport. Stromer battery-powered e-bikes, made in the small village of Oberwangen near Bern, are capable of travelling distances of as much as 180 kilometres at speeds of up to 45 kilometres per hour. Last year more than 10,000 bikes were sold – almost 70 per cent outside Switzerland.The Stromer e-bike was developed by Thomas ‘Thömu’ Binggeli, a cycling enthusiast. In a farmhouse south of Bern where he started a business

Read More »House View, May 2019

May 3, 2019Pictet Wealth Management’s latest positioning across asset classes and investment themes.Asset AllocationThere were no changes to our asset allocation in April. While we are encouraged by better-than-expected Q1 earnings and some improvement in earnings expectations, we remain neutral on global equities as we await new catalysts to justify current valuations. At the same time, we have a positive view of Chinese and Indian equities.We remain underweight government bonds given low yields, except US Treasuries, on which we are neutral. By contrast, we remain overweight local-currency emerging-market bonds, believing that they could outperform corporate credit as recent US dollar strength wanes.In general, we recognise that central banks’ support and an improvement in economic momentum could

Read More »The year of the doves

April 15, 2019Download issue:English /Français /Deutsch /Español /ItalianoWith all major central banks now having turned dovish, we can expect the continuation of ultra-low global interest rates in 2019. This is a relief for markets, which have already rallied in response. The greater concern is whether global growth can make a comeback.César Pérez Ruiz, Pictet Wealth Management’s (PWM) Head of Investments & CIO, will be looking for stabilisation in earnings revisions against the current backdrop of rich equity valuations. “For markets to continue to rally, we will need economic activity to bottom out and earnings revisions to stabilise in the second half of the year,” he writes in the April-May issue of Perspectives. “We see volatility in markets ahead until various resolutions have been reached,

Read More »House View, April 2019

April 3, 2019Pictet Wealth Management’s latest positioning across asset classes and investment themes.Asset AllocationAlthough we expect the economic picture to brighten and the decline in earnings expectations to end, we have a prudent stance on global equities, as expressed in our decision to book some profits on global equities and to invest in put options on large-cap European and small-cap US equities.At the same time, our willingness to take on reasonable risk means that the reduction in equities was matched by an increased allocation to local-currency emerging-market (EM) debt, part of a move toward seeking ‘carry’. Our desire to build a barbell strategy within this framework means we have more recently moved from an underweight to a neutral stance on euro investment-grade credits to mitigate

Read More »